Key Takeaways

- YZI Labs increased its investment in Ethena Labs’ USDe, the third-largest stablecoin.

- Exchanges recorded a 15.5 million ENA outflow, and Arthur Hayes’ recent $1 million investment hints at strong accumulation.

- ENA’s price action suggests the asset is poised for a 35% uptick and may reach the $0.80 level.

Tech startup backer YZi Labs, formerly known as Binance Labs, has doubled its investment in Ethena, the issuer of USDe, the third-largest stablecoin. This investment by YZi Labs is making waves in the cryptocurrency space, as it is linked to Binance co-founder Changpeng Zhao (CZ).

YZi Labs Investment

Last week, the crypto market witnessed a huge parabolic move in YZi Labs’ invested project, Aster (ASTR), after CZ’s appreciation. Meanwhile, this new investment by the Binance venture capital arm not only highlights Ethena’s long-term potential but also suggests YZi’s strong belief in the project.

As per the report, YZi was one of the earliest investors in Ethena Labs, having invested through its Season 6 incubation program before the project launched in 2024.

According to YZi’s recent report, this investment will advance Ethena’s next phase of growth, including deeper adoption of USDe across centralized and decentralized platforms, expansion on BNB Chain, and development of new products like USDtb (a fiat-backed stablecoin) and Converge (an institutional settlement layer).

The report further states, “USDe has grown to $13 billion in supply, making it the third-largest dollar asset in crypto and the fastest ever to cross the $10 billion milestone. In addition, Ethena now has more than $13 billion in TVL, with integrations spanning top centralized exchanges as well as leading DeFi applications.”

Current Price and Whale Accumulation

Despite such positive developments, Ethena’s native token ENA continues to bleed. At press time, ENA is trading near $0.60, down 9% over the past 24 hours. However, investors and traders have shown strong interest in the asset, resulting in a 120% surge in trading volume.

Looking at these developments, investors have already jumped in, scooping up millions of ENA. A well-followed crypto expert reported that Arthur Hayes, ex-CEO and BitMEX co-founder, scooped up almost $1 million worth of ENAfollowing the investment.

Meanwhile, on-chain analytics tool Coinglass shows that exchanges have recorded an outflow of $15.50 million worth of ENA tokens over the past 48 hours. Such an outflow hints at potential accumulation and serves as a bullish signal for token holders.

Ethena (ENA) Price Action and Key Levels to Watch

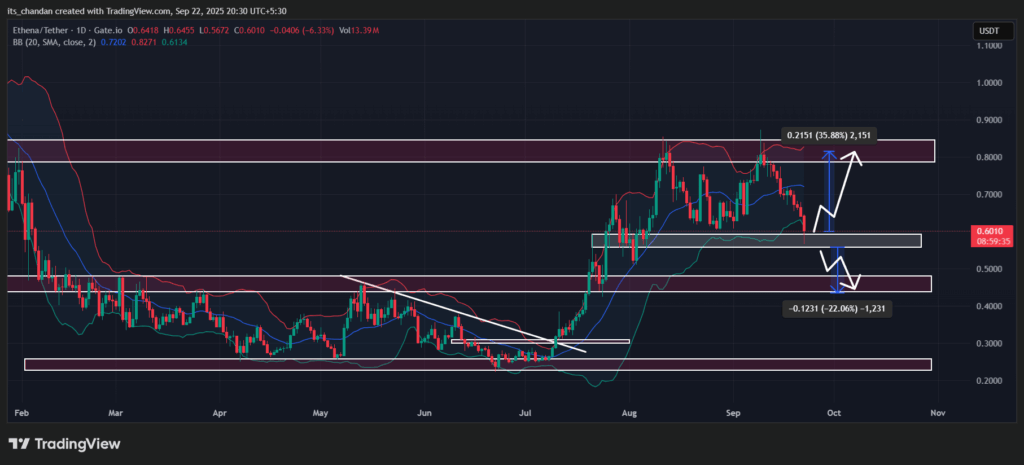

TimesCrypto’s technical analysis suggests that ENA is in a downtrend but is poised to end it. After a continuous price decline since September 9, 2025, the asset has reached its key support level of $0.59, which has a history of price reversals.

Based on the current price action, if ENA holds this support level, it could see an impressive 35% uptick and potentially reach the $0.80 level. However, if it fails to hold, the market may experience a 20% price decline.

At press time, ENA is hovering at the lower boundary of the Bollinger Bands, suggesting that the asset is in oversold territory and a potential rebound is on the horizon.