Key Takeaways

- Bithumb partners with Trump backed World Liberty Financial in a strategic move aimed at accelerating the growth and adoption of DeFi solutions worldwide.

- The main aim of the partnership is to fuel innovation and show that blockchain-based finance is becoming an integral part of the future global economy.

- Zak Folkman, co-founder of WLFl, also shared that the company is gearing up to launch a debit card and retail app “very soon.”

- Bithumb, which has long been viewed as playing second fiddle to rival Upbit, has been stepping up by growing its services and establishing international alliances.

South Korea’s Bithumb partners with World Liberty Financial aiming to foster global DeFi growth. The deal between the crypto exchange and the Trump Linked crypto venture comes at a time when the South Korean diaspora has seen a steady rise in DeFi adoption and utility.

The partnership, sealed on Monday with an MOU signing at Bithumb Financial Tower in Seoul, focuses on opening new business opportunities in DeFi while strengthening global investor trust.

Though the specifics of the deal are not disclosed, it is likely that WLFI will have a grater exposure of Asian clients by expanding its business in South Korea.

At the signing, Bithumb CEO Lee Jae-won called the collaboration a “milestone” for the exchange, saying it would sharpen Bithumb’s global competitiveness and expand its strategic network. WLF co-founder Zak Folkman also attended alongside executives from both companies.

The deal reflects a shared ambition to push DeFi into the mainstream by combining Bithumb’s strong market presence with WLF’s international vision. The main aim of the partnership is to fuel innovation and show that blockchain-based finance is becoming an integral part of the future global economy.

Bithumb Partners With World Liberty Financial Amid Other Expansion Projects

The partnership between the South Korean exchange and the crypto venture comes against the backdrop of a greater expansion policy that both the platforms have undertaken.

Just earlier in the day, Zak Folkman, co-founder of World Liberty Financial, shared that the company is gearing up to launch a debit card and retail app “very soon.” The debit card, powered by its stablecoin USD1, will work with Apple Pay and other everyday payment systems, making it easier for people to spend crypto like regular money.

The retail app will go beyond payments by combining trading features with peer-to-peer transactions, giving users one simple platform to manage their digital assets. Together, these tools are set to drive World Liberty’s push into the consumer market, making crypto more practical and accessible in daily life.

On the other hand, Bithumb has expanded support for authentication via major private financial apps such as KakaoBank in the customer verification (KYC) process.

Bithump Comes Under Scruitiny

Unfortunately, the tides of the new partnership also come at a time when Bithumb, South Korea’s second-largest crypto exchange, has landed in hot water with regulators after it was found to be sharing its order book with Australia’s Stellar Exchange. The allegations have sparked concerns that sensitive customer data could be at risk and that it may create loopholes for money laundering.

The Financial Intelligence Unit (FIU), under the Financial Services Commission (FSC), is now stepping in. Regulators said they plan to summon Bithumb CEO Lee Jae-won for questioning as they investigate whether the company followed proper procedures.

An FSC officials also noted that if Bithumb is found to have violated the Act on Reporting and Using Specified Financial Transaction Information, the exchange could face tough consequences.

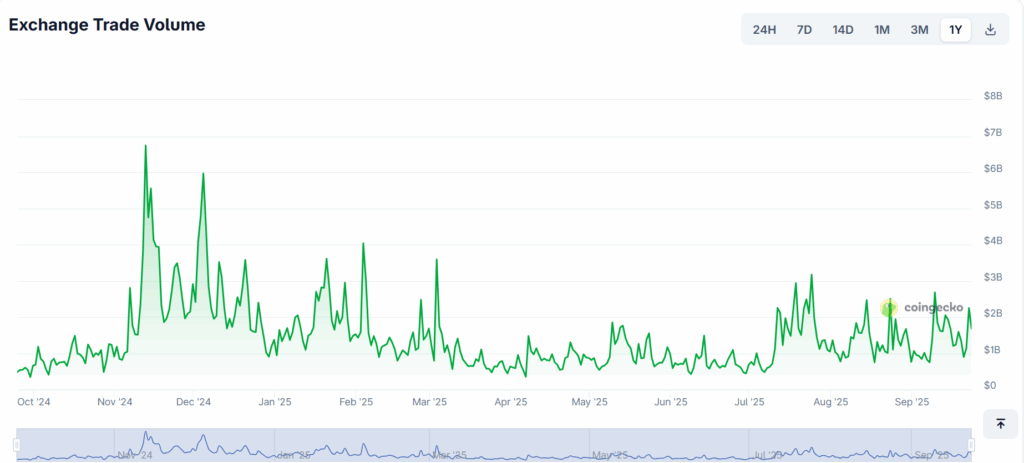

Bithumb Keeps Volumes Steady Despite Scrutiny

The second-biggest cryptocurrency exchange in South Korea, Bithumb, is preparing for its eagerly awaited initial public offering (IPO) by taking risks to increase its market dominance. Bithumb, which has long been viewed as playing second fiddle to rival Upbit, has been stepping up by growing its services and establishing international alliances in an effort to attract more investors and users.

According to market participants, the IPO might be a watershed moment that increases transparency and confidence in Korea’s cryptocurrency sector overall. In addition to trading, Bithumb is looking into DeFi projects and international partnerships, indicating its desire to expand far beyond regional rivalry. As the IPO approaches, the exchange is putting itself in a position to solidify its position as a significant player in the digital asset market.