Key Takeaways:

- Tether now holds $127 billion in US Treasuries, surpassing South Korea as the world’s 18th largest holder.

- The largest stablecoin project reported $4.9 billion in Q2 profit, bringing year-to-date earnings to $5.7 billion.

- Nearly $4 billion has been reinvested in projects such as XXI Capital and Rumble, focusing on the U.S. ecosystem.

Tether (USDT), the largest stablecoin issuer with a market cap of more than $163 billion, has cemented its position as a major player in the global financial system, with its holdings of US Treasury bonds currently surpassing those of numerous sovereign governments, including South Korea. The company’s Q2 2025 report showed a huge increase in its U.S. debt portfolio, highlighting the massive magnitude of the world’s largest stablecoin and its growing integration with traditional finance.

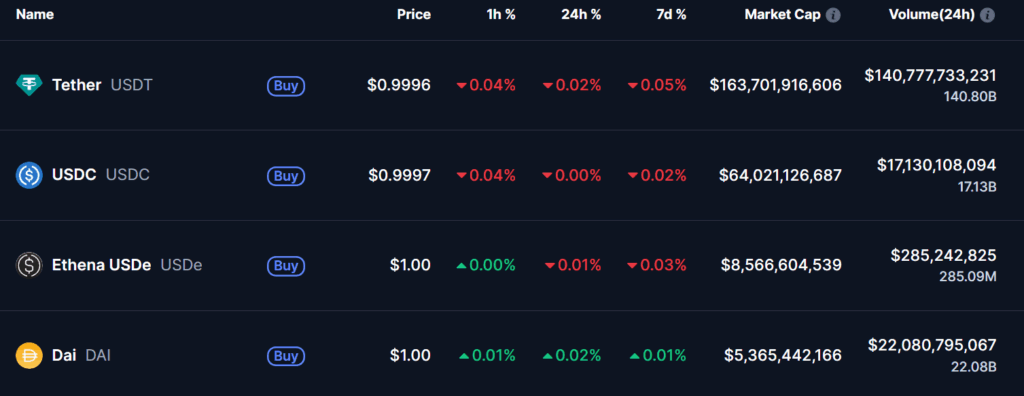

Top stablecoin tokens based on market capitalization-

Messari’s analysis shows that Tether’s US Treasury reserves have risen to $127 billion, overtaking South Korea and becoming the 18th largest holder of U.S. Treasuries. Additionally, Tether’s U.S. Treasury holdings have climbed by $8 billion since the first quarter, making it one of the world’s largest holders of US Treasuries.

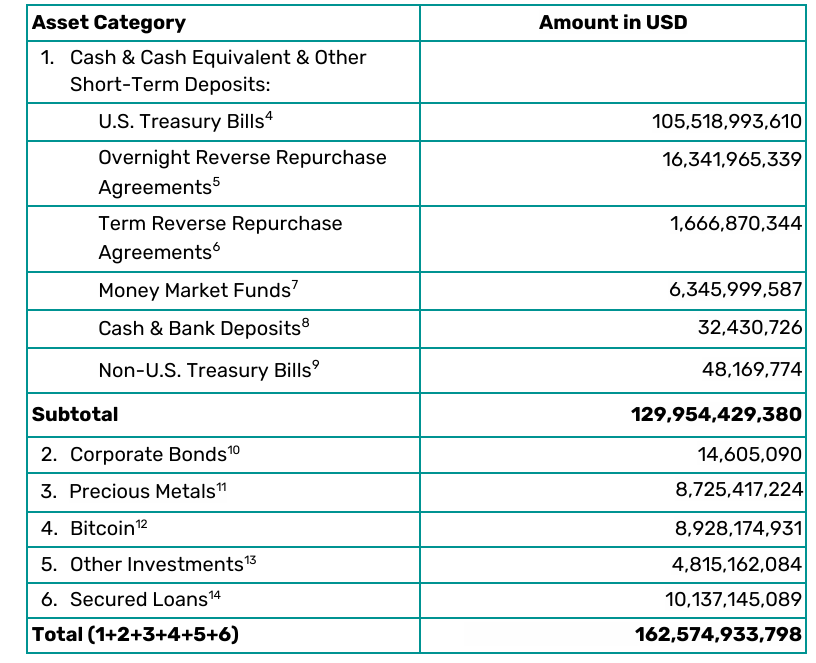

According to Tehter’s Q2, 2025 report, the holdings include $105.5 billion in direct ownership and $21.3 billion in indirect exposure, placing it among the world’s largest holders of US Treasuries. This milestone comes at a time of a beneficial shift in US policy, as the newly passed GENIUS Act seeks to strengthen the dollar’s role in the digital economy.

Tether reported a net profit of $4.9 billion in the second quarter alone, pushing its year-to-date profit to $5.7 billion. Tether’s total assets of about $162.6 billion currently surpass its liabilities of $157.1 billion, resulting in a protective equity buffer of $5.47 billion to strengthen its financial position.

Tether is reinvesting a significant percentage of its income in long-term strategic initiatives, with a particular emphasis on the U.S. ecosystem. So far, almost $4 billion has been invested in the US ecosystem. Key investments include XXI Capital and an investment in the digital freedom platform Rumble, which reflects a broader strategy of innovation in finance, data, and digital infrastructure.