Key Takeaways:

- The decentralized AI collaboration platform Flock.io (FLOCK) surged over 70% in one day.

- Its native token, FLOCK, is listed on major exchanges such as Coinbase, Upbit and Bithumb.

- Tokenomics of the FLOCK project highlight a community-first approach, but a slightly higher allocation for the internal team.

Exchange Listings Trigger Massive Rally for Flock

Flock (FLOCK), the native token of AI collaboration platform Flock.io, which increased by more than 70% this week following consecutive listings on Coinbase, Upbit, and Bithumb.

FLOCK is a community-run artificial intelligence network in which users exchange data, models, and processing capacity. It tracks blockchain contributions, pays participants, and protects their privacy.

On September 9, Coinbase offered FLOCK trading pairs in the United States, while South Korea’s Upbit and Bithumb introduced the token to one of the cryptocurrency’s most active investor bases. Over the previous 24 hours, Flock’s trading volume has surged by 2549.4%.

The joint impact of US and Korean exchange access resulted in record trading volumes, with FLOCK momentarily outperforming Ethereum (ETH) on select Korean marketplaces.

Coinbase Effect Meets Korean Demand

The listing announcement by Coinbase and Upbit led to a massive price gain for FLOCK. This could be called the “Coinbase Effect,” wherein assets face short-term price appreciation followed by the announcement of listing on Coinbase, as it increases the credibility for the project.

The post-listing effect led to FLOCK skyrocketing, as FLOCK surged as much as 116% intraday, setting a new all-time high (ATH) near $0.67, before falling to the $0.48 region. Daily volume increased by more than 2,000%, over $200 million.

Speculation of Binance Listing

The market has started speculating, following the listing on major exchanges, whether FLOCK will get listed on Binance. No official communications or confirmation have been made regarding the news on the listing. A potential Binance listing could further expand FLOCK’s global investor base.

What Does Tokenomics Say About FLOCK

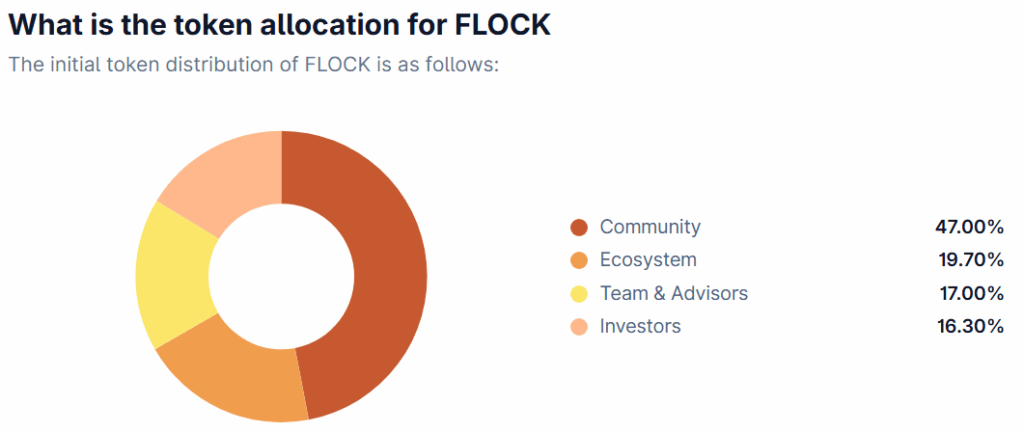

The FLOCK token allocation prioritizes the community, with 47% flowing to users to ensure decentralization and adoption. The team controls 33.3% in total, which could be considered slightly higher, but another 19.7% has been allocated towards ecosystem growth.

Overall, the distribution reflects community-first and ecosystem-driven growth, while incentivizing the core team and investors to support FLOCK’s long-term goals.

Caution Amid Hype

The recent rally for FLOCK is hugely driven by exchange listings rather than fundamental-driven developments such as new product upgrades or user-driven developments. However, with listings on major exchanges such as Coinbase, Upbit, and Bithumb, the token has gained credibility and would be on numerous traders’ watchlists due to speculation on Binance listing as well.

Whether FLOCK can sustain its momentum will depend on the Flock.io team delivering updates and broader adoption of its AI-integrated blockchain model.