Key Takeaways

- Metaplanet has bought 5,419 more Bitcoins, while targeting 30K BTC in corporate treasury by 2025 and 210K BTC by 2027.

- The firm has been steadily expanding its holdings through equity offerings and bond redemptions.

- Metaplanet’s approach towards Bitcoin purchase has closely mimicked major players like Strategy (previously MicroStrategy) which have set an industry standard.

Japan’s Metapanet expands Bitcoin holdings to 25,555 BTC amid a growing demand among institutional players. The firm has bought 5,419 more coins , cementing its position as Asia’s largest corporate holder of Bitcoin.

Metaplanet’s total Bitcoin holdings are currently worth $2.67 billion, surpassing Coinbase and Tesla in corporate reserves. The firm now targets 30K BTC in corporate treasury by 2025 and 210K BTC by 2027.

The Tokyo-listed business disclosed on Monday that it had spent approximately 93.65 billion yen ($627 million) in total, purchasing Bitcoin at an average price of 17.28 million yen (nearly $115,900) per coin. The corporation now possesses 398.21 billion yen (about $2.67 billion) in Bitcoin, with an average price of 15.58 million yen ($104,400) per BTC.

The move comes amid Metaplanet’s ongoing confidence in Bitcoin, showing its commitment to steadily building one of the largest institutional Bitcoin holdings in the market. Interestingly, Metaplanet’s Bitcoin purchase comes at a time when BTC prices have been underperforming, bring down over 2.5% in the past 24 hours. The OG-crypto has toppled nearly 2% in past 7 days.

Metaplanet’s Continuous Bitcoin Purchase

Since launching its Bitcoin treasury program, Metaplanet has been on a rapid Bitcoin accumulation path. The firm has been steadily expanding its holdings through equity offerings and bond redemptions.

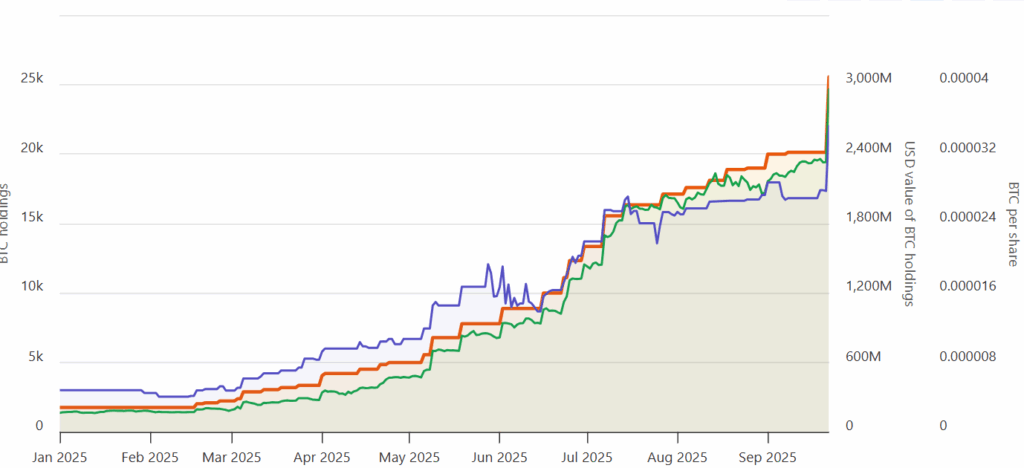

From the end of June to late September, the company’s Bitcoin stash jumped from 13,350 BTC to over 25,500 BTC, showing just how aggressively it’s been buying. Additionally, to help investors track performance, Metaplanet introduced “BTC Yield,” which measures how much Bitcoin each share represents over time.

Between July 1 and September 22, the company’s BTC Yield grew 10.3%, even after accounting for share dilution. This approach highlights the company’s ability to raise capital while steadily building its Bitcoin treasury.

Metaplanet’s approach towards Bitcoin purchase has closely mimicked major players like Strategy (previously MicroStrategy) which have set an industry standard. However, tracking a weakness in the broader market, Metaplanet shares are trading down over 3% at JPY589.00 at the press time. The firm’s market cap currently stands at JPY425.251 billion.

Metaplanet’s Bitcoin Buy: Why are institutional getting drawn to Bitcoin?

Institutional interest in Bitcoin has been growing rapidly, and for good reason. Many big investors view it as a store of value, especially in times of economic uncertainty or rising inflation. Bitcoin’s limited supply, capped at 21 million coins, makes it scarce. This makes Bitcoin’s utility and hype different from cash or government bonds. The scarcity also makes it attractive for long-term portfolio diversification.

The rise of institutional-grade infrastructure has also played a big role in Bitcoin’s inclusion in corporate treasuries. Secure custodial solutions, regulated exchanges, rise in value and investment products like ETFs make it easier and safer for big investors to enter the crypto space. The upgrade in corporate treasury holdings has made accumulating Bitcoin less cumbersome.

Liquidity and market maturity are additional draws, pacing the og-crypto at the forefront of expansion. Additionally, Bitcoin’s growing trading volumes allow institutions to manage large positions without drastically impacting prices. Its low correlation to traditional assets like stocks and bonds also offers a potential hedge against market swings.

Finally, corporate adoption and endorsements from prominent investors have further validated Bitcoin, making institutions more confident in seeing it as a credible, long-term addition to modern investment strategies.