Key Takeaways

- Tether deposited 8,888 BTC and treasury deposits were over 87,450 coins.

- Other than Bitcoin, Tether owns gold and a large portion of Adecoagro.

- Bitcoin is finding it hard to regain the lost ground of $120,000 even with the acquisition with the support of Bitcoin at about $110,000.

Table of Contents

USDT issuer Tether is again in news with blockchain data showing the stablecoin giant added around 8,888 BTC to its wallets on Monday. The most recent acquisition, valued at a little over $1 billion, reinforces the company as one of the largest corporate proprietors of Bitcoin in the world.

Tether’s Bitcoin War Chest

According to Arkham Intelligence data, the transfer takes Tether’s treasury balance of the Tether to over 87,450 BTC. The market observers, though no official announcement has been made, are of the opinion that the move was part of the long term attempt of the issuer to invest its reserves in the non-inflatable assets.

This accumulation trend goes back to months. Tether previously revealed that it had more than 100,000 BTC and about 50 tons of gold under its control. The company also transferred over 15,000 BTC to XXI, a treasury management company, that focuses on corporate Bitcoin strategies in June and July.

Beyond Crypto: A Push into Hard Assets

Tether has strategically diversified its portfolio not limiting itself to just crypto. The company has not restricted itself to digital assets and precious metals. It also has a majority holding (approximately 70%) in Adecoagro, a large Latin American agribusiness that operates in excess of 210,000 hectares of agricultural land in Argentina, Brazil, and Uruguay.

This multi-asset reserve policy, which spans Bitcoin, gold, and agriculture, is an indication that Tether is trying to give its balance sheet some resilience. Moreover, it is trying to avoid depending on traditional cash instruments and U.S. Treasuries.

Bitcoin Price Faces Pressure Despite Recent Acquisition

The latest billion-dollar BTC Buy comes at a time when Bitcoin is consolidating at key levels. Having notched a record of more than $124,000 in August, Bitcoin has since failed to decisively break out above the $120,000 mark again. The $110,000 level now serves as key support but traders are wary.

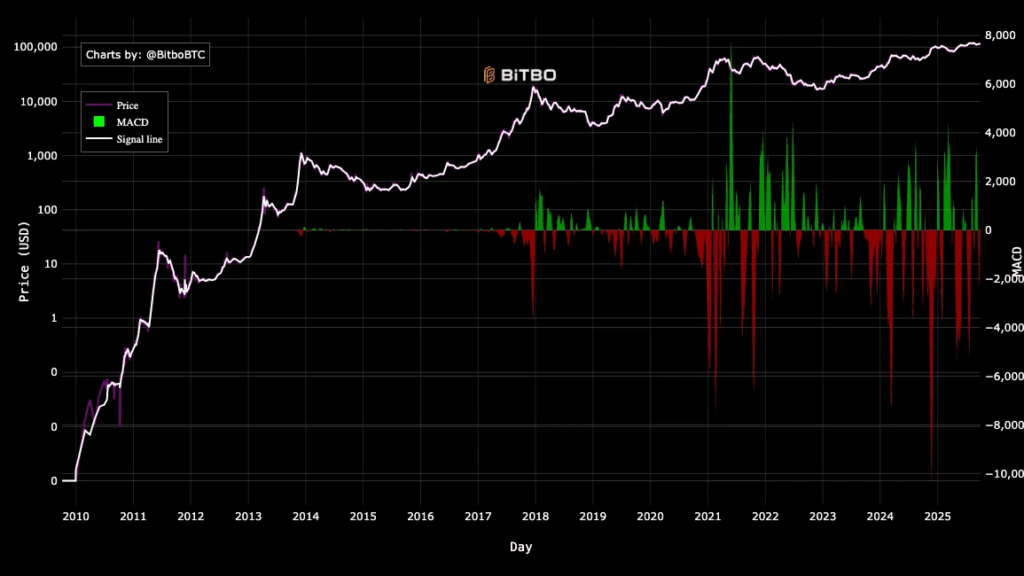

Technical readings are a mixed picture. At press time, Bitcoin price hovered around $113,519, slightly higher than the 50 day EMA. The Relative Strength Index (RSI) is neutral with the value of 53 while the MVRV ratio is close to what is typically considered overvalued.

On-chain watchers are also looking to the NVT ratio that has occasionally indicated massive breakouts when combined with an increase in transaction volumes. Currently, the NVT ratio is nearing a fall below 30, a trend which triggered gigantic rallies in 2020 and 2023.

In the meantime, Bitcoin is still receiving institutional capital in the form of ETFs. Statistics from Farside UK indicate that there have been inflows of about $57.29 billion to date, which proves that the market is being influenced by both corporate and fund demand.

Read More: Bitcoin Q4 Playbook: Fed Rate Cut, ETF Flows, Key Indicators Fuel BTC’s Future