Key Takeaways

- Solana’s DeFi TVL dropped by 3.28% over the past 24 hours, indicating a lack of investor confidence in the asset.

- Solana’s weekly transactions have fallen by over 50% since the start of October 2025, hinting at weakening momentum.

- Price action suggests that a SOL rally could be possible if it clears the $236.5 level.

Today, Solana (SOL) outperformed Bitcoin (BTC), Ethereum (ETH), and Binance’s Chain (BNB) with a 4% price jump. However, on-chain data tells a different story, raising questions about whether this rally is sustainable or just a trap. With a 4% jump, SOL price reached $228, once again reclaiming its prolonged ascending channel pattern, which it has been following since August 2025.

Also Read: Top 5 Altcoins to Watch in October 2025

Solana’s On-Chain Data Signals Caution Ahead

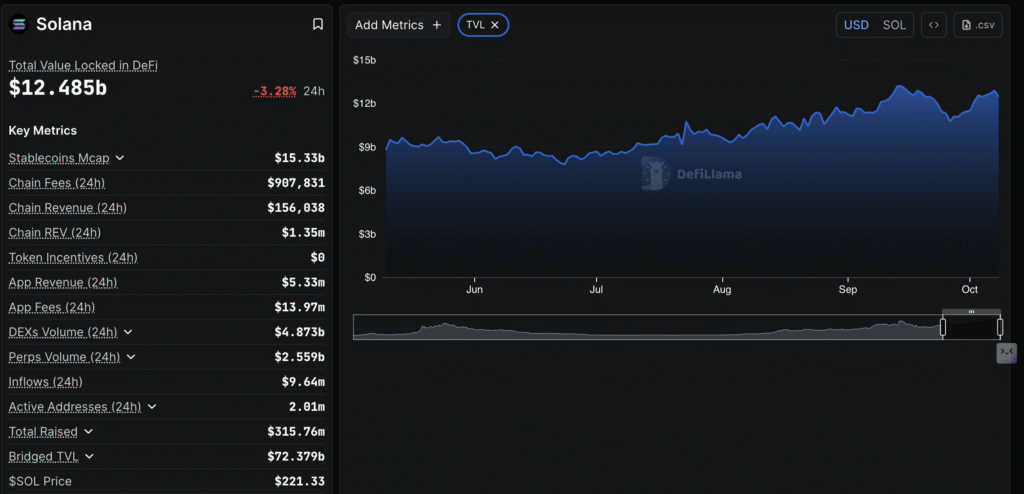

According to on-chain analytics platform DeFiLlama, Solana’s Total Value Locked (TVL) in DeFi has dropped by 3.28% over the past 24 hours, indicating short-term bearish sentiment. Solana’s TVL, a metric that shows the value of coins held on various smart contracts, has now fallen to $12.485 billion from $12.91 billion on Tuesday.

An increase in TVL reflects investors’ confidence as they stake their assets for the long term. On ther hand, withdrawals from staking decrease the TVL, which happens when investors move assets from staking to trading or selling.

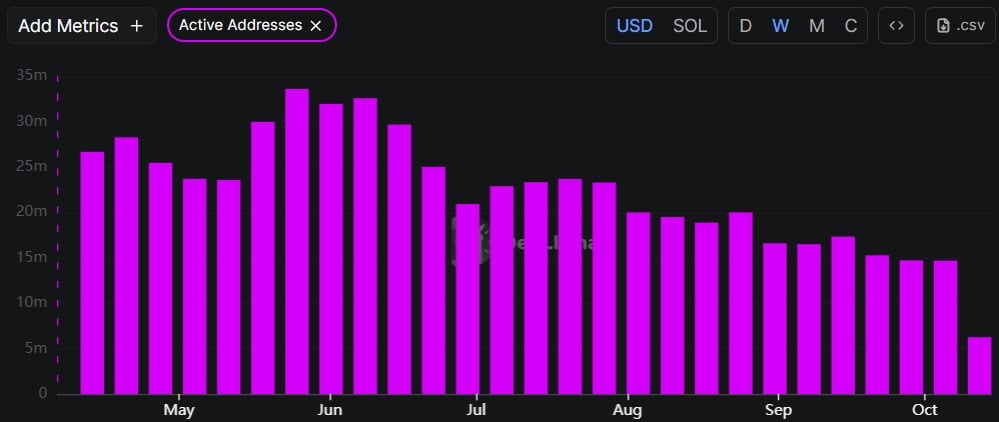

In the case of Solana, not just TVL but active addresses have also plummeted significantly. DeFiLlama’s weekly data shows that active addresses have been steadily declining since late May, now reaching 6.26 million from their May peak of 33.63 million. The notable drop in active addresses hints at decreased user engagement and lower demand for SOL.

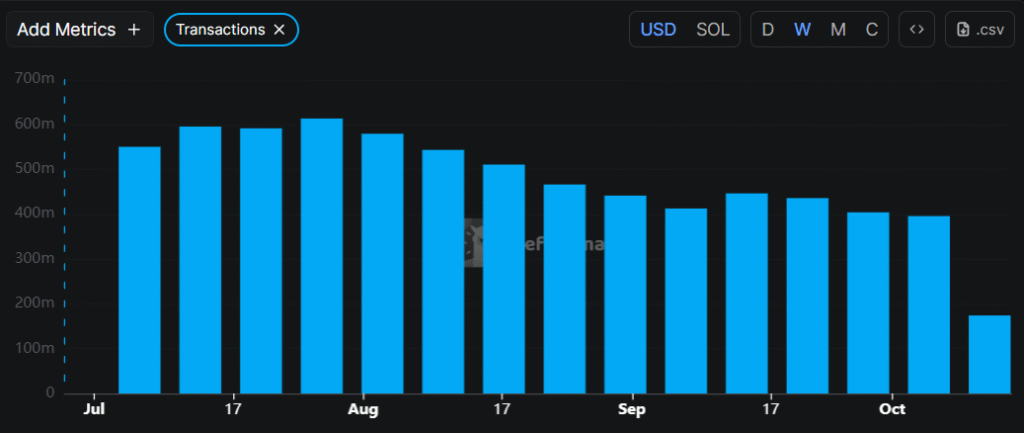

In addition, the number of transactions has fallen significantly over the past few weeks. Data shows that since the start of October 2025, SOL’s weekly transactions have dropped by more than 50%, falling from 395.54 million to 173.99 million at press time.. Such a decline in weekly transactions on the blockchain hints at weakening asset momentum.

Solana (SOL) Price Action and Critical Levels to Watch

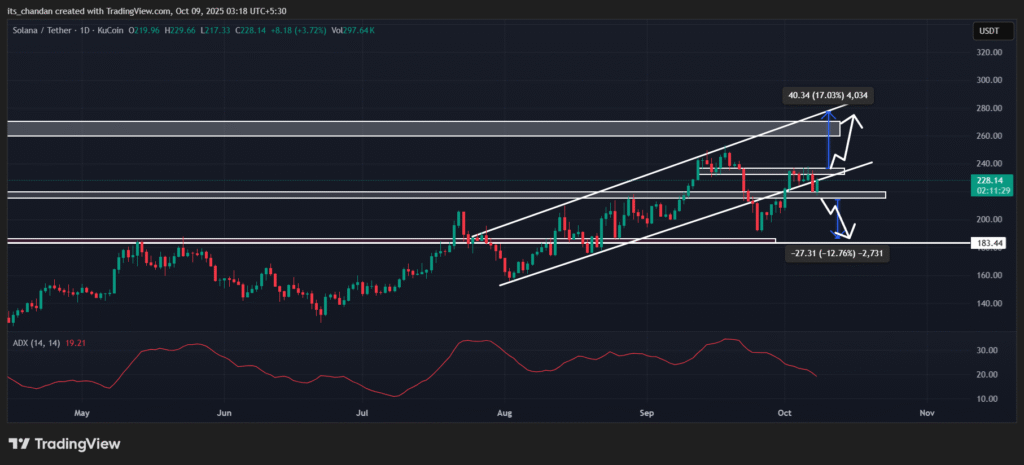

According to TradingView’s daily chart, Solana (SOL) is in an uptrend but is currently moving sideways. Since a week, the SOL price has been trading between $220 and $236.5, which is also a strong resistance zone.

During this period, SOL reached its upper boundary multiple times but failed to break through. So far, it is not yet confirmed whether the price will rally or crash in the coming days. Based on current price action, SOL’s quick rally is only possible if it breaks out of the key $236.5 resistance level.

If the breakout is successful, SOL could jump 17% and reach the $275 level. On the downside, strong bearish momentum could occur if the daily candle closes below $218, potentially pushing SOL down 13% to the $186 level.

At press time, the Average Directional Index (ADX) stands at 19.21, below the key threshold of 25, indicating weak directional momentum for Solana, which could constrain the asset’s upside potential.

Read More: Breaking: Bitwise Shocks Markets with Ultra-Low 0.20% Fee on Solana Staking ETF