Key Takeaways:

- The SEC will assess seven XRP ETF filings between October 18 and 25, raising hopes that inflows may top $5 billion.

- Trading volume increased by 190%, while option volume and open interest increased by more than 700% and 7% respectively, indicating increased leveraged demand.

- Bullish positioning accounts for 77% of options activity, with most traders purchasing calls and selling puts.

Ripple (XRP) is currently trading at $2.98 and rose by 4.8% over the past day at the time of reporting. Moreover, on September 7th as well, XRP rose by 3% intraday as speculation over ETF approvals fueled the rally in the futures market. This upside moved XRP to second place among the top 10 cryptocurrency top gainers, trailing only behind Dogecoin (DOGE), which rose by 4%.

ETF Speculation Takes Center Stage

Community conversations focus on the SEC’s next decision window, which runs from October 18 to 25, during which seven XRP ETF registrations will be reviewed.

With the SEC under increased pressure after approving BTC and ETH ETFs earlier this year, XRP traders are wagering heavily on a positive outcome. According to Vision Mark on X (formerly Twitter), the XRP ETF could potentially bring in inflows worth $5 billion, according to top CEOs.

Futures Drive the Rally

Over the past 24 hours, XRP’s trading volume increased by 190%; moreover, according to Coinglass’s data, options volume and open interest data had increased over 700% and 7% respectively. Possibly indicating that leveraged traders powered the move, fueled by ETF approvals.

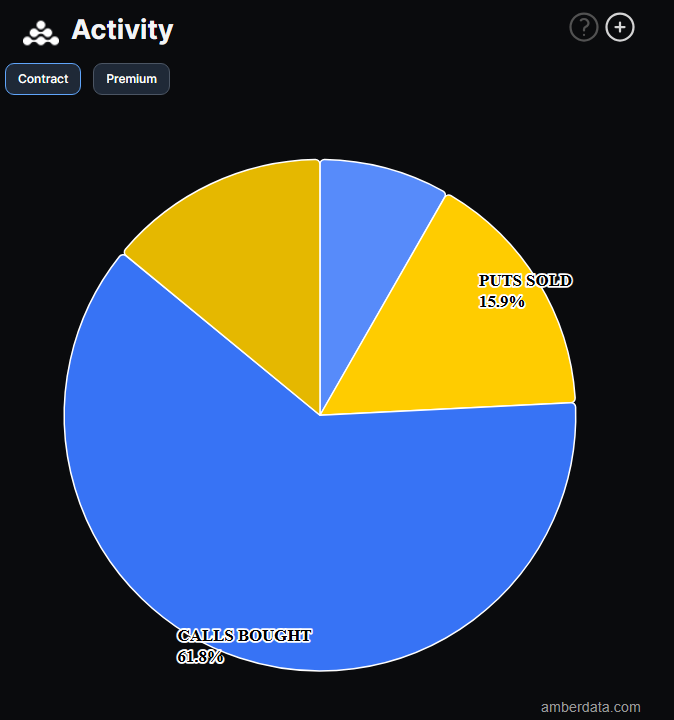

According to Deribit, the options activity chart depicts a bullish sentiment for XRP. This is because 61.8% of the traders are purchasing calls. Calls are an options strategy in which the trader would profit when the prices climb up.

Furthermore, 15.9% of the activity is from selling puts, showing a bullish-to-neutral outlook and the expectation that prices will not decrease significantly. 77% of options activity indicates an expectation of upward movement, implying that traders are planning for a future rally for XRP.

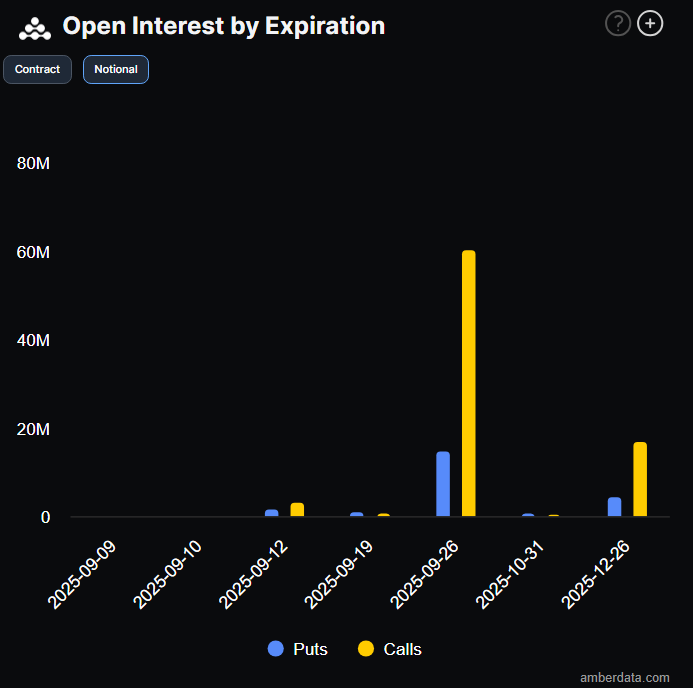

XRP: Open Interest by Expiration

The chart below depicts open interest in XRP positions by the expiration date, measured in notional value (dollar value) with call options (yellow) and put options (blue). Based on the graphical illustration, there are more call options than puts.

Specifically, most volatility can be expected on September 26th, 2025, with call options worth $60 million and put options worth $20 million set to expire. The current data suggests a potential bullish rally for XRP. However, it is important to note that the next FOMC meeting is scheduled for September 17th, 2025, which would determine the next rally.

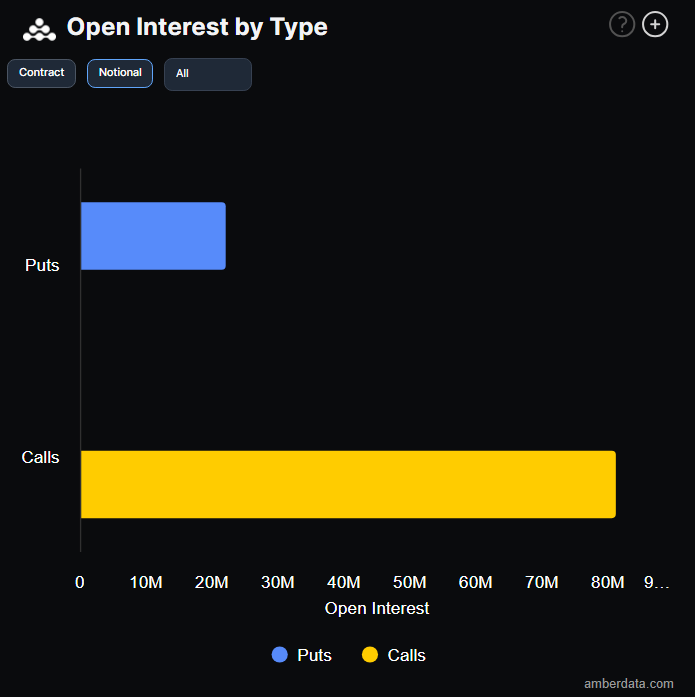

XRP: Open Interest by Type

Based on the chart below, it is evident that call options (yellow) are dominating the market. Call options are worth over $81 million in open interest in comparison to put options (blue) worth $22 million.

Call options (yellow) dominate the market, with over $90 million in open interest, while put options (blue) lag significantly, with just more than $20 million.

This huge disparity implies a strong bullish bias among options traders, with the majority betting on or hedging for an upward rise in XRP’s price. When calls outnumber puts, it usually indicates positive market sentiment, expectations of future price gains, or positioning for a potential breakout.

What’s Next for XRP?

The current bullish momentum for XRP is driven by the impact of ETF speculations. As a result, the futures market remains bullish with calls outweighing puts at the time of reporting.

With various XRP ETF deadlines approaching in October, traders anticipate increased volatility. The ability of leveraged traders to prevent overextension, as well as regulatory decisions, will determine whether bulls can continue their momentum.