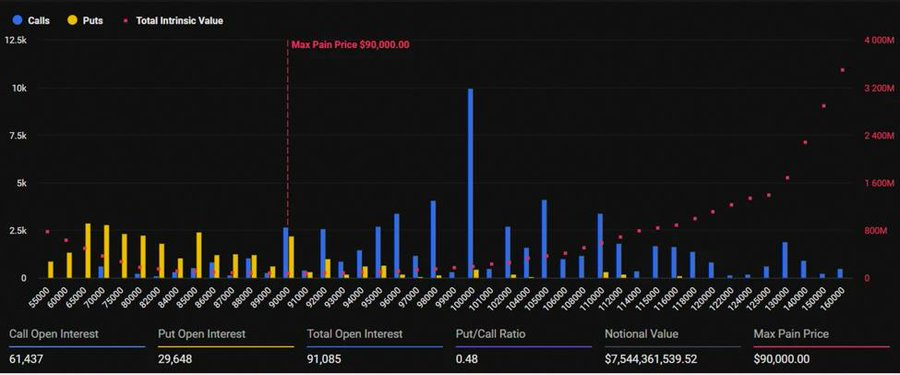

The crypto market faced its first significant derivatives event of the year when traders closed $8.3 billion worth of Bitcoin options Friday. The market saw the expiration of approximately 91000 BTC contracts which held a notional value of about $7.5 billion and $1.2 to $1.3 billion worth of Ethereum options which created total derivatives exposure that approached $9 billion. Traders maintained a put/call ratio between 0.48 and 0.54, which created moderate bullish market conditions before the expiration. The trend showed that market participants preferred to purchase call options instead of put options. The theoretical maximum pain point occurred at approximately $90,000, which states that aggregate losses of option buyers would have been largest at that point.

The market price of spot BTC stayed below the specified threshold, which led to multiple bullish call positions expiring worthless. The dealers needed to exit their hedging positions because of the mismatch, which created gamma-driven selling that increased the downward pressure on spot prices. The event shows that when derivatives expire, they can increase market volatility because traders use different strategies that cause spot prices to move sharply apart.

Immediate Market Reaction

The market response to the expiry was swift and pronounced. Bitcoin has seen a drop to fresh 2026 lows near $75,000 on Monday, which marked a 15% decline over the last 5 days. Ethereum mirrored this weakness, declining to roughly $2,191, while total crypto market capitalization fell below $3 trillion, briefly touching $2.8 trillion.

The market faced its highest impact from leveraged positions, which resulted in liquidations between $1.6 billion and $1.7 billion that primarily impacted buy-side traders who expected stable strike prices. The option expiry operation eliminated the pinning effect, which had maintained spot prices at higher strike price levels. The process facilitated natural price discovery to take place but at the same time displayed market deficiencies since traders used bullish options as their main method for maintaining price stability.

The crypto market has witnessed its strongest impact from leveraged positions that came into effect in liquidations worth $1.6 billion to $1.7 billion that highly affected buy-side traders who were expecting higher strike stability. The expiry operation removed the pinning effect, which had kept spot prices at elevated strike price levels. The process enabled natural price discovery but showed market shortcomings because traders used bullish options as their primary price stabilization approach.

Derivatives Mechanics and Structural Insights

The large-scale expiration shows how option positions link to spot market liquidity. In the case of spot prices diversion from max pain levels, it becomes necessary for the market participants to hedge by selling or buying the underlying asset, which creates amplified market movements called gamma swings. The expiry has reflected how their price differences caused market participants to sell BTC and ETH, which created stronger downward trends that exceeded typical market selling patterns.

However, the post-expiry redistribution of open interest means that there may be shifts in market risk perception. Open interest for the relative assets like Bitcoin and Ethereum is concentrated on the downside, particularly in the areas of $75 to $85k. The trend reflects an increased demand for downside protection. This concentration shows that traders are now leaning toward hedging for downside, which means that future spot movements could be more prone to breaches of these strike levels.

Finally, the expiry underscores the limits of derivatives as stabilizing tools. Large expiries, while sometimes acting as temporary support mechanisms by pinning spot prices near maximum pain, are only effective if they align with macroeconomic and liquidity conditions. When external risk factors dominate, expiries can instead act as catalysts for accelerated moves, as demonstrated in this case.

This type of large option expiries curate short-term support systems that helps to maintain spot prices at maximum pain points yet their success may vary depending on current economic situations and market liquidity. External risk factors also contribute in influencing market behavior because they cause expiries to trigger swift price movements.

Macro Factors Strengthening Post-Expiry Moves

Today’s expiry took place against a backdrop of heightened macroeconomic uncertainty. Considering the speculation regarding Federal Reserve policy, ongoing geopolitical tensions in the Middle East, and ongoing capital outflows from crypto to safer assets further amplified market fragility. Even with a significant option expiry, the market could not sustain higher strikes, which illustrates that crypto remains highly sensitive to global risk-off dynamics.

The way derivatives interact with broader economic forces demonstrates one fundamental market truth, which states that options expiration effects will not occur through isolated processes. The situation depends on three factors, which include available capital, trader leverage levels, and participants’ perspectives on risk management practices.