Key Takeaways:

- Monero (XMR) rose 7% to $308 despite its most extensive network renovation, which replaced 18 blocks and invalidated 118 transactions.

- Qubic, an AI-focused blockchain and mining pool, is suspected of carrying out the attack through mining strategies.

- A previous Qubic-led reorganization in August 2025 caused Monero’s price to fall 12% in four days, but this time the token rose, demonstrating exceptional market strength.

Monero (XMR), a leading privacy-based blockchain, surprisingly rose by more than 7% going from $287 to $308, before falling to $304 at the time of reporting. In the previous week, Monero has risen by 13%. The surge in its token occurred despite its blockchain experiencing the deepest chain reorganization (reorg) on record, replacing 18 consecutive blocks and invalidating about 118 confirmed transactions.

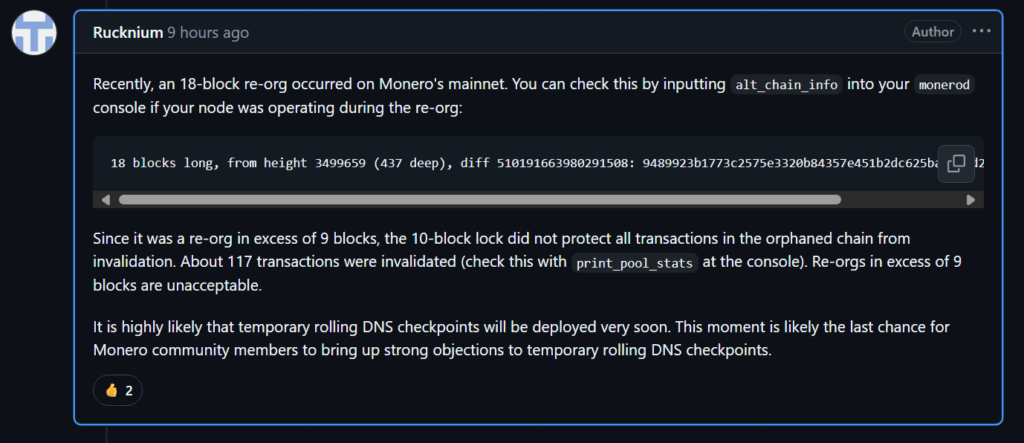

This particular incident happened on September 14th, which resulted in 36 minutes of transaction history being erased. Additionally, blocks 3,499,659 to 3,499,676 were rearranged. Possibly the largest reorganization in Monero’s history, reigniting discussion about the network’s security and resiliency.

Monearo Security Breach: What Happened?

A reorg happens when a competing chain with more cumulative proof-of-work (PoW) overtakes the current one, forcing previously mined blocks to be discarded and transactions to re-enter the queue. While Monero uses a 10-block lock to prevent minor reorganizations, this 18-block event exceeded that safeguard.

Suspicions rose around Qubic, an AI-focused blockchain and mining pool that recently acquired more hashpower than Monero. Researchers believe that mining practices by them may have prompted the event, exposing the risks of concentrated mining power even in the absence of a full 51% takeover.

Community and Developer Response

Merchants and services must wait for more confirmations, typically 20 to 30 blocks, instead of the usual 10, before trusting Monero transactions to avoid further interruptions. Developers are also considering changes such as enhancing how blocks travel over the network, adding safety “checkpoints,” and encouraging more tiny miners so that no single group has too much power.

Market Reaction

Qubic previously attacked Monero in August 2025, gaining over 51% of the hashrate and performing a 6-block reorganization (reorg) on the network. When the incident occurred in August, the price of Monero fell by 12% which continued for 4 days before the price started picking up.

The recent 18-block reorg on September 14, 2025, made it the most extensive reorganization in Monero’s history. The price surprisingly reacted positively, rising by 7%.

The Bigger Picture

While privacy features were not directly compromised, the incident highlighted flaws in Monero’s finality. The community has previously discussed potential improvements, such as merging with Bitcoin, implementing alternative consensus mechanisms, or introducing solutions like Dash’s ChainLocks. However, no adjustments have yet been implemented.

What is POW?

Proof of Work (PoW) is a consensus process that involves computers solving complicated problems to validate transactions and protect a blockchain.