Key Takeaways:

- DeFi Technologies has expanded into the UAE, aiming to bring its crypto investment products to institutional investors in the Gulf and wider MENA region.

- Valour, its digital asset subsidiary, recently rolled out eight new crypto ETPs in Sweden, pushing the group’s total product count to over 75, with plans to reach 100 by year-end.

- Shares of DeFi Technologies (DEFT) jumped more than 6% after the news, as traders reacted to the company’s broader global push.

Nasdaq-listed DeFi Technologies Inc. (DEFT) has expanded its operations into the Gulf and broader MENA region by registering a new entity under the Dubai Multi Commodities Center (DMCC) framework, aiming to provide services to institutional investors.

The Dubai expansion will also host a new trading desk operated by Valour, a subsidiary of DeFi Technologies and a leading issuer of digital asset exchange-traded products (ETPs).

DeFi Technologies is a Canada-based financial technology firm focused on digital asset investment products and infrastructure. It operates through its subsidiaries across areas including trading, custody, research, and asset management.

What’s Driving DeFi Technologies to the MENA region?

As institutional capital continues to flow into cryptocurrency-linked exchange-traded funds (ETFs) globally, asset managers are stepping up efforts to meet this growing demand.

According to a press release received by TimesCrypto, interest in spot Bitcoin and Ethereum ETFs has been rising steadily, not only in Western markets but increasingly across the Middle East.

In the UAE, this trend was reinforced by sovereign wealth fund Mubadala’s recent decision to expand its holdings in BlackRock’s Bitcoin ETF, which is a part of a broader institutional shift toward regulated, non-traditional investment vehicles.

Highlighting the importance of this shift, Andrew Forson, President of DeFi Technologies and Chief Growth Officer at Valour, stated:

We believe the demand for digital asset ETPs will increase not only globally but in the GCC and Middle East. Investors, whether sovereign wealth funds, institutional investors, family offices and even retail investors are interested in crypto but require familiar and efficient vehicles to get exposure.

Forson also emphasized that combining digital assets with traditional investment vehicles could play a key role in expanding crypto adoption.

Wrapping digital assets like Bitcoin and Ethereum in regulated financial instruments such as ETPs will increase the number of crypto investors and offer countries such as the UAE, Qatar, Oman, and Saudi Arabia access to international foreign investment.

What Will DeFi Technologies’ Expansion Bring to the MENA Market?

Valour, the digital asset arm of DeFi Technologies, has launched eight new exchange-traded products (ETPs) on Sweden’s Spotlight Stock Market, further expanding its presence in the Nordic region.

The new SEK-denominated listings provide exposure to a range of digital assets, including Bitcoin Cash (BCH), Unus Sed Leo (LEO), OKB, Polygon (POL), Algorand (ALGO), Filecoin (FIL), Arbitrum (ARB), and Stacks (STX).

DeFi Technologies’ expansion into the Gulf and wider MENA region is seen as a key element of its broader strategy to grow both its product range and global footprint. The move could pave the way for Valour’s crypto-linked ETPs to reach new investor segments across the Middle East.

Market Response and (DEFT) Technical Outlook

Hourly Chart

Shares of DeFi Technologies Inc. (DEFT) rose sharply this week, trading around $2.97 as of Thursday afternoon, following the announcement of eight new exchange-traded products (ETPs) through its Valour subsidiary and the company’s expansion into the MENA region.

Short-term price action has turned positive, with hourly technical indicators showing increased momentum.

On the one-hour chart, (DEFT) broke above a key resistance level near $2.8 and extended gains toward $3. The Relative Strength Index (RSI) climbed to 63.87, signaling rising buying interest, while the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover, which is often viewed as a signal for upward price continuation.

Short-term sentiment appears to be driven by investor optimism around the firm’s growing ETP footprint and regional expansion plans.

Daily Chart

The daily chart reflects a similar shift in tone. After a period of weakness from mid-May to late June, DEFT has rebounded, gaining nearly 6% on the day.

The MACD flipped positive for the first time in weeks, and the RSI, at 51.54, is inching closer to neutral territory, suggesting a possible reversal in trend. If current momentum holds, technical analysis shows that (DEFT) may test resistance between $3.20 and $3.50 in the near term.

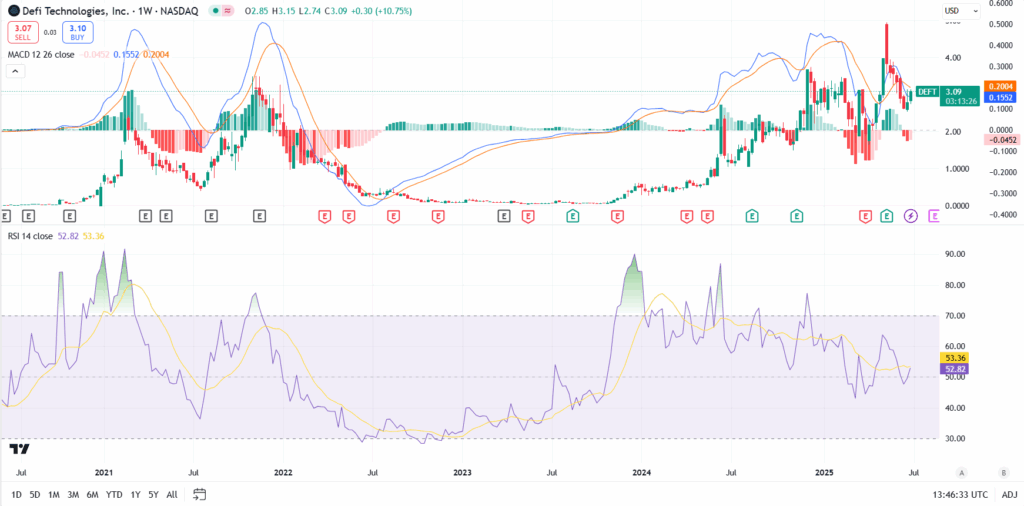

Weekly Chart: The Bigger Picture

Looking at the broader picture, DEFT remains well off its 2025 highs of above $4.50. The weekly chart shows that while the stock has staged a recovery from its 2022 lows, it has struggled to maintain upward momentum amid volatility in the broader crypto sector.

The RSI on the weekly timeframe stands at 52.82, pointing to a market in consolidation. Technical analysis shows that sustained movement above the $3.00 level could signal a longer-term shift in sentiment.

Read More: Bybit Goes Full MiCA: Launches EU-Compliant Platform as Crypto Giants Battle for Europe