Key Takeaways:

- SBI Holdings announces to list a dual-asset cryptocurrency ETFs on the Tokyo Stock Exchange, stock price rises over 3%.

- SBI Holdings also plans to launch a public investment trust, allocating 51% of its holdings to gold and 49% to crypto-based ETFs.

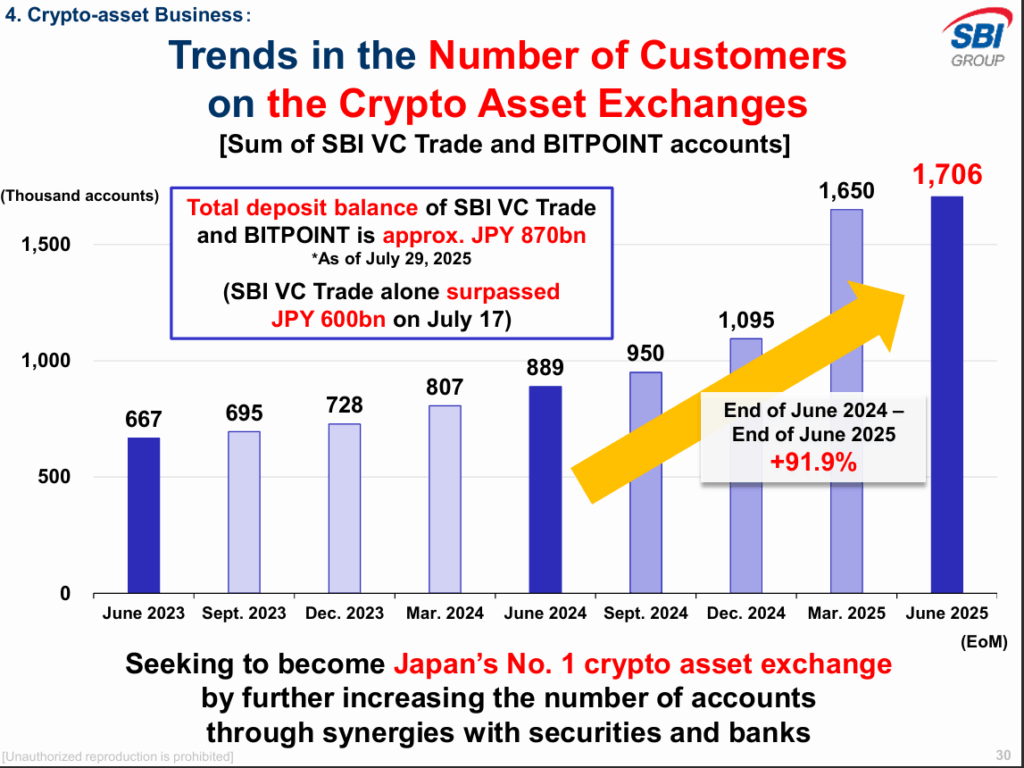

- The company plans to become the number one cryptocurrency exchange in Japan.

SBI Holdings, one of the largest financial companies in Japan, has unveiled ambitious plans to introduce the nation’s first publicly offered dual-asset cryptocurrency exchange-traded funds (ETFs), by offering exposure to both Bitcoin (BTC) and XRP. This move was announced in the company’s latest earnings report, signaling a major step towards integrating digital assets into Japan’s highly regulated financial markets. Following the announcement, SBI Holding’s stock has jumped over 3%.

SBI outlined two distinct crypto-based products. The first is a unique Bitcoin-XRP dual ETF, which the firm intends to list on the Tokyo Stock Exchange, the country’s largest stock exchange. The second is a publicly offered investment trust that would combine gold and crypto, allocating 51% of its portfolio to gold-based ETFs and 49% to crypto-asset ETFs like those for Bitcoin.

SBI also plans to become Japan’s number one crypto exchange, according to its earnings report.

Currently, these products are due for launch as they have yet to receive regulatory approvals. The timing of this move comes at a positive time for the regulatory landscape in Japan. In June, Japan’s Financial Services Agency (FSA) proposed a change that would lead to a more favorable tax environment, along with approvals of crypto ETFs. The rule would essentially classify certain digital assets as “financial products” under the Financial Instruments and Exchange Act (FIEA).

Based on the announcement made by SBI in its earnings report, it is still unclear whether the company has formally submitted these proposals to the regulatory authority or is still in preliminary planning stages. Nonetheless, when one of the biggest financial institutions starts expanding its services to the crypto world, it represents a huge confidence for the entire cryptocurrency industry in Japan.