Key Takeaways

- BoE stablecoin rules set for November 10: The Bank of England will publish its long-awaited framework, focusing on systemic stablecoins used in payments.

- Two-tier regulation: Larger, “systemic” issuers will fall under BoE oversight, while smaller ones will be regulated by the FCA under lighter rules.

- Temporary holding caps: Limits of £20,000 for individuals and £10 million for businesses aim to protect bank deposits during early adoption.

- UK-U.S. coordination: The BoE and U.S. regulators are working together under a new transatlantic task force to align digital asset policies.

Table of Contents

The Bank of England (BOE) will unveil its long-awaited stablecoin regulatory framework on November 10, aiming to match the pace of U.S. efforts, Deputy Governor Sarah Breeden confirmed on Wednesday.

According to a Bloomberg report, the framework will focus on “systemic” stablecoins expected to be widely used in payments, while smaller issuers will come under lighter oversight from the Financial Conduct Authority. It also introduces temporary holding caps of £20,000 ($26,000) for individuals and £10 million for businesses.

“Our aim is to make sure that our regime is up and running just as quickly as the U.S.,” Breeden said at the SALT conference in London, addressing industry concerns that the UK lags behind its transatlantic counterpart.

While the U.S. enacted its stablecoin legislation, the GENIUS Act, in July, the UK has been preparing its own strategy in parallel. Both countries are now working together through a joint task force announced in September to align their approaches to digital asset regulation.

Breeden added that coordination between the BoE and U.S. regulators, including the Federal Reserve and finance ministries, is ongoing: “It’s really important we do this together.”

The UK’s upcoming consultation marks a shift from earlier, stricter proposals. Regulators hope the adjusted framework will foster innovation in tokenized payments without destabilizing traditional financial institutions.

UK Advances Blockchain Integration Across Banking, Funds and Sovereign Debt

Even as Britain moves cautiously on stablecoin policy, it has been steadily developing its fintech and blockchain landscape through pilot projects, updated rules, and partnerships that make it one of the most dynamic markets for Web3 innovation.

One of the most ambitious initiatives is the tokenized money pilot, announced in late 2024 under the coordination of UK Finance and supported by the Bank of England.

The project brings together major banks including Barclays, HSBC, Lloyds, and NatWest, with the goal of enabling real-world transactions using tokenized sterling deposits.

The pilot will explore programmable payments and atomic settlement, using technology that allows instant exchange of value between parties without intermediaries, marking a critical step toward integrating blockchain infrastructure into the UK’s core financial systems.

The first live transactions are expected by mid-2026, signaling a move from experimentation to execution in digital money innovation.

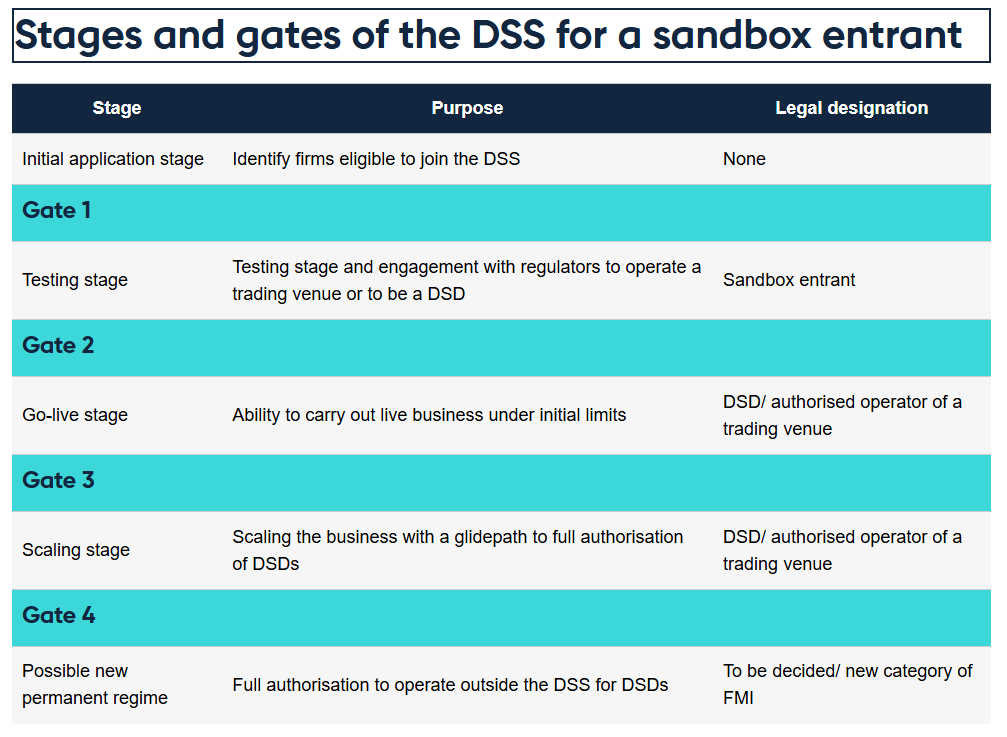

In September 2024, the Bank of England and the Financial Conduct Authority (FCA) took another major step by launching the Digital Securities Sandbox (DSS) to support blockchain-based innovation in financial markets.

The DSS provides a legal and regulatory environment where firms can issue, trade, and settle tokenized securities using distributed ledger technology (DLT). This initiative gives market participants flexibility to test new blockchain-based infrastructures under real regulatory supervision, paving the way for full-scale adoption in the years ahead.

The sandbox, set to run until 2029, is one of the most comprehensive frameworks globally for digital market experimentation, bridging the gap between fintech innovation and traditional capital markets.

Building on this foundation, the Fund Tokenization Blueprint, unveiled by the FCA in January 2025, authorized the UK’s first tokenized investment fund. This milestone allowed regulated funds to maintain investor records on blockchain systems, enhancing transparency, efficiency, and real-time reconciliation.

By mid-2025, the FCA followed up with a consultation (CP25/28) proposing to extend tokenization to a wider range of investment vehicles, potentially reshaping how fund ownership and distribution operate in the UK’s asset management sector.

The Digital Gilt Instrument (DIGIT) pilot, introduced in March 2025, further demonstrated the government’s commitment to blockchain adoption at the sovereign level. Led by HM Treasury and the Debt Management Office, the project explores issuing and managing UK government bonds (gilts) on blockchain networks.

The initiative aims to test whether distributed ledgers can enhance efficiency, transparency, and settlement speed in the public debt market.

In parallel, the UK intensified regulatory cooperation with the United States, launching the Transatlantic Taskforce for Markets of the Future in September 2025. The taskforce brings together the UK Treasury, the U.S. Department of the Treasury, and financial regulators on both sides of the Atlantic to coordinate approaches to stablecoins, digital assets, and capital markets innovation.

The collaboration underscores London’s intent to align global standards and promote interoperability across digital financial systems.

Read More: UK’s FCA Moves to Modernize Finance with Tokenization and Crypto Market Reforms