Bitcoin Enters Oversold Territory

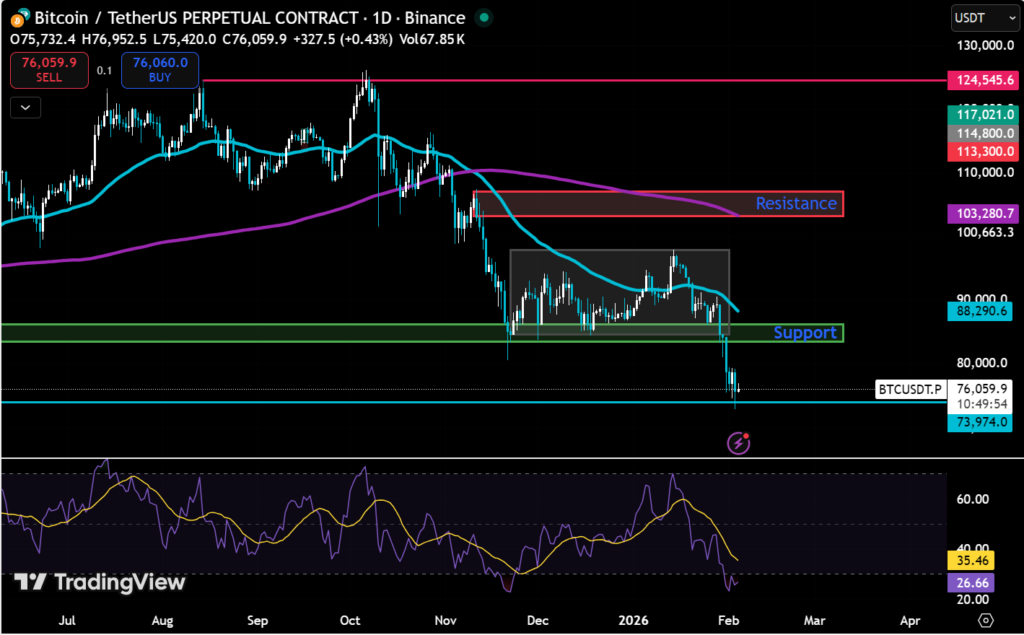

The daily Relative Strength Index (RSI) for Bitcoin has dropped below the important 30 level, which means that the asset is now officially in oversold territory. This change in momentum is happening while the spot price is trading just above the clearly defined support range of $73,000 to $75,000. This range has repeatedly acted as a demand area during different corrective phases.

An oversold momentum reading of indicators like RSI and being close to structural support suggest that downside pressure may get cooled down. But history demonstrates that these variations of market instances are inclined to result in tactical rebounds rather than long-term trend turnarounds, particularly when the overall market structure is still going through a downturn.

RSI Breakdown Shows Increased Selling Pressure

The Relative Strength Index is a momentum indicator that keeps track of the rate of recent price shifts over a specific period’s lookback. In the case of the RSI below 30, it shows that the sell-side participants are more dominant than the buying interest for the asset. This market situation usually unfolds after a sharp or long-term drop.

At the time of writing, Bitcoin’s RSI is in oversold territory, but the volume hasn’t gone up, which means that the drop has been caused more by ongoing distribution than by capitulation-style selling. This difference is important. When there are oversold readings and rising volume, it often comes before sharper rebounds. On the other hand, in the cases of low-volume decline, it often takes longer for the position buildup from either side.

The $73,000–$75,000 Structural Support

The $73,000 to $75,000 range may act as a technical horizontal zone that has been respected in the past with a strong volume profile nodes, and role-reversal dynamics. This area was the low point of the correction in April 2025 and was also resistance during the first part of the bull cycle in 2024 before acting as support.

Traders currently utilize it as a buying point, as the zone has been respected multiple times. The market is expected to receive resting orders from discretionary traders and automated traders who have established their bets at this particular price point. The upcoming price movement will determine whether the market establishes a new higher-level trading range or continues its downward trend. The market will experience a structural breakdown if it maintains a price below $73,000, which will invalidate the immediate oversold rebound theory.

Trend Context Makes Oversold Signals Less Reliable

The current trend analysis shows that traders must proceed with caution despite the RSI indicator showing a drop to below 30. The daily chart shows Bitcoin making lower highs, which means that the cryptocurrency is now following a correction phase or distribution period that corresponds to its November 2025 market peak. The current risk situation has historical evidence that supports its existence. During the 2022 bear market, Bitcoin experienced multiple occasions of reaching oversold conditions according to the RSI indicator. The readings resulted in brief price increases of 10% to 20% until the sellers regained control of the market.

The late 2025 market situation developed when oversold momentum results evolved into price movements that stayed within a fixed range regardless of showing any signs of reversal. The historical data shows that traders should use oversold market conditions to time their trades during market uptrends rather than using them as standalone indicators during market corrections.

Bitcoin futures open interest has dropped to $23.93B, which represents a nearly 50% decline from its mid-2025 peak of approximately $45B and marks the lowest level since early 2024. The current downtrend shows significant deleveraging because it resulted in extensive long liquidations and total market position reductions, which typically happen before markets reach their lowest point and then restore stability after complete market exit occurs.

Moving Averages and Volume: Weakened Market Structure

Key moving averages help further define the technical landscape. The 50-day moving average, which is currently around $82,500, has been a dynamic barrier during recent attempts to bounce back. This shows that there is still supply at higher levels. If current support fails, the 200-day moving average, which is around $68,000, will be the next major downside reference. Volume trends give the setup more depth. The recent drop happened when volume was low, which could mean that sellers are tired or that there aren’t many aggressive dip buyers.

Key Levels and Scenario Study

If Bitcoin stays above $73,000 and the RSI starts to move back toward neutral territory, there is likely to be resistance in the short term between $78,000 and $80,000. These levels are in line with previous consolidation zones and partial Fibonacci retracements of the recent drop. On the other hand, if the price breaks below $73,000, attention would turn to the $65,000 to $70,000 area, where demand has been strong in the past and the 200-day moving average is rising.

For people in the market who are thinking about tactical long exposure, strict risk management is still essential. If you enter around current levels, it would likely be against the trend, with targets for the upside between $78,000 and $80,000. If support fails, protective stops below $72,500 help keep losses to a minimum.

Confirmation signals, such as a bullish RSI divergence, higher lows on intraday timeframes, or a return to the 20-day moving average, would make it more likely that the trend will continue. It becomes crucial for the traders to follow the institutional flow data, especially spot Bitcoin ETF inflows and outflows.