Table of Contents

Key Takeaways:

- Analysts say that Bitcoin (BTC) frequently lags gold by 100 days, and that if the pattern continues, BTC might reach $167,000.

- Experts say a bullish “cup and handle” pattern and on-chain signals show that Bitcoin (BTC) may still have an upside.

- However, the upcoming rally for BTC will be dependent on the Federal Reserve’s interest rate decision on September 17th.

The broader crypto market currently trades in green as the entire crypto market capitalization (cap) has increased from $3.83 trillion to $3.92 trillion in one day, representing a rise of 2.34% within one day.

Moreover, the top three crypto tokens by market cap have also shown positive momentum, with Bitcoin (BTC), Ethereum (ETH) and XRP rising by 1.4%, 1.5% and 4% respectively.

Gold, on the other hand, has grabbed headlines for breaking its all-time high (ATH) and is currently trading around the levels of $3,646. According to Crypto Quant’s analyst, Axel Adler Jr, the recent rally in gold is driven by interest rate cut expectations and the People’s Bank of China accumulating gold for the tenth consecutive month, reducing the share of dollar-based assets or treasuries.

A negative correlation exists between interest rates and gold prices. When the interest rates go down, the returns on asset classes such as bonds decrease and investors shift to gold.

Moreover, rate cuts also signal a weaker economy and fuel inflation; investors shift to gold as a hedge against this risk. Another reason is that the falling US dollar due to a decrease in interest rates makes gold cheaper for global buyers, further fueling the price of gold. The rising interest rate cut expectations have fueled the rally of gold prices, crossing its ATH levels.

Cryptocurrency analyst, entrepreneur and key opinion leader (KOL) named Quinten Francois, with over 200K followers on X, tweeted that

Bitcoin has a 100-day lag on Gold’s price

The tweet emphasized that BTC frequently tracks gold’s price, with gold reaching an ATH, BTC could follow soon, according to the analyst. However, BTC has a 100-day lag; if this trend holds, then according to the projections, BTC could reach $167K.

BTC Cup-and-Handle Pattern Points to $167K

Moreover, another crypto expert and macro strategist known as Gert van Lagen on X, with over 121K followers, recently tweeted about a bullish cup and handle pattern across major markets.

The cup and handle pattern is a bullish chart pattern that depicts a tea cup, with the “cup” being a rounded bottom and the “handle” being a minor dip or sideways movement. When price breaks over the handle, it usually indicates a strong upward trend.

According to the tweet, Lagen believes that gold and the S&P 500 have already broken out based on the cup and handle pattern. The macro strategist believes that BTC’s breakout is underway, potentially reaching towards $300K. Additionally, even altcoins (TOTAL3) are poised for a breakout.

The takeaway, according to Lagen, is that markets are moving in lockstep, and cryptocurrency, particularly BTC and altcoins, may still have tremendous upside potential.

What Do On-Chain Signals Say About BTC?

According to this crypto analyst’s X profile, On-Chain College, with over 70K followers, believes that BTC has a greater potential to top this cycle.

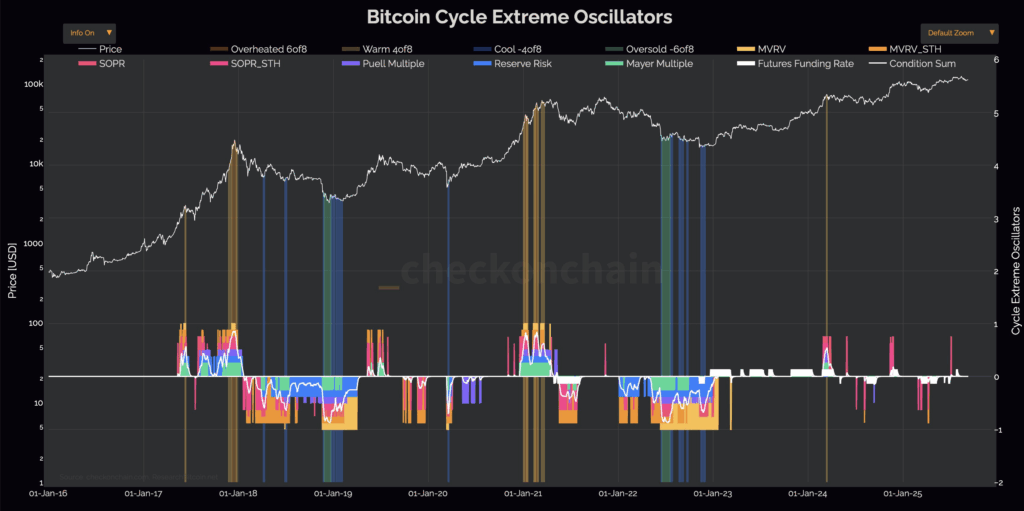

The analyst used 8 on-chain indicators to track BTC’s position in the market cycle, indicating whether the asset is overvalued (possible top) or undervalued (potential bottom).

The color-coded verticals in the chart are used to illustrate market sentiment. Orange and yellow bars suggest overheated or “warm” conditions; these conditions often occur near cycle tops. On the other hand, the blue and green bars point to cooler and oversold conditions, which emerge near cycle lows.

Currently, those signals are largely absent, signaling that BTC has not yet reached its cycle peak. The expert says that believing the top has already been reached contradicts historical data and is thus a low-probability risk, signaling that the current bull cycle may still have room to go.

Conclusion

BTC’s price outlook is improving as analysts note its 100-day lag behind gold, which recently reached record highs. With bullish chart patterns such as the cup-and-handle appearing across markets and on-chain indications indicating no cycle top, BTC might still have tremendous upward potential. However, its direction will be determined by macroeconomic considerations such as the Federal Reserve interest rate decision.