XRP is showing signs of bullish reversal thanks to increasing ETF inflows and the Market Structure Bill. The price has broken above the $2.10 mark, which also signals a shrinking supply. At the time of writing, the asset is trading around $2.14. The inflows and on-chain metrics are quite strong, prompting analysts to suggest that the price could go as high as $3.00 in the coming weeks.

Core Catalysts

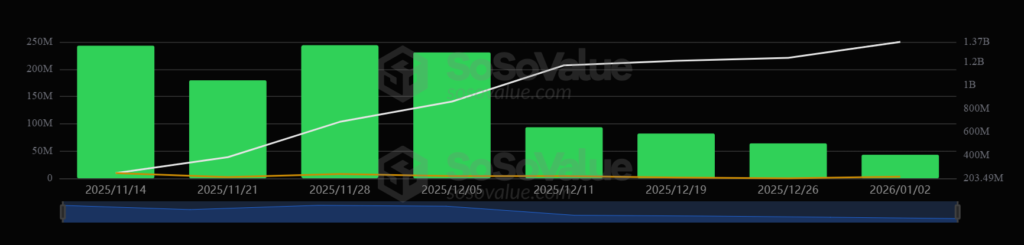

U.S. XRP-spot ETFs brought in $43.16 million in net inflows for the week ending January 2, which extended an eight-week winning streak and pushed total inflows to $1.18 billion since launch. Franklin’s XRPZ ETF led daily gains with $9.72 million on January 2 alone, subsequently followed by 21Shares’ TOXR at $2.72 million, bringing assets under management (AUM) to $1.37 billion. This value contrasts strongly with Bitcoin-spot ETF outflows of $2.26 billion since mid-November, highlighting XRP’s decoupling as XRP/BTC rises 9.89% in January.

The Senate Banking Committee will review the Market Structure Bill (CLARITY Act) on January 15, demonstrating progress with bipartisan support on important crypto regulation, including DeFi oversight, SEC/CFTC roles, and stablecoin yields.

At this point, the optimism regarding a potential passage in Q1 has supported XRP’s price rise by 20% since December 31, which pushed it beyond $2.20 for the first time after early December. Some observers have has also pointed out that XRP’s returns over a 3 and 5 year period are excellent, surpassing even top assets, like BTC and ETH, despite the legal uncertainties.

On-Chain Momentum

The on-chain metrics reflect the evolving sentiment, with CryptoQuant reporting 19,706 active accounts (unique senders) on January 4. The value marks it as the month’s peak and the second-highest ever since mid-December. This recovery from December’s $1.7712 lows signals the continuation of utility growth along with ETF demand and potential liquidity squeezes from exchange balances at 15.4 billion XRP. Tokenization on XRPL shot up over 2,200% in 2025 value, which promotes long-term adoption rather than price speculation.

Technical Breakdown

XRP gained 3.59% on January 4 to close at $2.0908, outperforming the crypto market’s 1.06% rise and breaking the 50-day EMA at $2.0468. It remains below the 200-day EMA ($2.3452), mixing near-term bullishness with longer caution, though fundamentals dominate. Key supports hold at $2.00, $1.75, and $1.50; resistances loom at $2.20, $2.50, and then $3.00.

Holding above the 50-day EMA confirms reversal toward the 200-day and $2.50. A sustainable EMA breakout demonstrates the medium-term $3.00 path for the asset.

XRP Outlook: Key Levels and Market Risks

The bullish structure with the positive fundamental outlook targets $2.50 short-term (1-4 weeks), $3.00 medium (4-8 weeks), and $3.66 longer (8-12 weeks), driven by ETF flows, Fed dovishness, and bill passage. Additionally, a break from all-time highs could lead the price to climb to $5 within the next 6–12 months. The challenges include Bank of Japan (BoJ) neutral rates (1.5-2.5%), delayed Fed cuts, MSCI delistings for digital asset treasuries, bill stalls, or ETF outflows triggering a bearish flip to $1.75.