Key Takeaways:

- Bitcoin (BTC) slid 4.5% in the week, falling from $124K to $113K, dragging down crypto-related stocks.

- Saylor’s Strategy (MSTR) hit its lowest since April, down nearly 8%, after updating equity issuance guidance.

- New rules allow more share issuance flexibility, raising dilution concerns but giving Strategy options to manage debt and buy more BTC.

Bitcoin (BTC) is showing downward momentum, having dropped from its all-time high of $124K to its current levels of $113K. According to CoinMarketCap, BTC has declined by over 4.5% within a week.

BTC’s recent fall has led to a decline in numerous crypto-related stocks like Strategy (MSTR), Coinbase (COIN), and Marathon Digital (MARA) declined by 7.43%, 5.82% and 5.72% respectively, during the last trading session.

The shares of Michael Saylor’s Strategy have reached their lowest levels since April. The company also announced it has updated its equity issuance guidance. The fall in Strategy’s stock comes amid the recent dip in BTC’s prices.

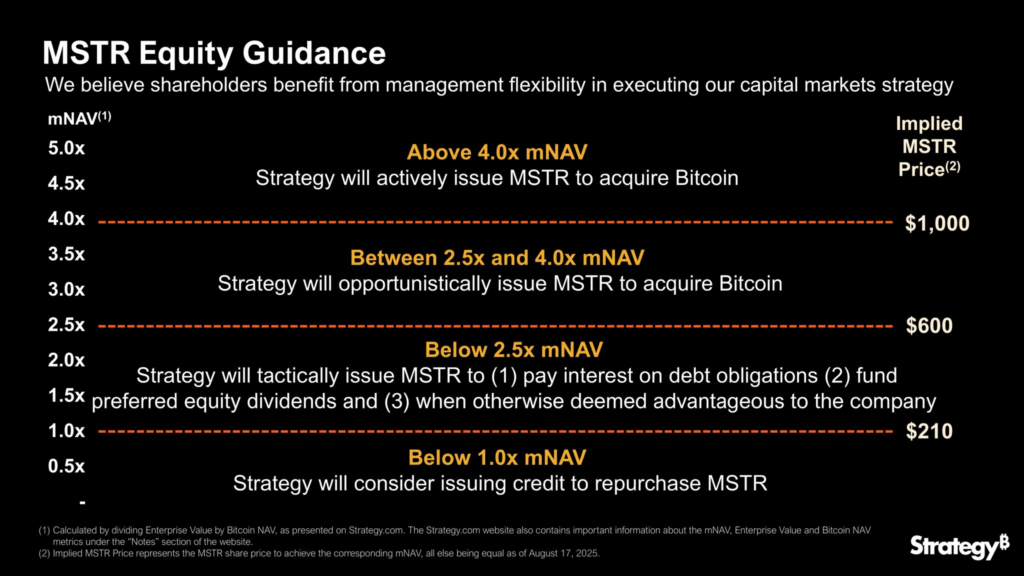

Under the new equity issuance guidance, it gives Strategy more flexibility on how its stock is valued compared to the Bitcoin it holds (mNAV). The term “mNAV” refers to the market net asset value. It compares MicroStrategy’s stock price to the total value of Bitcoin on its balance sheet.

Under the new guidance, when the mNAV is above 4.0x or at levels between 2.5x and 4.0x, Strategy will actively issue shares to acquire more BTC. When the mNAV is below 2.5x, the shares issued by Strategy will be primarily used to pay off debt and cover dividends.

Essentially, servicing the debt obligations. When the mNAV falls below 1.0x, Strategy can borrow credit for share buybacks instead of issuing new shares. Investors have raised concerns regarding dilution, since issuing more shares can reduce how much BTC each share represents. However, this also gives Strategy more flexibility to raise capital.

Currently, the mNAV of Strategy is 1.54, but as long as BTC remains above $73,320, which is the cost-basis for Strategy, its balance sheet remains strong. But equity issuance below favorable multiples could dilute long-term holders.

With Bitcoin sliding from recent highs of $124K and Strategy revising its capital strategy, investors will closely track upcoming disclosures to gauge whether new issuance will support debt coverage or signal more Bitcoin accumulation.