Key Takeaways

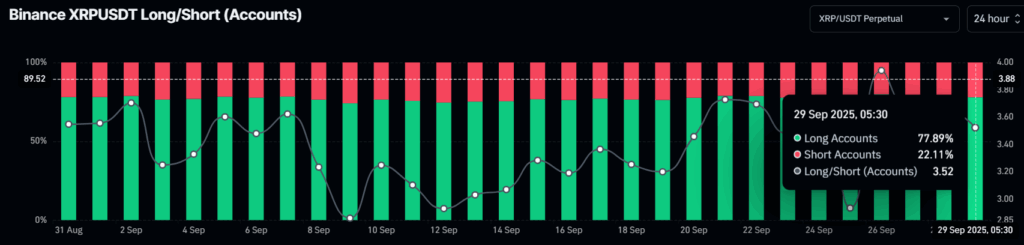

- 77.89% of Binance’s traders are going long on XRP, while 22.11% hold short positions.

- The odds of spot XRP ETF approval in the US have soared to 95%.

- XRP’s price action suggests that the asset could rise by 15%, potentially reaching the $3.25 level.

XRP has received strong support from the bulls over the past 24 hours, driven by the market recovery, the potential approval of a spot XRP ETF, and positive price action.

Trader and Investor Activity Highlights

Data from the on-chain analytics tool Coinglass reveals that currently 77.89% of Binance’s XRP traders are holding long positions, while 22.11% are on the short side.

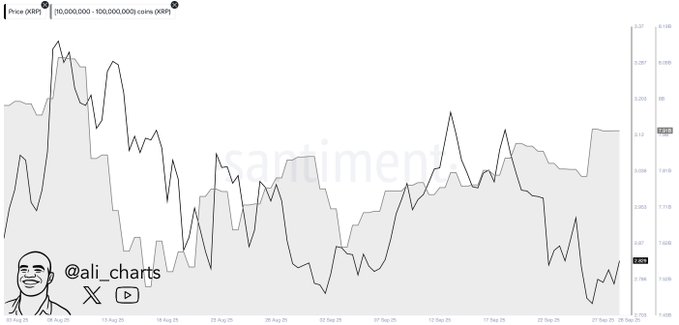

Additionally, an expert shared on-chain data that further strengthens the asset’s bullish outlook. A post on X shows that whales holding 10–100 million XRP have purchased an additional 120 million tokens.

Current Price and Trading Volume Trends

Despite strong bullish activity from traders and investors, XRP’s price remains neutral, changing only 0.71% over the past 24 hours, according to TradingView data. The asset is currently trading near $2.89, with trading volume up 55%, reaching $4.92 billion.

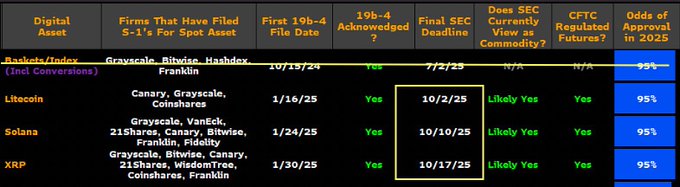

Spot XRP ETF Approval Hits 95% Odds

Given the current market sentiment, an expert shared a post on X noting that XRP could become one of the most valuable digital assets.

In the post, the expert shared ETF data showing that the odds of approval for a spot XRP ETF have reached 95%, with the United States Securities and Exchange Commission (SEC) expected to make a final decision on October 17, 2025.

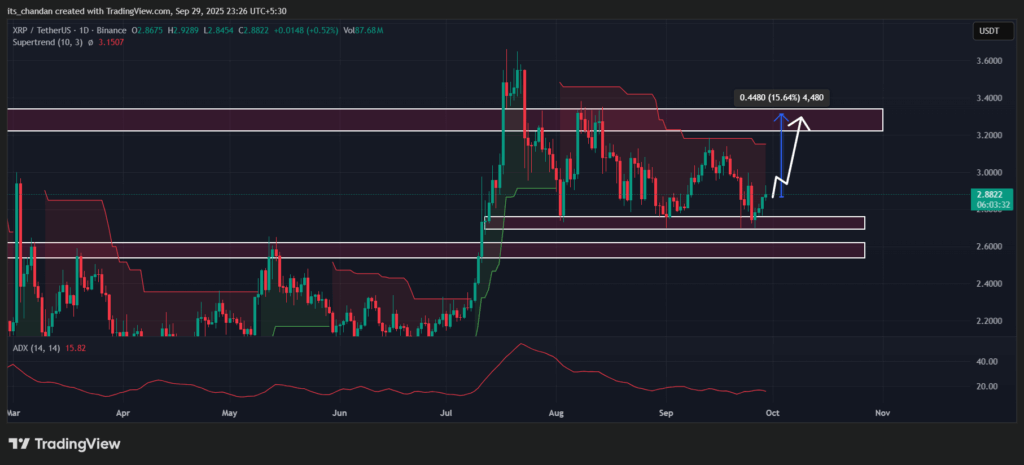

Price Action and Technical Analysis

According to TimesCrypto and technical analysis, XRP is in an uptrend but has been moving sideways since mid-July 2025, trading between the $2.70 and $3.27 levels. During the recent dip, the price reached the lower boundary but is now experiencing a reversal, similar to past movements.

Since July 2025, XRP’s price has touched the lower boundary more than four times, with each instance resulting in a price reversal.

Based on the current price action, if history repeats itself, there is a strong possibility that the asset could see an impressive 15% price increase, potentially reaching the $3.25 level in the future.

At press time, XRP’s Supertrend technical indicator remains red and above the price, indicating that the asset is in a downtrend. Meanwhile, the Average Directional Index (ADX) value is 15, below the 25 threshold, suggesting that the asset has weak directional momentum.

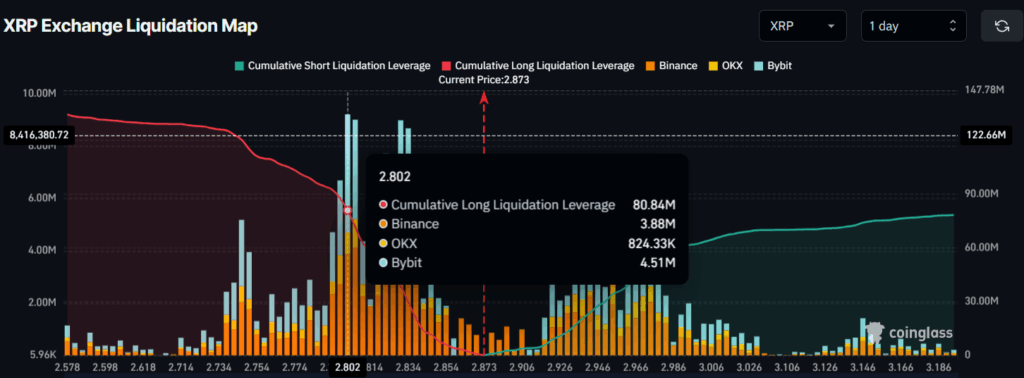

XRP Major Liquidation Levels

According to Coinglass data, XRP’s major liquidation levels, where traders are over-leveraged, stand at $2.802 on the lower side and $2.974 on the upper side. At these levels, traders have accumulated $80.84 million in long positions and $52.16 million in short positions.

When combining on-chain metrics with the current price action, XRP’s long-term and short-term outlook appears bullish, and the asset could soon experience an impressive price uptick.