A sharp sell-off in World Liberty Financial (WLFI), a token tied to the Trump family, began hours before a broader market decline wiped almost $7 billion of leveraged positions across digital-asset markets, according to a new analysis by blockchain analytics firm Amberdata.

The unusual behavior has drawn attention to WLFI as a possible early warning signal of broader crypto-market stress, given its political links, heavy leverage, and concentrated ownership, the study said.

Five-hour gap between WLFI drop and wider crypto decline

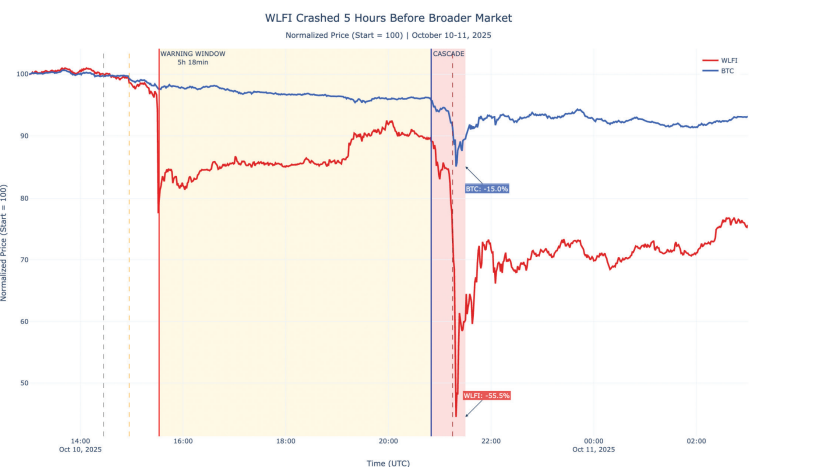

Amberdata’s study examined trading on Oct. 10, 2025, when WLFI started to drop at about 3:32 p.m. UTC, while Bitcoin was still trading near $121,000 and major cryptocurrencies were broadly steady.

Roughly five hours later, selling accelerated across the market, with Bitcoin falling around 15%, Ether losing about 20%, and some smaller tokens dropping as much as 70%. In total, about $6.93 billion of leveraged positions were liquidated across the market in under an hour, the report said.

The timing, Amberdata argued, suggests that WLFI reacted earlier than benchmark coins to a shift in sentiment following tariff comments from U.S. President Donald Trump, released at 2:57 p.m. UTC.

Leverage, volatility and vanishing liquidity magnify WLFI’s slide

Trading activity in WLFI surged almost immediately after the tariff remarks. Within minutes, hourly volume in the token jumped to roughly $474 million, more than 20 times its recent average of about $22 million, as large holders moved to cut exposure.

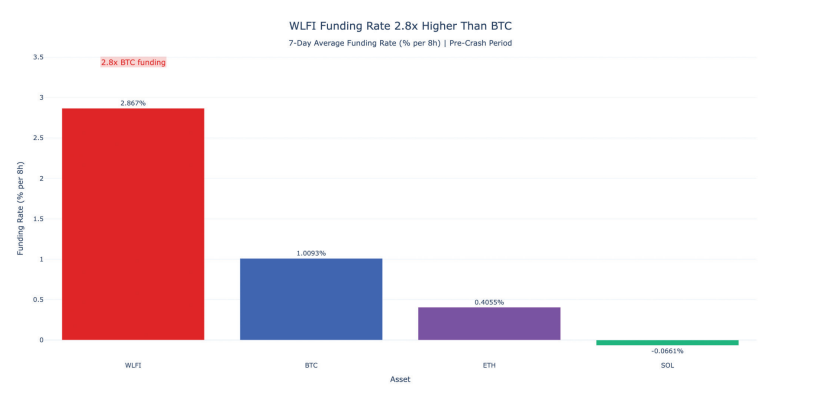

The report said WLFI perpetual futures were heavily tilted toward leveraged long positions. The token’s funding rate, which reflects the cost of holding such positions, stood near 2.87% per eight-hour period, compared with about 1.01% for Bitcoin over the same window. On an annualized basis, that implied financing costs above 130% for traders betting on price gains.

Price swings were also far more violent in WLFI than in Bitcoin. Amberdata calculated realized volatility at about 672% on an annualized basis for WLFI, versus roughly 84% for Bitcoin. Over the Oct. 10–11 period, WLFI dropped by more than 55% from peak to trough, compared with a 15% decline for Bitcoin.

Liquidity in WLFI thinned rapidly as the sell-off deepened. Order-book depth within 0.2% of the mid-price fell from around $1.79 million at the start of the period to about $10,000 at the worst point, a decline of more than 99%. Bitcoin’s depth also contracted, sliding from roughly $311 million to $11 million, as market makers pulled quotes during the wider decline.

Taken together, the jump in volumes, stretched funding rates, violent price swings, and vanishing liquidity point to a crowded bullish trade rapidly reversing as investors reassessed the tariff news and raced to cut risk. The pattern indicates a swift deleveraging in a thin market that unfolded hours before selling intensified in larger cryptocurrencies, reinforcing WLFI’s role as an early point of stress in the market.

Small token, big impact via cross-margin links

The report suggests that WLFI’s market value was too small for its price moves to push Bitcoin directly. Instead, the firm pointed to cross-margin systems on derivatives platforms, where traders use multiple tokens as a common pool of collateral.

As WLFI slumped, the value of that collateral was marked down. That triggered margin calls and forced some investors to sell more liquid assets, including Bitcoin and Ether, to shore up their positions. Automated liquidation mechanisms then sold additional holdings into already-thin markets, amplifying the fall in larger coins.

Political tokens could offer clues to looming stress

The report said politically themed tokens such as WLFI may be structurally prone to moving first in response to policy headlines because their ownership is clustered among aligned investors, advisers, and entities close to the underlying political figure. That means those networks may adjust risk more quickly than the broader, fragmented base of Bitcoin holders.

The study suggested that monitoring patterns such as sudden volume spikes, extreme funding rates, surging volatility, and collapsing order-book depth in similar tokens could help market participants spot potential red flags ahead of future crypto sell-offs. However, Amberdata stated that the analysis covered a single market episode and that more data would be needed to determine whether similar patterns reliably precede broader downturns.