Key Takeaways

- The Solana Company treasury is now greater than 2.2 million SOL and more than 15 million in cash.

- Recent price increase of SOL puts the company holdings values at a point of more than 235 per token.

- Solana Company will utilize cash reserves to increase its holdings in SOL.

Nasdaq-listed Solana Company has revised its digital asset portfolio. According to the latest report, its Solana (SOL) assets have reached over 2.2 million tokens as of October 6. In conjunction with the above $15 million cash, the firm’s Solana treasury stash is currently over $525 million.

Solana Company Acquires More SOL Tokens

The market price of SOL had also fallen to $232.50 per coin earlier in the morning on Monday trading. However, the token has now gone up following wider market performances of the crypto market. So far, SOL is trading around $233.77, and this boosts the value of the holdings and the position of the Solana Company, which will find itself in a position to potentially gain value should the altcoins rally again.

The company has proposed that it will use its $15 million cash reserve to grow its digital asset treasury. Such a step should augment the total holdings of Solana Company in SOL and strengthen its status as one of the largest corporate investors with SOL treasury.

Cosmo Jiang, the general partner of Pantera Capital and the observer of the board of Solana Company, stressed the importance of strategic accumulation in the firm. “Following in the footsteps of Michael Saylor at MSTR and Tom Lee at BMNR, HSDT Solana Company is focused on maximizing shareholder value by efficiently accumulating Solana,” Jiang said in an announcement. He added, “As evidence of that focus on efficient accumulation, HSDT’s Solana and cash holdings now exceed the initial capital raise amount in less than three weeks.”

Solana Company is becoming part of a list of an increasing number of publicly traded companies that are actively buying SOL. Other prominent corporate investors are Forward Industries, Upexi, DeFi Development Corp., Sharps Technology, and Sol Strategies. Some of these companies have also indulged in staking, which is also aiding the Solana network security and may also yield a better yield on their investments.

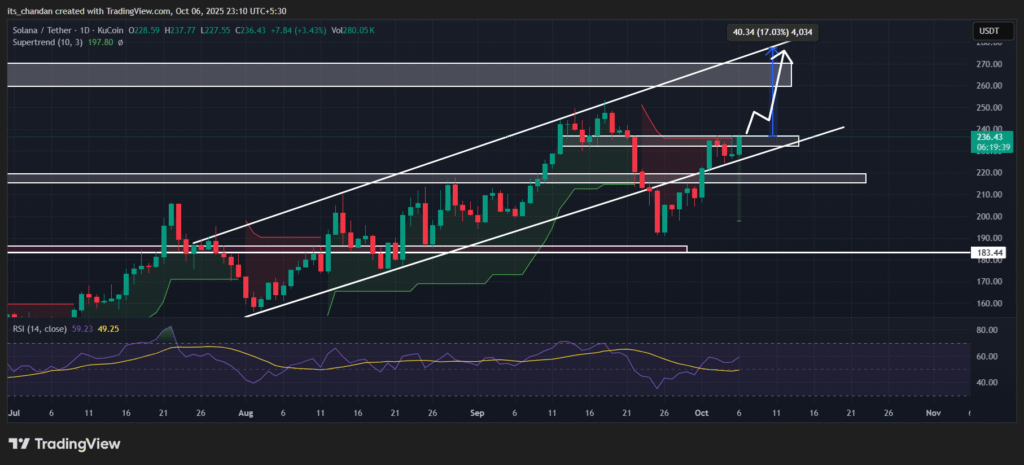

Is SOL Price Surge Incoming?

The company’s treasury policy shows that the company is not limited to the long-term acquisition of digital assets, but seeks to use the market dynamics to maximize the value of the portfolio. As the cash is easily accessible to continue the purchases, the Solana Company focuses on further improving its presence in one of the most popular blockchain ecosystems.

Amid growing corporate treasury strategies, analysts expect the Solana price to rally unprecedentedly. Bulls are now eyeing the $270 level for SOL, with $237 acting as a major resistance point. Once the altcoin breaks this resistance level, a massive uptrend could follow as a price reversal trend will take over.

Also Read: Solana News Today: Bulls Watch $270 as SEC Prepares SOL ETF Decision