Key Takeaways:

- The White House has proposed a pro-crypto report with the goal of making U.S. the crypto capital of the world.

- The White House Crypto report recommends expanding the Clarity Act and modernizing several regulations under the SEC.

- Congress is urged to provide the CFTC control over non-security cryptocurrency spot markets, amongst other recommendations.

The Trump administration has publicly established its strategic vision for the US digital asset sector, releasing a much-anticipated policy brief that calls for sweeping new laws and swift action by the Securities and Exchange Commission (SEC). The instruction intends to reinforce the United States’ position as the world’s cryptocurrency capital.

The policy framework released on July 30th, 2025, is the first significant result of President Trump’s presidential crypto task force, a working group formed to fulfill his campaign promise of creating a crypto-friendly atmosphere. The task force consists of high-ranking individuals, including Treasury Secretary Scott Bessent and SEC Chair Paul Atkins.

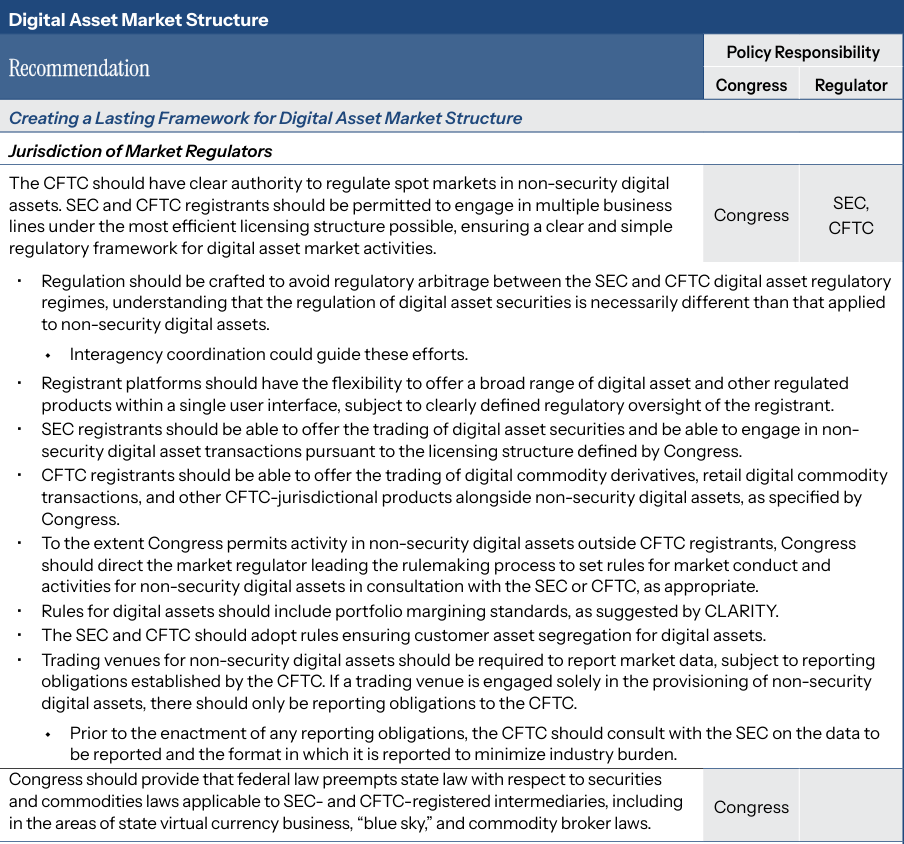

According to the factsheet, the special working group for digital assets under the White House administration specifically recommended expanding the existing “Clarity Act” to include further provisions such as allowing trading platforms to function as qualified custodians and establishing tailored disclosure requirements for firms issuing crypto assets.

The SEC has been recommended to modernize its custody norms on how financial firms can safely keep digital assets for their clients. Key proposals include updating existing criteria and deciding whether to authorize specialized state-chartered crypto businesses as recognized “qualified custodians”. This approach would improve safety and trust, potentially allowing more traditional financial institutions to provide cryptocurrency services to investors. Several other recommendations concerning how the SEC should treat airdrops and Decentralized Finance (Defi) have been included in the report as well.

Another key recommendation based on the report is that Congress should pass legislation granting the Commodity Futures Trading Commission (CFTC) explicit authority to regulate spot markets for non-security digital assets. However, no further updates or detailed facts were provided about the highly anticipated Bitcoin Strategic Reserve.

This proactive, development-focused plan represents a substantial shift from the previous administration’s strict approach, which was marked by high-profile lawsuits against industry leaders.

Despite public concerns about potential conflicts of interest, the administration’s policy report is on track to become a foundational guide for US crypto legislation. The document is expected to have a significant impact on ongoing Senate discussions and eventually, the legal framework for the digital asset market.