Key Takeaways

- Strategy launches 5 million shares of STRC Stock at a $100 par value, offering a 9% starting dividend yield.

- Dividend rate will be adjusted monthly based on market conditions, to keep the stock trading near par.

- Proceeds will fund general corporate purposes, including expanding Strategy’s Bitcoin reserves.

- The new offering adds to Strategy’s broader crypto play, reinforcing its position as the largest corporate holder of Bitcoin.

Nasdaq-listed Strategy, holder of the world’s largest corporate Bitcoin reserve, announced on Monday its plans to launch an IPO of 5 million shares of a new preferred stock, aiming to raise funds for corporate operations and additional Bitcoin purchases.

Offering Details: STRC Stock Structure and Yield

The new security, named STRC Stock, is a preferred share offering with a variable annual dividend. It will start with a 9% yield, paid monthly beginning August 31, 2025.

According to the announcement, the company will retain the right to adjust the dividend rate each month, but only within strict limits. As stated:

Strategy will have the right, in its sole and absolute discretion, to adjust the monthly regular dividend rate per annum applicable to subsequent regular dividend periods. Strategy’s right to adjust the monthly regular dividend rate per annum will be subject to certain restrictions.

Additionally, dividend payments will be made in cash only, with any missed payments to be accumulated monthly with compounded interest until paid.

From Investor Cash to Crypto Stash

Strategy has designed its new stock to function more like a yield-focused instrument, adjusting the dividend rate based on market conditions to help maintain its trading price near the $100 par value.

As part of this strategy, proceeds from the offering will be used for general corporate purposes, including expanding the company’s Bitcoin reserves.

Backed by Wall Street and Cleared for Offering

The offering is being led by Morgan Stanley, Barclays, Moelis & Company, and TD Securities, while Co-managers include AmeriVet Securities, Keefe, Bruyette & Woods, and others.

Additionally, the IPO is reportedly registered with the U.S. Securities and Exchange Commission under an existing shelf registration and will be issued through regulated offering documents.

Not Your Usual Preferred Stock

STRC Stock blends characteristics of traditional income-generating investments with Strategy’s ongoing commitment to Bitcoin accumulation. The stock carries a $100 par value and pays monthly dividends, with the rate adjustable within limits tied to the SOFR benchmark, which is a structure more commonly seen in fixed-income markets than equity.

Unlike conventional preferred shares or growth stocks, STRC is designed to behave like a yield-focused instrument, while channeling capital into a crypto-centric treasury strategy. By linking dividend flexibility to market conditions, Strategy aims to keep the stock trading close to par, offering investors price stability alongside regular payouts.

New Stock Comes Amid Strategy’s Aggressive BTC Push

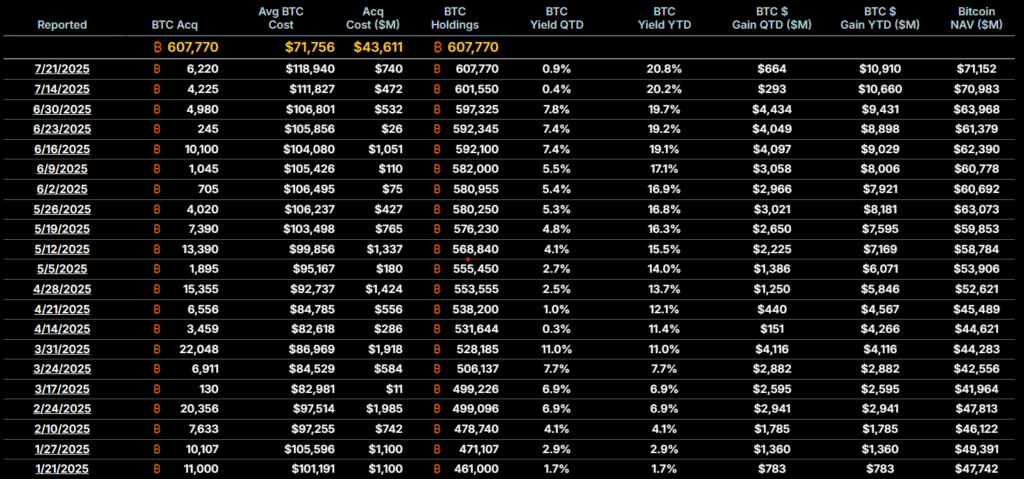

The new stock offering follows Strategy’s recent purchase of 6,220 bitcoins for $740 million, using proceeds from multiple at-the-market offerings. As of July 21, the company held 607,770 BTC, reinforcing its continued reliance on capital markets to expand its position as the largest corporate holder of the cryptocurrency.

Read More: DeFi Dev Corp Nears 1M SOL Treasury as Token Surges to $200