Key Takeaways

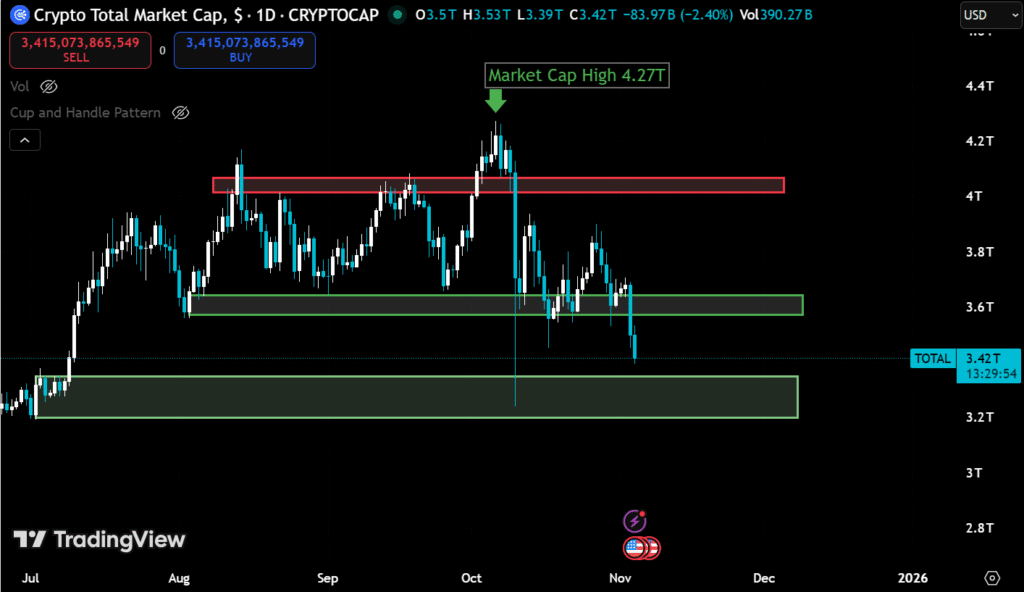

- The overall market capitalization of cryptocurrencies dipped to $3.55 trillion on Tuesday.

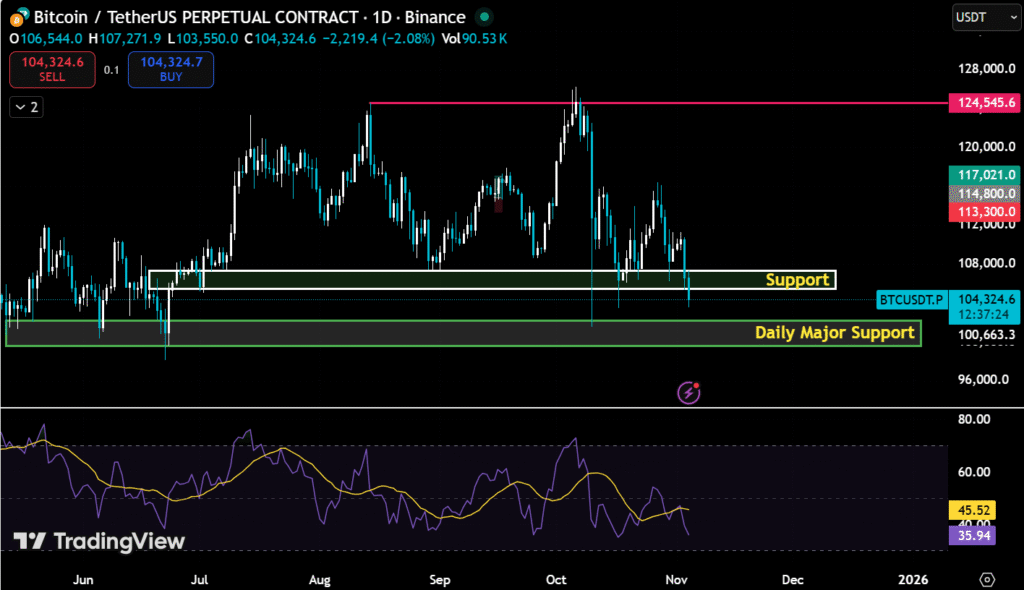

- Bitcoin slipped below the horizontal support area of $106,500.

- The Federal Reserve’s comments have reduced expectations for further rate cuts.

- Outflows of over $186.5 million from U.S. spot Bitcoin ETFs indicate institutional profit-taking.

On November 4, 2025, the crypto market declined sharply, with the combined market cap at $3.52 trillion, dropping 4% in the previous 24 hours. At the time of writing, Bitcoin trades at $104,000, down more than 2% for the day.

Ethereum trades at $3,490, down 9%, and Solana is down by 13% at $159. Coins like XRP and Cardano experienced a drop of 8% and 5.7%, respectively.

Meme coins like Dogecoin declined 45% from recent highs at $0.306.

The Crypto Fear and Greed Index has fallen to 21, which indicates investors’ fear. According to CoinGlass, liquidations are reported to be $1.36 billion in the last 24-hour.

Reasons for the Crypto Market Decline

Federal Reserve Chair Jerome Powell stated future rate cuts are uncertain following a rare 25 basis point cut in October. The hawkish tilt has substantially strengthened the U.S. dollar and the inverse correlation drives traders away from riskier assets, such as cryptocurrencies. The probability of another rate cut in December has also declined from 69.8% to 67.5%, adding to the tension.

According to sources like Sosovalue, the U.S. spot Bitcoin ETFs recorded outflows of $186.51 million on November 3, which reflects reduced demand. A DeFi protocol exploit on Balancer drains $120 million, which shakes confidence in Ethereum-linked tokens and audited smart contracts. Technical indicators lean towards the bearish possibility. With the support sliding below $3.55 trillion, the market could face a further correction.

Bitcoin Price Analysis

Bitcoin’s current price hovers below the $106,000 horizontal support, the final barrier before a potential 20% plunge. A close below the current level could target $94,400. The current daily RSI falls below 40, which shows that sellers continue to dominate.

The consistent gains since April align with the long-term support zone of $106K. A weekly close below the stated zone could hint at the end of the current bullish market phase. The case would accelerate the drop and may drag Bitcoin to levels near $95,000.

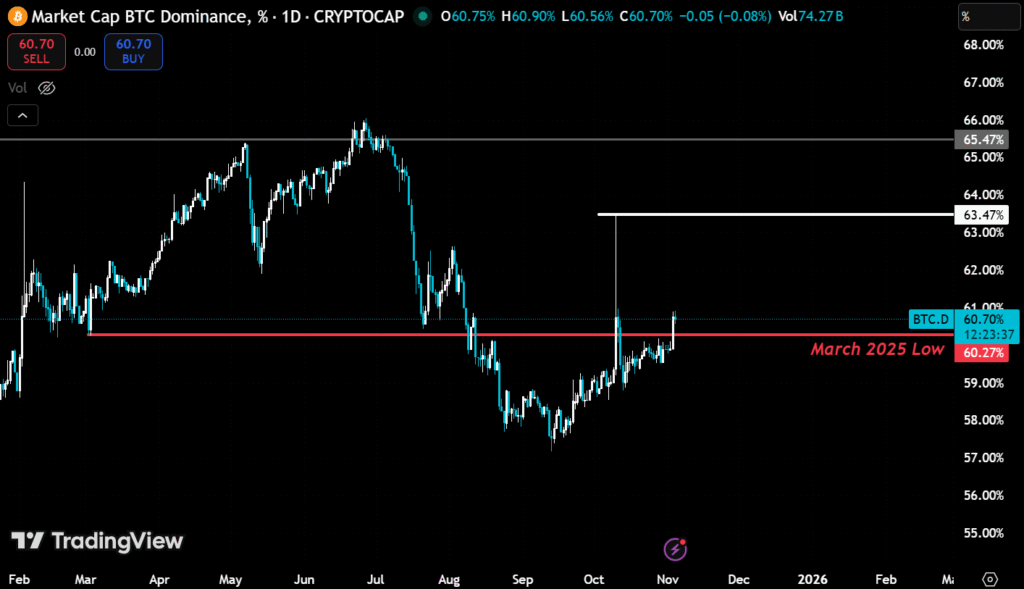

Altcoins Drop as Bitcoin Dominance Bounces Back

Ethereum lost key support near $3,700 with a drop of 7%, Solana dropped more than 10%, and meme tokens like Dogecoin, Shiba Inu, and Pepe suffered double-digit losses due to liquidations with leverage.

Bitcoin dominance has recovered from 57% back above the key resistance just over 60.5% and intends to reclaim the significant area of the March 2025 low; the breakdown in altcoins shows a fresh capital rotation towards the largest cryptocurrency. The structure may continue toward the cycle high near 66%, illustrating the risk-off move as traders liquidate high-beta alt positions.

Outlook for the Market

Bitcoin may experience further correction if it breaks below $100K, a psychological level. Altcoins declined at a steeper pace in the current meltdown. The crypto bulls should reclaim $106,000 for Bitcoin to support the upward market trend.