Key Takeaways

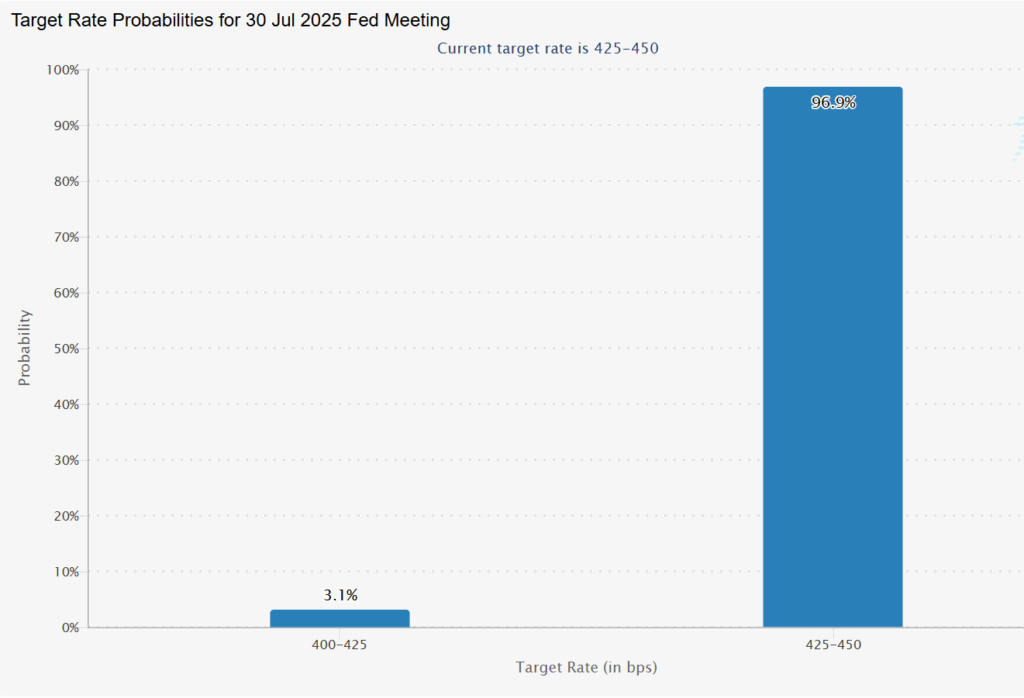

- According to CME FedWatch, the market is expecting the Fed rate to be unchanged.

- Bitcoin (BTC) price remains range-bound: BTC is expected to hold still unless the Fed develops a surprise.

- Liquidity will drive BTC in all likelihood: As indicated by prior sessions, BTC price is extremely sensitive to Fed policy and moves in liquidity.

The Federal Open Market Committee (FOMC) is expected to continue maintaining rates in a range between 4.25% and 4.5% when it meets on July 30, 2025. The decision will happen in the context of mixed economic data, with a strong consumer sector and inflation stabilizing.

How the FED Rate Impacts the Cryptocurrency Market

The impact of historical Federal Open Market Committee (FOMC) meetings on Bitcoin price has been the subject of several studies, demonstrating that Bitcoin’s price is sensitive to monetary policy declarations. On every Fed rate cut, borrowing becomes cheaper, boosting the money supply and risk appetite for the economy. Following the case, investors usually move capital into riskier asset classes like cryptocurrency.

Bitcoin Embraces Volatility: Expert Opinions

Arca Co-founder and CIO Jeff Dorman says it’s not how quickly interest rates fall—it’s the direction that matters. Move too fast, and it likely means trouble’s brewing: a recession or crisis. Dorman further adds, “The reality is, if rates come down too much, too fast, it’s far more likely to be due to a bad outcome (bank failure, recession, etc.) than it is to be a good thing.” He calls it a “Goldilocks” moment that reflects the market equilibrium.

George Sweeney, DipFA at Finder, explains that Bitcoin is directly affected by global liquidity, and the Fed’s decision on Wednesday will impact the M2 money supply.

The analyst further adds, “A surprise drop in rates would increase the M2 money supply and potentially the price of Bitcoin, but if rates continue to stall (as expected), it could also lead to a stall in Bitcoin’s recent price movement.” This means that if the Fed cuts the rates this week, more liquidity will enter the market, and Bitcoin might surge. The unchanged rates might put the crypto market at a standstill.

What to expect?

According to the data from CME FedWatch, the recent target rate probability in basis points (bps) is expected to be 425-450. The current probability highlights the market expecting the unchanged rate. If the U.S. FED keeps rates steady in July, it is expected to make its first interest rate cut of 2025 in September.

The case for unchanged rates will likely make Bitcoin persist sideways, barring new shocks and reflecting current caution among both traditional and crypto investors. As George Sweeney (Finder) notes, “If rates continue to stall (as expected), it could also lead to a stall in Bitcoin’s recent price movement.”

On the contrary, if there is any surprise rate cut that comes in, it could trigger a BTC rally, as more liquidity would drive risk-taking and weaken the dollar. In case of such an occurrence, it could signal economic weakness and could have a negative impact on the growing economy. The rapid rate reductions may indicate deeper problems (bank failures, recession), possibly injecting volatility into all markets, including Bitcoin.