PEPE is now going through extreme market pressure from the beginning of 2026 with a stagnant volume. The memecoin market experiences declining speculative interest while the complete market remains in a state of uncertainty. The token experienced an initial increase during January, which ended with a decline that reached 48% from its peak of the year and brought the price back to levels not observed for several months. At the time of writing, PEPE is trading for about $0.00000375 on most major exchanges. The current market structure for the asset shows that there isn’t much momentum and not many buy-side individuals are sure about it.

Participation metrics reflect that the market participants are now in an exhaustion phase, with daily trading volume at $315.81 million, demonstrating trends lower in comparison to expansion phases. The trend of continued lower highs and lower lows has been going on since late 2025.

External factors like market sentiment can also have a significant impact on the price of the relative asset. The drop in the market participants’ confidence is due to competition from newer memecoins like Nietzschean Penguin ($PENGUIN), less whale activity, and ongoing regulatory scrutiny of speculative tokens. Still, PEPE’s strong community presence makes it a favorable choice for short-term speculation, especially during short risk-on cycles.

Analysis of Price Action

There is a clear descending channel in the daily structure from September 2025 to early 2026. In late January, there were attempts to hold above $0.00000385, but they failed. This triggered more selling pressure and a fall back to the $0.0000037 area. The shape that comes out looks like a descending triangle, which usually means that demand is weakening and sellers are gaining more control.

This trend makes more sense when you look at how candlesticks behave. In December, there were several indecision candles, such as doji and spinning tops. Then, in early February, bearish engulfing formations confirmed that the market would continue to go down. Recent price movements show a small bounce from oversold territory, but the lack of strong volume follow-through suggests that the move is still corrective and not structural.

Comparing the past, corrections like these in 2025 led to drops of 30% to 50% before things settled down. The downward trendline from the highs in November is still in place. The wider bearish structure would only take place if the price broke above the previous lower highs with a sustained volume.

Important levels of support and resistance

The direction in the near future depends on clearly defined technical zones. Immediate resistance is around $0.00000385, a level that has repeatedly turned down attempts to go up. If the price stays above $0.0000050 for a long time, it will mark a structural change and open up the possibility of going up to $0.0000068 and maybe even $0.000010 in the medium term.

The main demand zone between $0.0000036 and $0.0000038 is still very important, even though things are going down. This area is in the same place as the lower Bollinger Band and a key Fibonacci retracement from the 2025 rally. If the asset experiences a breaks down, it could show $0.00000319 and $0.00000300, both of which haven’t been tested much since mid-2025. Liquidity sweeps are likely to occur before a reversal to clear out the resting liquidity followed by hige chunk of capitulation volume and aggressive spot demand.

Indicators of Technology

Momentum signals still favor sellers, but they are starting to point more toward exhaustion than acceleration. The MACD is still below the signal line, and the histograms are still negative, which shows that there has been downward pressure since December 2025.

RSI is close to 36, which means that the market is oversold but not completely giving up. If the price drops below 30 and then rises again, it would make the case for a relief bounce stronger. The Chaikin Money Flow is still negative, at about -0.07, which shows that money is still flowing out and being distributed. The RSI and other oscillators are mostly neutral, which means that the market may need to consolidate before making its next move.

Metrics and Sentiment on the Chain

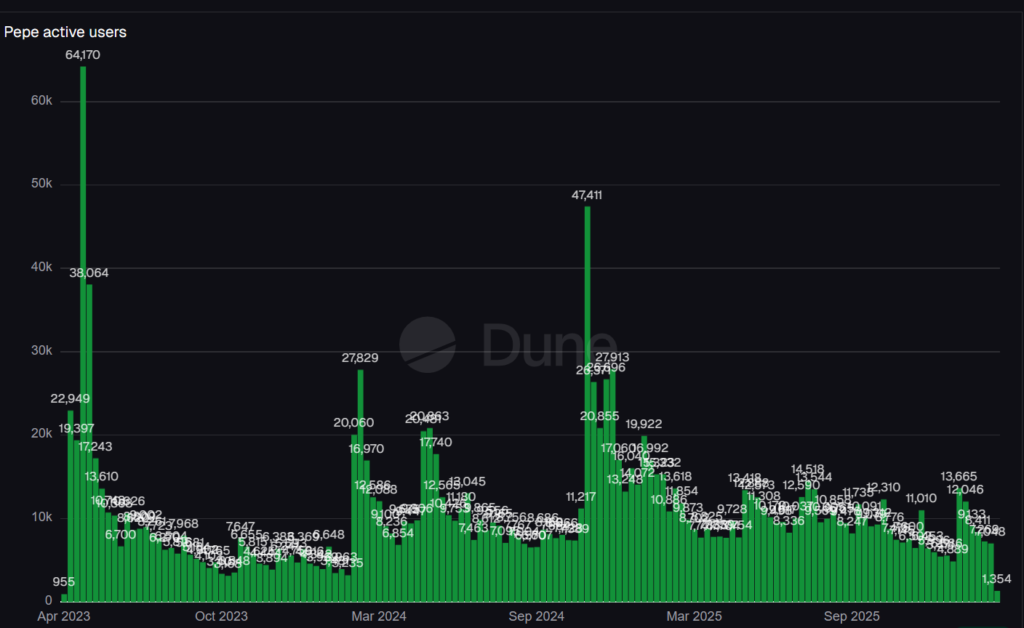

The actual on-chain activities confirm that users have reduced their online interactions. Pepe reached its highest user count for YTD when 19922 active users utilized the platform on January 13. Now, the platform experiences only 1354 active users. The current whale holdings show stable patterns, but there exists no proof that these investors are actively acquiring more assets.

People’s feelings about social issues are still mixed. People on crypto-native platforms are cautiously hopeful about possible rebounds, but their confidence is still shaky. The Fear & Greed Index is close to extreme fear levels, which shows that people are being careful. This is a sign that people are getting ready to buy, but it doesn’t mean that prices will go up right away.

Exchange inflows have gone up a little, which suggests that there is still selling pressure. Negative funding rates in derivatives markets show that people are still being defensive.

Possible Price Scenarios

For a bullish outcome, PEPE needs to keep the $0.0000036 support band and get more spot demand. The short-term price target of $0.00000524 is likely to be achieved in the case of volume increases together with this daily support and market structure shift.

A bearish continuation break will occur when support levels break because this will lead to a price drop that targets the $0.00000259 level, especially during times of market weakness. The market is expected to remain in its current state until its price reaches between $0.0000033 and $0.0000040 since traders are waiting for more powerful trading drivers.

In the long run, recovery is still possible if liquidity improves and memecoin rotation comes back. Stabilization levels could form near $0.00000389 in the next few months.

The Risk Factor

The PEPE asset shows high price fluctuations because market trends depend on investor sentiments. The market faces three main challenges, which include liquidation cascades, sudden shifts in retail investor sentiment and macroeconomic factors that lead to market volatility based on the outcomes. The market maintains two major problems, which involve liquidity gaps and slippage taking place during times of extreme market volatility. The process of managing risks requires investors to use controlled position sizing methods together with specific invalidation levels.