- Avalanche price snaps two-day winning streak, retreating from 21-day and 100-bar SMAs within a week-long rising wedge.

- RSI and MACD momentum indicators also point to bearish consolidation in AVAX price.

- A clear break below $29.80 will confirm the bearish rising wedge pattern, signaling potential weakness towards $25.50.

- Avalanche looks poised for short-term downside, but reversal of three-month uptrend hinges on $25.30 breakdown.

Avalanche (AVAX) price slides over 2.0% intraday to $30.20 early Friday, snapping its two-day winning streak within a week-long “Rising Wedge” bearish chart setup.

In doing so, the AVAX retreats from the 21-day and 100-bar Simple Moving Averages (SMAs), backed by neutral conditions of the 14-day Relative Strength Index (RSI) and bearish signals from the Moving Average Convergence Divergence (MACD) momentum indicators.

Meanwhile, a pullback in the trader participation, per trading volume and market capitalization (market cap), alongside multiple downside support levels, challenges the Avalanche sellers. According to Santiment, Avalanche’s daily trading volume retreated from a one-week high to $1.37 billion, whereas the market cap cools off to $12.73 billion by press time, after hitting a nine-day top the previous day.

With this, AVAX is likely to face short-term downside pressure, potentially challenging its three-month uptrend if it manages to break the key support levels outlined below.

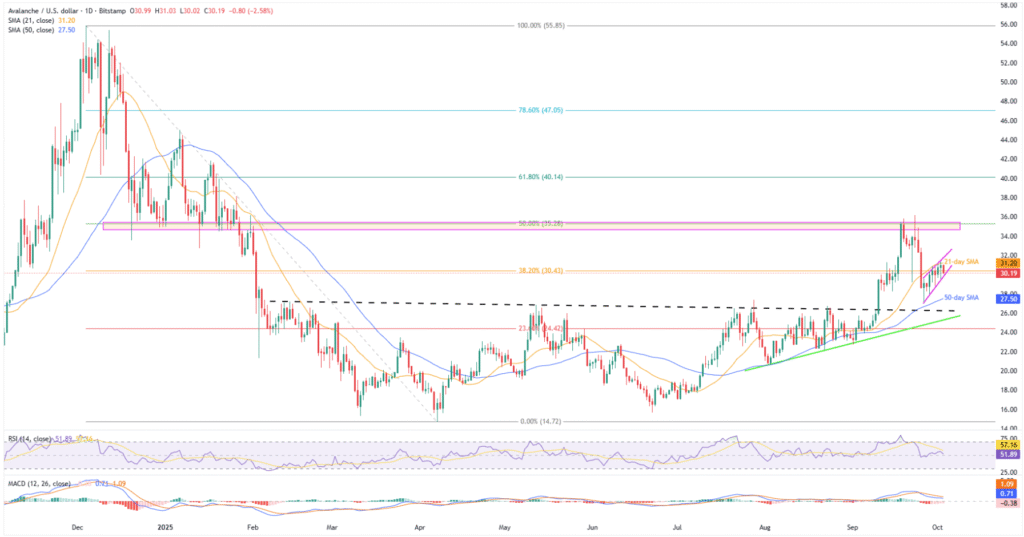

Avalanche Price: Daily Chart Highlights Bearish Consolidation

A clear reversal from the 21-day SMA, within a week-long “Rising Wedge” bearish chart formation, combined with neutral RSI and bearish MACD signals (red), underpins short-term bearish bias about Avalanche. However, a clear downside break of the stated wedge’s bottom, close to $29.80 at the latest, becomes necessary.

Following that, the 50-day SMA and previous resistance line from February, respectively near $27.50 and $26.20, could act as intermediate support levels as AVAX potentially moves towards the wedge’s theoretical target of $25.50.

Notably, a two-month ascending support line, around $25.30, will be the last defense of Avalanche buyers before handing control to bears and bracing for reversing its three-month uptrend, highlighting the yearly low of $14.67. During the anticipated fall, lows marked in August and June, close to $20.60 and $15.64, may act as buffers.

Alternatively, AVAX recovery needs validation from the 21-day SMA and stated wedge’s top, close to $31.20 and $31.90 in that order.

In a case where Avalanche remains firmer past $31.90, the $32.80 mark could attract bulls, but they’ll face a key resistance around $34.65-$35.50, which includes levels from the past nine months and the 50% Fibonacci retracement.

Additionally, the AVAX’s daily closing beyond the $35.50 hurdle boosts the odds of witnessing a rally toward reversing the yearly loss, currently around 15.70%, can’t be ruled out. This highlights the 61.8% Fibonacci ratio near $40.15 and the yearly peak of $45.05.

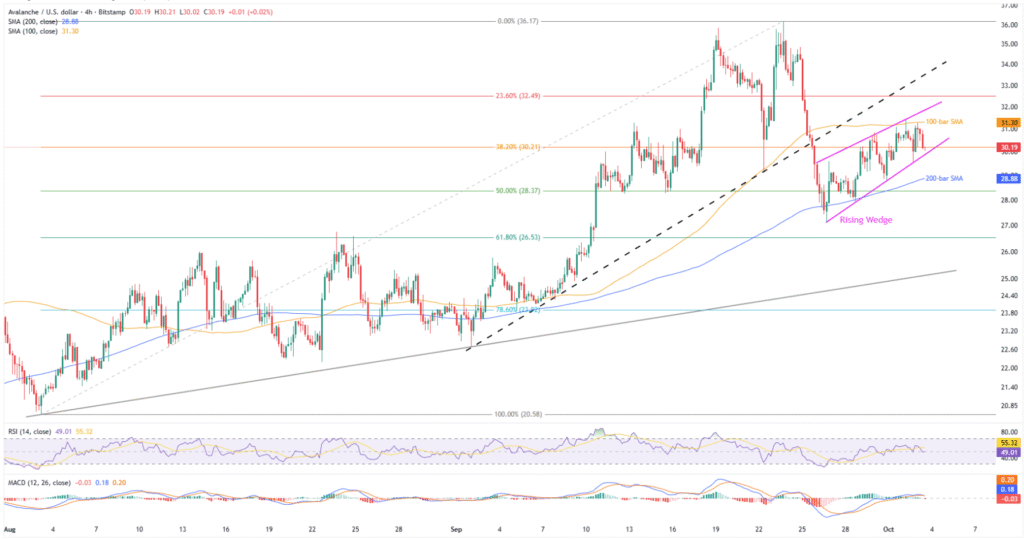

Avalanche Price: Four-Hour Looks More Bearish

On the four-hour chart, Avalanche shows a more bearish trend, backed by upbeat RSI and bearish (red) MACD signals. However, a clear downside break of the stated wedge’s bottom, close to $29.80, is needed to welcome the bears.

In that case, the 200-bar SMA surrounding $28.85-$25.90 might act as an additional downside filter before highlighting the daily chart’s deeper support levels.

On the flip side, the 100-bar SMA guards immediate AVAX upside near $31.30, before the stated wedge’s top surrounding $31.90.

Notably, a month-old previous support line, currently around $33.60, can offer additional challenge to Avalanche buyers before directing them to the highest levels discussed on the daily chart.

Conclusion

Avalanche’s three-month uptrend is at risk as the quote forms a bearish chart pattern and gains support from downbeat momentum indicators. The altcoin’s six-month consolidation, however, appears to be a greater challenge for the bears unless they manage to keep the reins past $25.30.

Also read: Crypto Morning News: Bitcoin Climbs to 121K as U.S. Shutdown Boost Fed Cut Bets