Key Takeaways

- Spot XRP ETF filings by major asset managers like Grayscale, Bitwise, and others face major SEC deadlines in the coming month.

- In October, other crypto ETF applications will also be reviewed by the U.S. SEC.

- The market is expecting BlackRock to file for an XRP ETF in the meantime.

XRP investors are anticipating a landmark decision by U.S. Securities and Exchange Commission (SEC) in October that could either make or break the token’s entry into the exchange-traded fund (ETF) market alongside Bitcoin and Ethereum. The final deadlines of various spot XRP ETF applications are in the coming six weeks, and regulatory clarity and market momentum are in the limelight.

XRP ETF Filings Await Critical SEC Deadlines in October

The first important decision by the SEC concerns Canary Capital’s application for a Litecoin spot ETF due on October 2. That ruling is expected to establish a tone for future rulings on applications involving all types of digital assets, including XRP, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), and Hedera (HBAR).

President of NovaDius Wealth Management, Nate Geraci, dubbed October “enormous” for the ETF industry. “We’re coming up on final deadlines for multiple filings across altcoins,” he noted. Geraci added, “The SEC could decide to rule sequentially based on individual deadlines or approve several products at once.”

In the case of XRP, the schedule itself starts in mid October:

- Grayscale: October 18

- 21Shares: October 19

- Bitwise: October 20

- Canary Capital: October 24

- CoinShares: October 25

- WisdomTree: October 25

- Franklin Templeton: 14 November.

Regardless of what approach the SEC chooses to take (staggered or a batch approval), the results will have a significant impact on the XRP direction going into the last quarter of 2025.

The BlackRock Factor Into Play

Some speculation has been growing regarding the possibility that BlackRock will add an XRP ETF to its iShares portfolio. The asset manager already has a leading position with its Bitcoin and Ethereum spot ETFs, which have been used to propel record inflows into such markets.

BlackRock Head of Digital Assets Robbie Mitchnick has recently discussed the company’s approach to digital assets ETFs in an interview with Geraci. Although he did not confirm plans for an XRP ETF, Mitchnick stated, “We’re looking at things like market cap, liquidity, maturity, but also clarity of investment thesis and overall product and portfolio considerations in terms of how clients are going to use these products long term.”

Since XRP is the third-largest crypto asset by market capitalization and has been known to play an important part in cross-border payments, any action on behalf of BlackRock would go a long way in influencing investor sentiment. Notably, pursuant to the Generic Listing Standards of the SEC in respect of commodity-based shares, the issuers can list some spot ETFs without a lengthy examination with the Commission, yet the Commission can postpone the launch.

What’s Next for Ripple’s XRP Price?

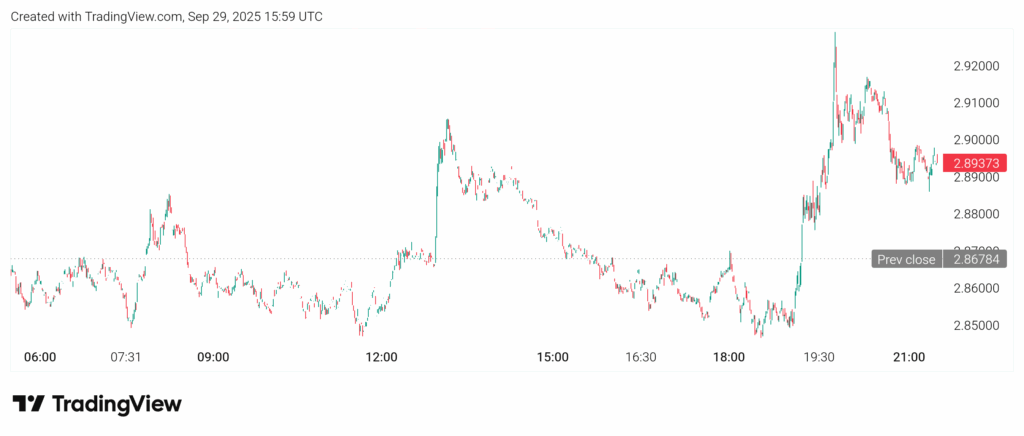

In the recent sessions, the XRP price has been lifted by optimism over possible approvals. The token ended the trading day at $2.8684 on Sunday, September 28, increasing by 2.17%. Ripple’s XRP continuing its four-day winning streak with a 2.99% gain today, reaching $2.89 on Monday, September 29.

Now, the psychological barrier of 3 is being watched by traders. Once XRP price breaks out from $3, the next resistance levels are to occur at $3.2 and $3.335, and finally, at the all-time high of 3.66.On the negative side, there if the crypto breaches important support areas of $2.7 and $2.5, it could fall to a low of $2. However, with the critical SEC deadlines looming and anticipation an approval for spot XRP ETFs, Ripple’s native token could benefit greatly.

In case of a successful launch, retail and institutional capital could flow into these funds, which could drive demand for XRP. This influx could indeed drive the XRP price higher as seen Bitcoin’s case, which surged roughly around 340% since tha launch of spot BTC ETFs in January 2024.

Read More: Ripple News Today: XRP Could Rally 17% If $2.75 Holds