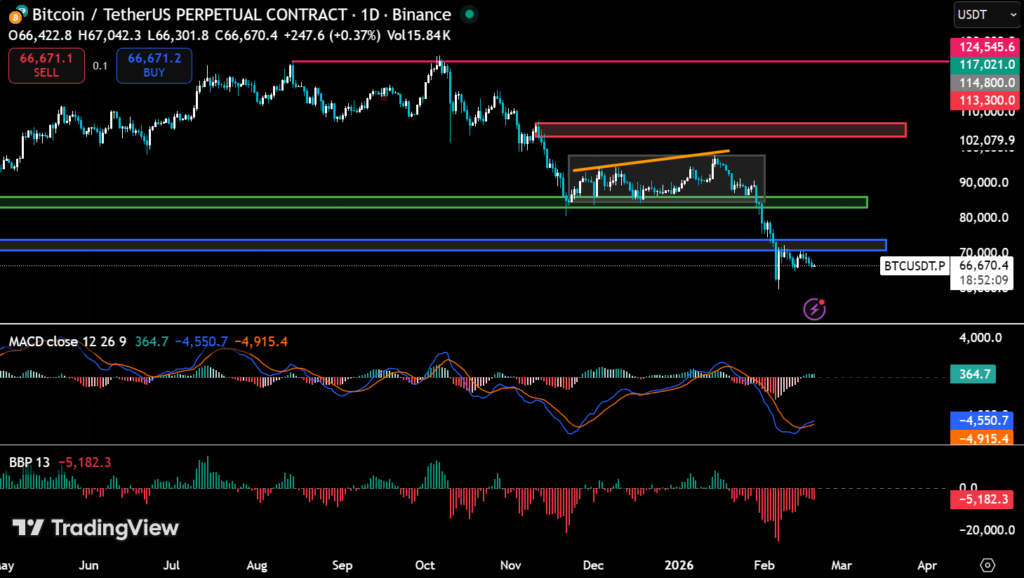

In mid-February 2026, Bitcoin is going through a rough patch. It is exchanging hands close to $66,700 on major derivatives platforms like Binance. The asset has experienced a drop of 1.66% in the past 24 hours but the overall structure still shows more doubt than confidence.

Bitcoin tried to recover several times toward the $68,000–$69,000 zone after falling earlier in the month during a larger correction in February. But every time someone tries to buy, they are met with more selling pressure. This shows that momentum is still weak and rallies are still being absorbed by the bears.

Price Structure Demands Caution

Bitcoin is stabilizing from a technical point of view, but it hasn’t started to go back down yet. Price action is still hovering just below the important $70,000 level, which is a key point for both the mind and the structure.

There are big resistance clusters far above this zone, in the $110,000–$114,000 range, and then stronger barriers between $117,000 and $124,000. On the downside, there is more support near $90,000 and $80,000. The immediate short-term battleground is around $70,000 and the mid-$60,000 area.

If it stays above this level, it could make another push toward the recent highs of $68,000–$69,000. In the other case, the asset could hunt down the lower resting liquidity and, as a result, could intensify the selling pressure.

Indicators Suggest Lack of Momentum

Technical indicators still point to the current cautious market phase. Momentum indicators like MACD are still in the negative zone, with the signal line currently below the neutral level and histogram readings showing that bearish momentum is still strong.

The Bull Bear Power indicator measures the balance between buyers and sellers by comparing price extremes to a 13-period Exponential Moving Average (EMA). The oscillator indicates extreme oversold levels and demonstrates that selling pressure can get a cooldown soon. The largest cryptocurrency will need a confirmed bullish divergence that could act as a reversal signal and can trigger positive movement for the price. The market maintains active trading volume, but it does not carry the adequate strength for a prolonged breakout, which shows that market participants do not have solid belief and are making moves with caution in the market.

Macro Conditions: Risky Assets Are Getting Mixed Signals

Macro conditions are easing slightly, but they are still mostly unfavorable for these high-risk assets. The Federal Reserve is still expected to lower interest rates, and the markets are pricing in a gradual easing through 2026. But policymakers keep telling people to be careful.

Recent comments and advice from the Federal Open Market Committee showed that they are still worried about inflation. This means that tighter policy is still an option if disinflation stops. This position has helped the U.S. dollar and limited the upside of risk assets, such as crypto.

It costs more to hold onto assets that don’t provide interest and liquidity flow for safer investments in the case of U.S. dollar dominance. In times of tightened cycles, this has created pressure on crypto assets.

Connection to Traditional Markets

Bitcoin’s recent behavior also shows how sensitive it is to macro flows. During U.S. trading hours, intraday rallies have often faded, which is when the dollar gets stronger and expectations about interest rate policy change.

The difference is clear when you look at equities. Major indexes like the Nasdaq and the broader U.S. indexes are still drawing in dip buyers near important moving averages. Bitcoin, on the other hand, is still well below its own longer-term trend levels. The current trend from the investors and institutions shows their cautious behavior and lower confidence in the high-risk market like cryptocurrencies in comparison to other financial markets.

Sentiment and on-chain signals Weakness

People are still uncertain of the market. Fear metrics have dropped to very low levels in the past few weeks, which is something that has happened before during times of stress or transition.

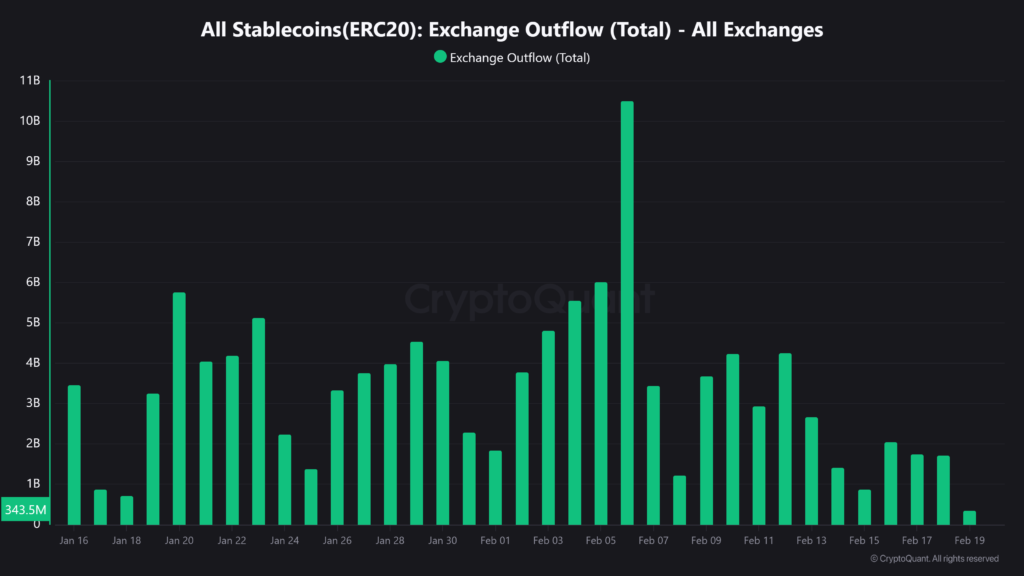

Data from the blockchain backs these findings up. According to CryptoQuant, stablecoin outflows from exchanges indicate that liquidity is tightening and reflect concerns from long-term holders similar to those seen during previous bearish phases. The largest outflow took place on February 6, 2026, at over 10.5B.

There has also been inconsistent demand for spots. Sellers quickly take in each rebound, which suggests that accumulation is happening but not on a large enough scale to change the market structure.

Limited Tactical Upside

The overall crypto market continues to show potential for near-term gains. Periods of defensive positioning can spark rapid squeezes, particularly if macroeconomic data surprises positively or the dollar softens briefly. The market rallies can still take place with the hope of gradual policy easing and better liquidity. Still, without steady inflows supporting them, these moves are expected to remain short-lived and tactical, rather than evolving into a lasting, structural uptrend.

For a long-lasting bullish move to happen, a number of things would have to happen at the same time. To shift the investors’ minds, there would need to be clear signs of disinflation, a significant drop in the value of the U.S. dollar, steady demand for spots, and better on-chain liquidity conditions.

Outlook: A period of consolidation before the next big move

Bitcoin is currently in a consolidation phase after a sharp drop in February that brought the price down by about 19% at one point. There is a demonstration of equilibrium, but not much conviction at the current stage. $70,000 still stands as a crucial level to look for. If the metrics align, it could support another attempt to reach higher resistance zones. If it doesn’t, it could trigger another drop toward the $60,000–$65,000 area. The market right now is better for being patient. There may be some liquidity sweeps to clear the late shorts, but for the long-term uptrend, there is a need for stronger technical levels with the backing of clearer macro support and liquidity.