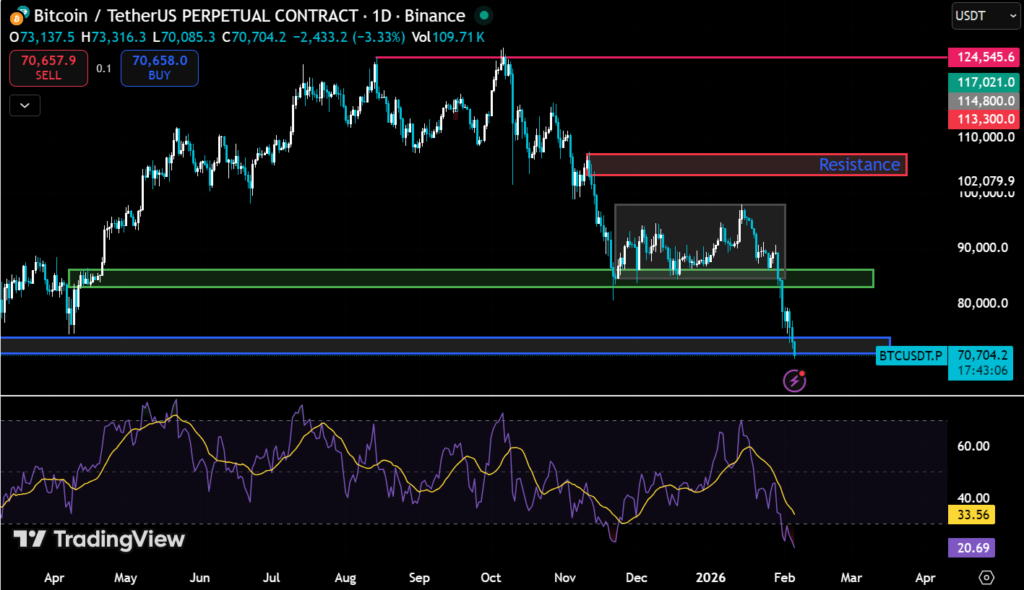

Bitcoin is now trading near $70,700 on major perpetual markets, which is below the important $71,000 level. The change is due to a change in the short-term structure of the market, not just a price change. From the technical perspective, this breakdown shows that current crypto valuations are being affected by a mix of technical weakness, derivative market pressure, and macroeconomic uncertainty.

The drop comes after a strong rally that lasted for several weeks, so the retracement is statistically expected. The most important question right now is to determine if this move is just a temporary move or just the lack of capital or the start of a longer correction phase.

Market Structure and Price Action

The price drop persists through the $71,000 mark, which creates a major technical event because this price point had functioned as an important support level during the recent market period. The market downturn has further intensified selling pressure, leading to higher market activity across different trading platforms.

Trading volume jumped about 35% above the recent 24-hour average, which means that both retail and institutional traders were actively scaling into their positions. The Binance BTCUSDT perpetual pair is still a global liquidity benchmark, and its price movement shows that the drop is happening across the whole market, not just on that exchange.

On-chain data also show that coins are moving more often from older wallets to exchanges. In the past, this kind of behavior has often come before times of distribution and short-term selling pressure.

Impact on the Derivatives Market

Positioning in derivatives was a big part of the move, with a rise in open interest in the futures and options markets made things more unstable, which could have sped up downside volatility. This kind of deleveraging event happens a lot after big price rises. When leverage unwinds, price corrections can look sharp, but they often help reset the market and cut down on too much speculation.

Funding rates for the relative digital assets and positioning data demonstrate that traders were leaning long before the drop, which makes it more likely that a downside cascade would happen after support failed.

Important Technical Levels to Keep an Eye On

The important level of $72,500, which was previously support, has now turned into resistance. Near-term support is at $69,200. Short-term reaction level: $67,800 Major support: Structural demand zone

If it stays above $69,200, it would mean that the pullback is under control and the trend is still going up. If the price drops to $67,800, it could mean a bigger correction phase and a possible change in medium-term momentum.

The 20-day simple moving average is another important dynamic level. When prices remain below the 20-day simple moving average for an extended period, it typically weakens short-term sentiment among systematic and institutional strategies.

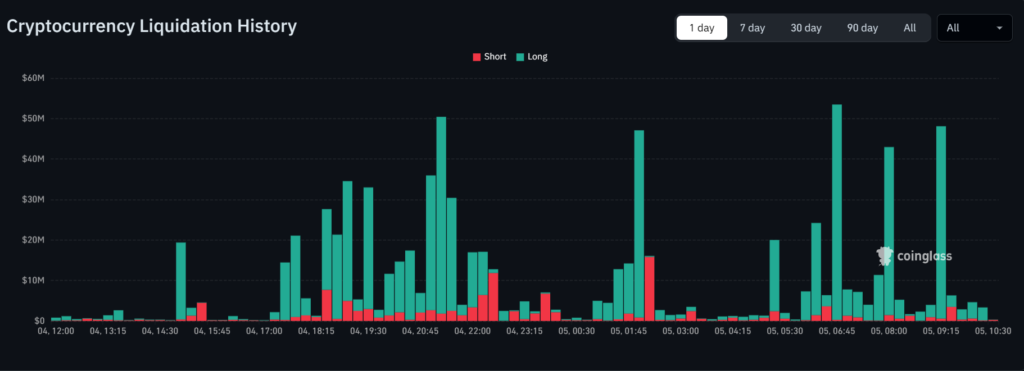

Liquidations

As Bitcoin fell below $71,000, there was significant liquidation activity in the derivatives market. CoinGlass data highlights that in the last 24 hours, the market had experienced liquidations worth $841.88 million, liquidating 173,664 traders. A position worth $11.36 million was liquidated on Aster’s BTCUSDT pair, which was the biggest single wipeout. This sign shows how big the leverage unwinding was behind the move.

Chain Signals and How Investors Act

Even though there is a lot of short-term selling, the supply of long-term holders stays pretty stable. The fact that short-term traders and long-term investors are acting differently suggests that Bitcoin’s structural conviction has not weakened.

Some important things to keep an eye on are

- Exchange net flows to see if the pressure to sell is going up or down.

- Realized price to check the market cost basis support

- The MVRV ratio can aid the market participants in figuring out if BTC is overvalued or undervalued

If exchange inflows speed up while prices fall, it would confirm distribution. If flows stay steady, accumulation may start again near support zones.

Effect on the Crypto Market as a Whole

Bitcoin is still the leading cryptocurrency in the market. When BTC went down, altcoins went down too, as the dominance of the digital asset still stands at 59.24%. This link makes Bitcoin even more important as the main source of liquidity in digital assets. When BTC drops, capital rotation slows down and the ecosystem’s desire to speculate drops as well.

Context from the past and a cycle view

Bitcoin has gone through corrections of more than 20% many times during bullish cycles before reaching new highs. These drawdowns usually reset leverage and make long-term trends more stable.

The basics of the network are still strong, thanks to:

- High hash rate safety

- Ongoing participation by institutions

- More infrastructure, like regulated goods and custodial services, is growing.

The market is now trying to figure out if this move is just a normal reset in the middle of the cycle or the start of a bigger correction.