Key Takeaways

- Nvidia and the AI Bubble face critical moment with Wednesday earnings report.

- CEO Jensen Huang claims visibility into $500 billion in future chip sales.

- 300 AI experts survey shows mixed sentiment about AI sector sustainability.

Table of Contents

Make-or-Break Moment for AI Investment Landscape

The relationship between Nvidia and the AI Bubble reaches a critical juncture this week as the chip giant prepares to report earnings that could either reignite the artificial intelligence stock rally or confirm growing market skepticism.

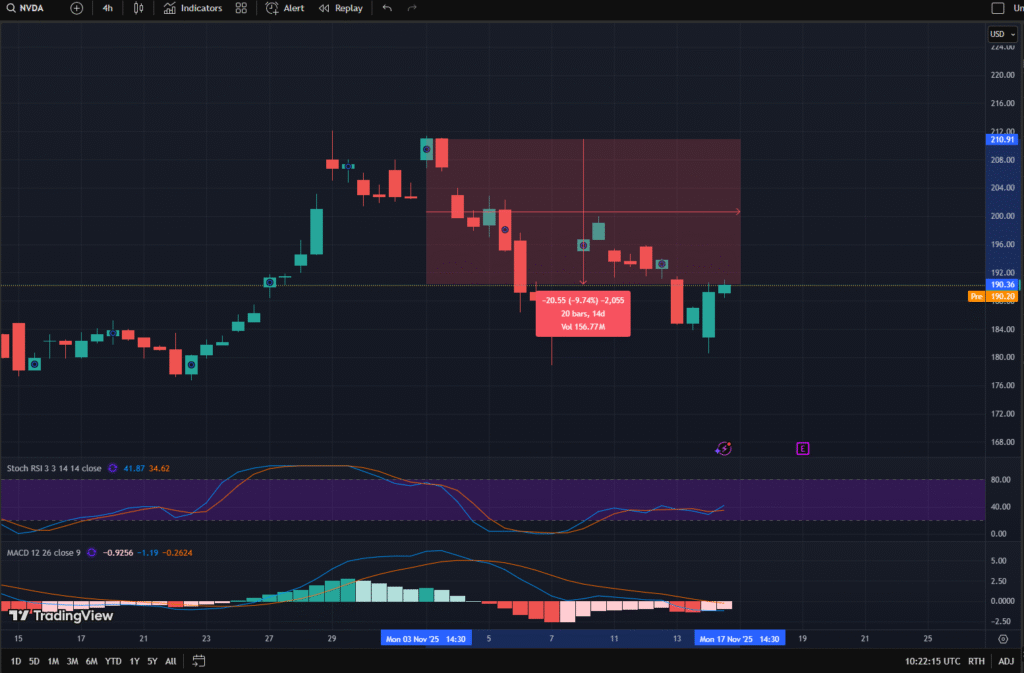

With Nvidia stock down around 10% since late October and the Magnificent Seven index falling nearly 6%, Wednesday’s report represents what analysts describe as a “make-or-break” moment for the AI trade.

The outcome will test whether Nvidia and the AI Bubble can sustain their explosive growth trajectory or face a necessary market correction.

Read also: NVIDIA’s Robotics Developments: Omniverse & Cosmos AI Redefine Machine Intelligence

Conflicting Signals from Industry Insiders

A survey done with 300 AI experts shows very mixed opinions about Nvidia and the AI bubble. Attendees of the recent Cerebral Valley AI Summit predicted that ‘Nvidia’ would reach a $6 trillion valuation by 2026, but expressed ‘bearish’ outlooks about other AI companies, such as OpenAI and Perplexity.

Venture capitalists are openly acknowledging the existence of the ‘Nvidia’ and AI bubble, but treating it as just a normal boom-bust cycle of technological aggregate like the early internet, where massive investment precedes industry consolidation and a few dominant players emerge victorious.

Read also: Nvidia Bets $5B on Intel to Forge AI Infrastructure Alliance

High Stakes for Broader Market Dynamics

The performance of Nvidia and the AI Bubble carries broader ramifications beyond the chip sector and could shape the whole tech backdrop.

Wedbush analyst Dan Ives believes a strong result will help establish legitimacy around the AI revolution and provide a “positive catalyst for tech stocks into year-end”. At the same time, Gene Munster at Deepwater Asset Management warns of a “Catch-22” in which strong guidance could amplify overspending concerns while modest results could signal premature growth normalization.

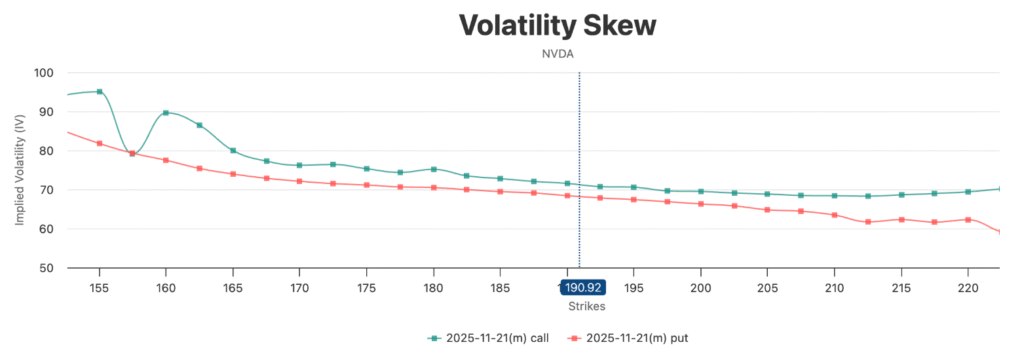

Options markets are currently pricing in significant uncertainty, with a projected 7% post-earnings stock swing, the largest in over a year. The implied volatility (IV) for options expiring on November 21 is high, currently sitting at around 70%.

This figure is expected to climb to approximately 100% by the time the company releases its results, making options prohibitively expensive and a highly speculative gamble. Notably, the implied volatility for call options is even higher than that for puts.

Investors’ reaction to favorable guidance is unpredictable. The current “coin toss” odds might not be enough to drive tech stocks and the broader market higher, particularly as the year draws to a close.

FAQs

Why are Nvidia earnings so important for the AI bubble?

Nvidia and the AI Bubble are intrinsically linked because Nvidia’s performance serves as the clearest indicator of actual AI infrastructure demand, with its chips powering most major AI systems and its revenue forecasts influencing broader market sentiment.

What are experts saying about Nvidia and the AI bubble?

Experts are divided on Nvidia and the AI Bubble, while 300 AI insiders surveyed at a recent summit predicted Nvidia could reach $6 trillion valuation by 2026, many simultaneously expressed bearishness about other AI companies, creating a complex outlook.

What should investors watch in Nvidia’s earnings?

Key metrics for Nvidia and the AI Bubble include revenue guidance for Blackwell and Rubin chips, commentary on China restrictions, data center growth rates, and any signals about customer spending patterns from major cloud providers and AI companies.

For more Nvidia-related stories, read: U.S. Pushes AI Trade Forward: Nvidia Chip Exports to UAE Under New Deal