Key Takeaways

- Strategy has acquired 21,021 bitcoins, using proceeds from a $2.521 billion IPO of preferred shares.

- The STRC IPO is reportedly the largest in the U.S. in 2025, with trading set to begin on Nasdaq under the symbol STRC on July 30.

- STRC stock begins with a 9% annual dividend paid monthly, adjustable within limits, and designed to trade near a $100 par value.

- The offering marks a hybrid approach, blending income-generating features with a crypto-focused treasury strategy, which is an uncommon model in capital markets.

Nasdaq-listed Strategy Inc, the largest corporate holder of bitcoin, said Tuesday it had purchased 21,021 bitcoins following a $2.521 billion initial public offering of preferred shares.

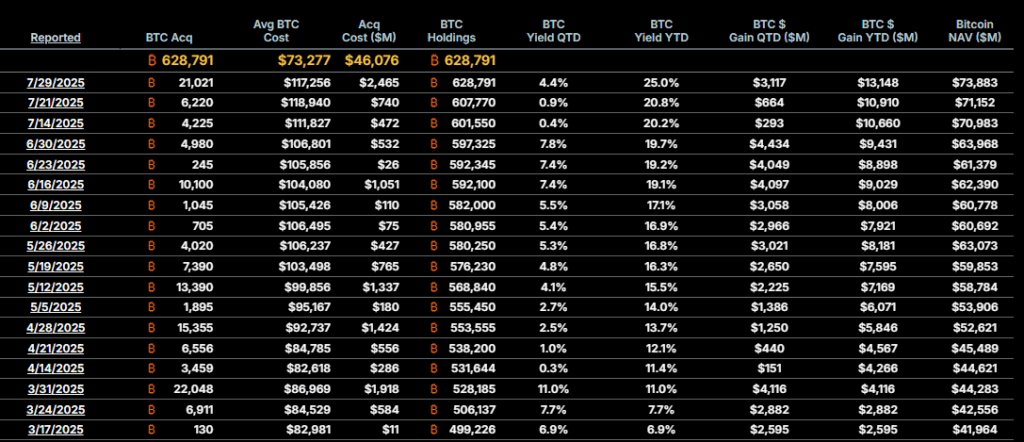

The acquisition, made at an average price of $117,256 per bitcoin, lifts Strategy’s total holdings to 628,791 bitcoins, purchased at a cumulative cost of approximately $46.8 billion. The company said it used proceeds from its $2.521 billion initial public offering of STRC, a new class of variable-rate perpetual preferred stock priced at $90 per share.

According to the company, the STRC IPO is the largest in the United States so far this year and one of the biggest crypto-linked listings in recent years, with trading set to begin on Nasdaq under the symbol STRC on July 30.

Strategy plans to use the estimated $2.474 billion in net proceeds to expand its bitcoin reserves and launch an income-oriented investment vehicle. Additionally, STRC will pay monthly dividends, with rates determined by the company’s board.

What Is STRC? A Hybrid of Yield and Crypto Ambition

STRC is a new class of preferred stock issued by Strategy, structured more like a fixed-income product and designed to deliver steady income while backing the company’s bitcoin acquisition strategy.

The new stock offers a variable annual dividend starting at 9%, with payments made monthly beginning August 31, 2025. Unlike typical equity, STRC incorporates features aimed at providing yield stability and price anchoring.

STRC is engineered to trade close to its $100 par value, with dividend adjustments aimed at reflecting market conditions and supporting price stability. By linking yield to market dynamics, the offering combines elements of bond-like reliability with Strategy’s ongoing crypto exposure.

The stock is part of Strategy’s broader plan to tap capital markets for bitcoin accumulation, as proceeds will be used to support general operations and bolster Strategy’s already massive bitcoin reserves.

Morgan Stanley, Barclays, Moelis & Company, and TD Securities are leading the IPO, which is registered with the SEC under an existing shelf filing, alongside several other top-tier financial institutions.

In essence, STRC represents an unconventional approach to preferred equity, blending stable income features with crypto-driven capital deployment, and offering investors a rare mix of monthly yield and digital asset exposure.

Read More: Bitmain Bets on America: Chinese Bitcoin Mining Giant to Open First U.S. Factory