Berachain’s native token, BERA, has come up with one of the most explosive moves of 2026. The digital asset remained under heavy selling and consolidation periods for weeks; the token surged 72% in 24 hours, testing the $1.36 mark and pushing its market capitalization close to $200 million. What many expected to become a liquidity collapse instead turned into a textbook short squeeze. This report breaks down the structural catalysts behind the move, the on-chain evidence, and the technical levels that will decide the next leg.

Two Major Overhangs Cleared on the Same Day

The early week of Feb brought two potential catalysts for a sharp decline. First came the unlock of 63.75 million BERA tokens, equal to roughly 41.7% of the circulating supply. Token unlocks of this size normally flood the market with sell pressure. Traders had built large short positions in anticipation of exactly that outcome.

Instead, the supply was absorbed smoothly. On-chain data showed large wallets and spot buyers stepping in to take the tokens off the market. The price did not collapse. It reversed.

The second event was the expiration of Brevan Howard Digital’s $25 million refund clause. Early backers had the right to exit their positions if performance targets were missed by this data and no refunds were requested. In crypto markets, the moves from sophisticated or large capital often carry more weight than public statements. It is considered a strong sign of institutional confidence when the smart money doesn’t exit their positions.

Spot Buying and Volume Confirmation

The combination of these two events triggered immediate buying. Spot markets recorded approximately $39 million of net inflows within 24 hours. Trading volume exploded to $1 billion, the highest level seen in months. This was not retail FOMO alone. The rotation came from traders who had been short and were now forced to cover, plus fresh capital rotating back into the name once the overhang narrative disappeared.

Persistent Downtrend and Crowded Shorts

Following the violent bounce, the broader structure continues to be in a downtrend. In the time since mid-November, BERA has traded in a controlled grind lower. Most of the decline came from steady distribution rather than panic selling. Price found temporary support in the $0.50 to $0.57 zone, where buying interest has repeatedly appeared.

Funding rates on perpetual contracts stayed negative for the entire downtrend. Shorts were paying longs to keep positions open. Two clear spikes in negative funding (mid-January and early February) signaled overcrowded short exposure. When the market finally turned, those positions were squeezed hard. The 72% move was the direct result of that forced covering.

Technical Structure and Key Levels

The daily BERA/USDT chart shows a classic descending triangle pattern. Lower highs and lower lows have defined the trend since the April 2025 highs above $5. The recent impulse from the lows reached the 0.236 Fibonacci retracement of the entire decline, located near $0.98. That level acted as immediate resistance. After a brief wick above it, the price has pulled back and is currently trading near $0.82.

The $0.50-$0.57 region (marked in green) remains the most important demand area. As long as the price holds above this range, the downtrend is still intact but under pressure. A clean break and close above the price level of $0.98 would mark the first higher high in months and shift the structure to neutral or bullish.

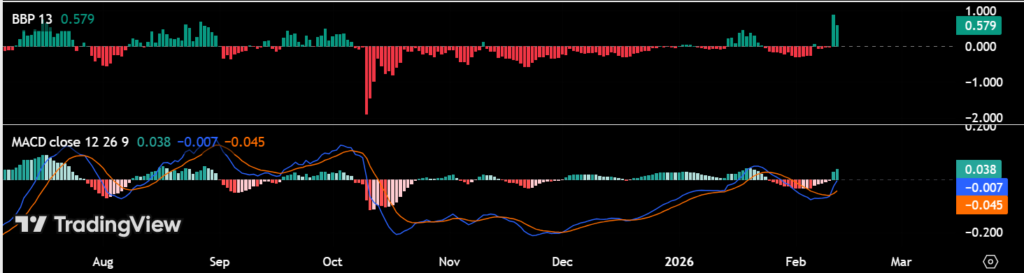

Indicator Support for the Bounce

Two technical indicators are flashing positive signals. The Bull Bear Power histogram posted a strong positive spike during the rally, confirming that real buying pressure, not just short covering, drove the move. The MACD has also produced a bullish crossover on the daily timeframe. These are encouraging developments, but both are still forming below the descending channel’s upper boundary. The rally needs to sustain itself above the $0.98 zone before the indicators can be trusted for a larger trend change.

Upside Targets and Risk Levels

If BERA reclaims $0.98 and consolidates above it, the next logical targets are the 0.382 Fibonacci level at $1.38 and the 0.5 level at $1.70. Volume will be the key confirmation. Continued high volume on up days would support the case for further upside.

On the downside, a failure to hold the $0.50 support would invalidate the recent bullish price action and open the door for a retest of the $0.33 low. Traders should watch funding rates closely. If they remain negative or turn more negative while the price consolidates, it could signal that shorts are rebuilding and another leg lower is possible.

Ecosystem Tailwinds

The price move is not happening in isolation. Berachain’s recent PoL v2 upgrade now routes 33 percent of block rewards directly to BERA stakers. In a market still feeling liquidity pressure, real yield matters. Staking APYs briefly reached levels that attracted capital looking for sustainable returns rather than pure speculation.

The ecosystem is also maturing. The approval of Ethena’s USDe as collateral for the HONEY stablecoin strengthens the DeFi primitives on Berachain and moves the project further from its early “meme chain” perception toward a structurally investable layer-1.

Final Outlook

BERA’s 72 percent surge was a clear example of how crowded positioning and narrative shifts can create violent reversals. The absorption of a 41.7 percent supply unlock and the absence of institutional refunds removed two major bearish overhangs at the same time. On-chain buying, record volume, and positive indicator signals all support the idea that the worst of the selling may be behind us. The macro downtrend is not yet broken, however. The 0.98 dollar zone is the critical pivot. A decisive hold above it would open the path toward $1.38 and beyond. Failure to reclaim that level keeps the risk of a retest of the $0.33 to $0.50 support alive.