Key Takeaways

- U.S. grants Nvidia export license to the UAE under AI deal, after a five-month delay.

- UAE commits $1.4 trillion investment in the U.S. over 10 years, securing, 500K AI chips annually.

- Chatter grows about American cloud companies benefiting from the UAE’s AI boom, alongside rising security concerns.

- U.S.-UAE AI partnership could be a major win for the Trump administration if it goes through.

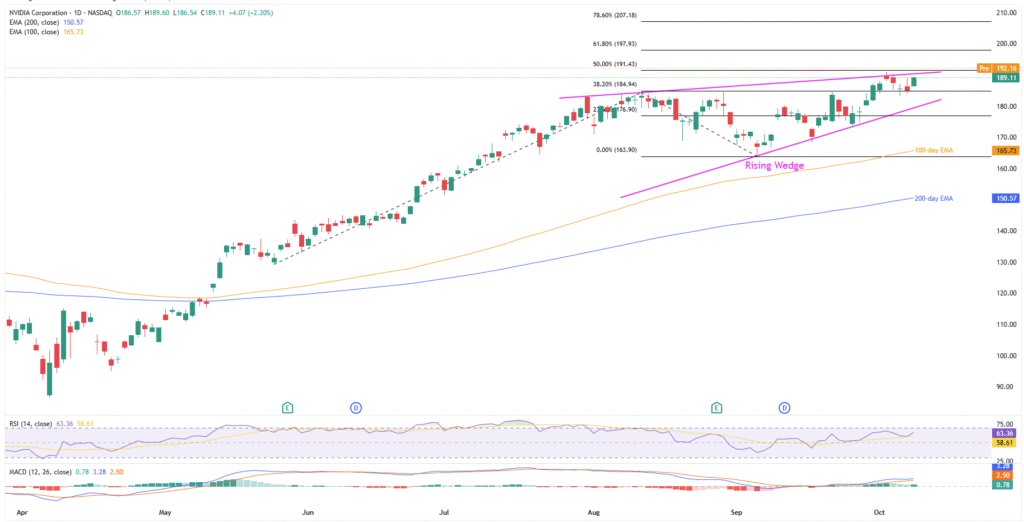

- NVIDIA jumped 2.3%, targets new all-time highs, but rising wedge signals caution for traders.

The U.S. administration granted a multi-billion-dollar worth of chip export license to Nvidia, per anonymous sources cited by Bloomberg.

Under the alleged terms of agreement, discussed during U.S. President Donald Trump’s Middle East visit in May, Nvidia’s AI chips will float to the United Arab Emirates (UAE) in return for an equal value of investment in American soil.

Nvidia-U.S.-UAE Deal

“The Commerce Department’s Bureau of Industry and Security recently issued the Nvidia export licenses under the terms of a bilateral AI agreement hashed out in May, according to people familiar with the matter, who requested anonymity so they could discuss a sensitive issue,” said Bloomberg.

The news also suggests that the latest licenses are the first Nvidia AI chip sales to the Gulf nation under the Trump administration, and is a tangible sign of progress.

Details of the deal, per Bloomberg, include the UAE promise to invest a whopping $1.4 trillion on American soil over the next ten years, a pledge the Gulf nation has not broken down into specific projects. The US, meanwhile, planned to approve up to 500,000 advanced American AI chips annually, with a fifth slated for Abu Dhabi AI juggernaut G42.

Additionally, none of the AI accelerators approved for the UAE will be destined for Abu Dhabi-based AI major G42 group, at least for the first batch, but will be operated by American companies that have datacenters in the UAE.

What Lies Underneath

Even if the Trump administration cheers their success in writing the U.S.-UAE AI partnership, there are multiple loopholes and unanswered questions that have gained attention.

Firstly, the official details on the type of Nvidia chips to be exported aren’t there.

Secondly, the timeline of the additional license issuing and the amount of the UAE investment into the U.S. companies is also questionable.

Further, the U.S. policymakers are also concerned about the size of a datacenter, about five gigawatts, in the Gulf nation’s capital, Abu Dhabi, where China has notable business and economic roots.

Moreover, which American data center and cloud companies will benefit from the Nvidia chips and how they’ll export chips to the UAE will be a matter of discussion.

The NVIDIA..

Following the news, shares of Nvidia Corporation, listed on Nasdaq, jumped 2.3% to $189.11. That said, pre-market pricing becomes more interesting as it suggests a fresh all-time high of $192.22 by press time, versus the previous top of $191.05.

Nvidia Price: Daily Chart Suggests Limited Upside Room

Nvidia’s pre-market bids suggest a fresh record top around $192.20-25 amid bullish signals from the Moving Average Convergence Divergence (MACD) and the 14-day Relative Strength Index (RSI) momentum indicators.

However, an upper line of a 10-week “Rising Wedge” bearish chart formation, close to $192.25 by press time, could test the buyers if prices fail to offer a daily closing beyond the said hurdle.

If NVIDIA stays firmer past $192.25, the 61.8% Fibonacci Extension (FE) of its late May to early September moves, near $198.00, followed by the $200.00 threshold, could lure the bulls.

Meanwhile, a 38.2% FE level of $184.94 can restrict short-term NVIDIA downside ahead of the rising wedge’s bottom surrounding $179.50.

Notably, NVIDIA’s daily closing beneath the $179.50 confirms a bearish chart formation, suggesting a theoretical target of $152.50. However, the 100-day Exponential Moving Average (EMA) and September’s, respectively, near $165.70 and $164.00, could offer intermediate halts during the anticipated south-run.

Also read: Square Bitcoin Launches Zero-Fee Payments for 4 Million Merchants