Key Takeaways

- Philippines Bitcoin Plans: Central Bank May Add Up to 10,000 BTC to Reserves

- The legislation also proposes a proof-of-reserves system to increase accountability and transparency.

- It is interesting to note that the new proposal comes at a time when the Philippines is constantly seeing a rise in crypto adoption and user base.

The Philippines advocates adding more Bitcoin to its central bank reserve, with holdings reaching up to 10,000 BTC. The policymakers plan a strategic move to make the nation one of the first in Southeast Asia to embrace Bitcoin as a strategic asset by establishing a reserve of 10,000 Bitcoin at the central bank.

The move positions the nation as a strong rival to peers like Singapore and Malaysia in the race to establish itself as a crypto-friendly hub in the region.

The “Strategic Bitcoin Reserve Act” bill would require the BSP to purchase 10,000 Bitcoin at current market values, which would amount to $1.1 billion. According to the proposed law, the asset would be kept in a trust for a minimum of 20 years. This would imply that the coins could only be used to pay off government debt and could not be sold, exchanged, or disposed of otherwise.

The legislation also proposes a proof-of-reserves system to increase accountability and transparency. The public would have a clear picture of the country’s cryptocurrency reserves under this arrangement, since the central bank governor would provide quarterly reports outlining the central bank’s Bitcoin holdings, wallet addresses, and control over private keys.

In an interview with TimesCrypto, Bitunix analyst Dean Chen said, “With gross international reserves (for the Philippines) at about $105.7 billion in July, the proposed 10,000 BTC—roughly 1% of GIR at current prices—poses little direct risk to FX liquidity or currency management, but carries strong symbolic weight as sovereign adoption.”

Why is Philippines’ Bitcoin Move significant?

The Philippines’ decision to accumulate Bitcoin as a part of its strategic reserve comes at a time when most institutions and nations are mulling similar ideas. Additionally, the nation’s move will come against the larger backdrop of rising inflation, currency volatility, and a desire to diversify reserves. The current inflation rate in the Philippines is one of the lowest the nation has seen in over five years. However, the Bitcoin purchase can help the nation secure a hedge against future inflation rise.

Further, the peso is somewhat stable regionally, although it is not regarded as a powerful currency globally. Therefore, accumulating a globally accepted cryptocurrency is likely to give an upper hand to Philippines in trade negotiations and global deals.

Philippines Bitcoin Reserve Comes Amid Growth in Crypto Userbase

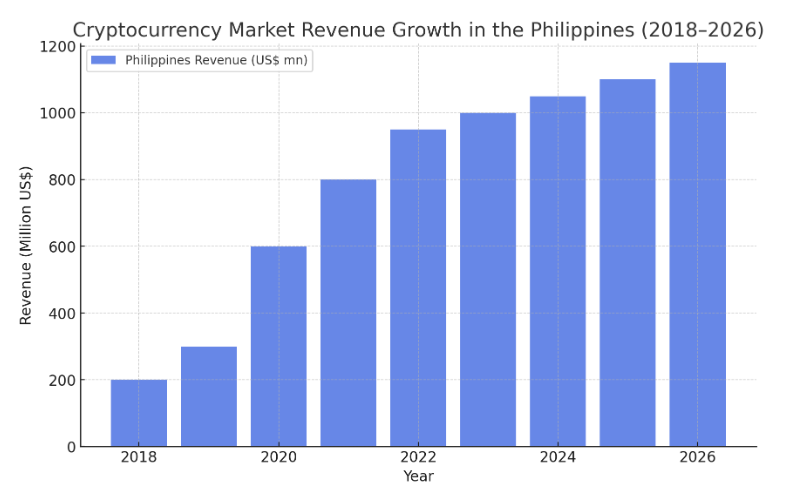

It is interesting to note that the new proposal comes at a time when the Philippines is constantly seeing a rise in crypto adoption and user base. According to market research, it is anticipated that the Philippine cryptocurrency sector will reach over $1.1 billion by 2025 and increase at a rate of almost 4.6% each year through 2026.

Each user is expected to earn roughly $88.4 in revenue on average the next year, and by 2026, there may be 12.79 million cryptocurrency users worldwide, surpassing the 10% penetration rate.

Due to growing local interest and more companies starting to take digital currencies despite legislative obstacles, the Philippines is experiencing a surge in demand for crypto adoption. The expansion of the market indicates a growing national interest in cryptocurrencies.

The Philippines could surpass El Salvador in Bitcoin Reserve

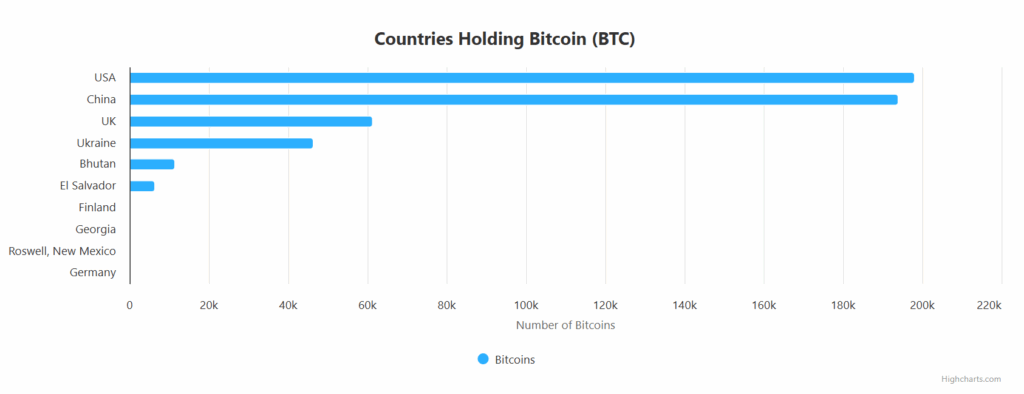

If the law manages to get a green signal, the Philippines would surpass El Salvador and come very close to Bhutan as one of the nations with the largest Bitcoin holdings.

According to Arkham Intelligence, Bhutan’s reserves are 10,565 BTC, or around $1.2 billion, while El Salvador now has about 6,276 BTC, or about $700 million.

By joining a few nations actively investing in Bitcoin reserves, such a move would not only signify the Philippines’ expanding position in the global digital asset ecosystem but also represent a significant step towards national cryptocurrency adoption.