- Dogecoin price slides 3.0% after bulls rejected at 50-day SMA, undoing Sunday’s jump.

- Stochastic conditions and several key support levels make it tough for DOGE bears.

- Dogecoin recovery remains elusive below $0.2600, while the $0.2000 breakdown threatens a three-month uptrend.

- DOGE shows short-term uncertainty, but still maintains overall recovery momentum.

Dogecoin (DOGE) price takes offers to reverse the previous day’s jump, down nearly 3.0% around $0.2300 early Monday morning in New York.

Also read: Crypto Weekly Price Prediction: BTC, ETH & XRP all Tumble as U.S. Data Fuels Dollar, NFP Eyed

In doing so, the memecoin extends pullback from the 50-day Simple Moving Average (SMA), even as nearly oversold Stochastic challenge bears, along with several key technical support levels.

Notably, upbeat trading volume during the DOGE pullback suggests active trader participation, pointing to further weakness in prices, while the market capitalization softens. According to Santiment, Dogecoin’s daily trading volume prints a three-day high of $1.92 billion, while the market cap retreats to $34.78 billion as we write.

These catalysts together portray the DOGE’s struggle to defend a three-month uptrend, even if multiple downside filters challenge the bears in extending the yearly loss. However, a strong fundamental push is needed to clear the memecoin’s further direction.

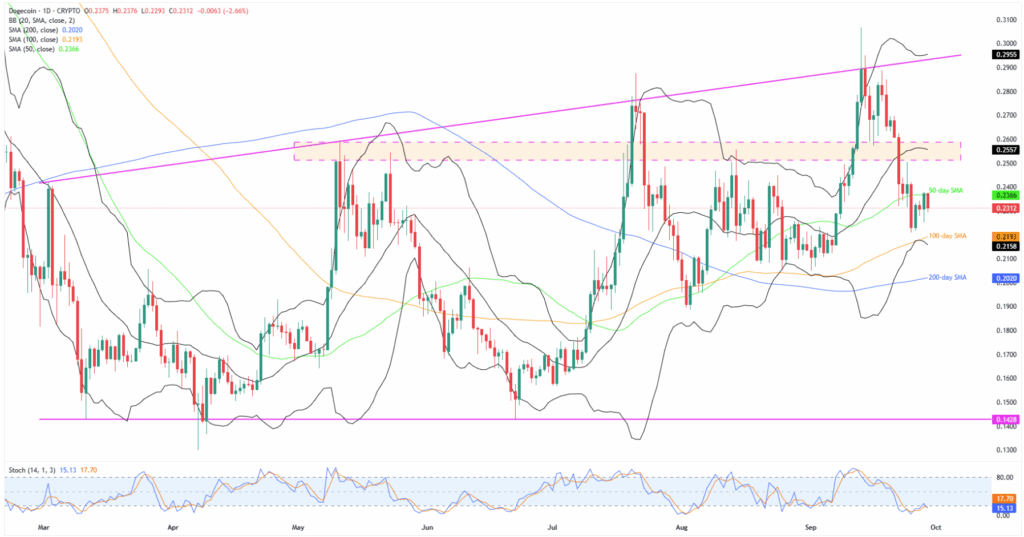

Dogecoin Price: Daily Chart Portrays Trader’s Indecision

After breaking a 4.5-month support region, now resistance around $0.2500-$0.2600, Dogecoin dropped to a three-week low before bouncing off $0.2209. The recovery moves, however, failed to cross the 50-day SMA hurdle of $0.2366, suggesting another attempt to poke the $0.2200 threshold.

This also highlights the 100-day SMA support of $0.2190 and the lower Bollinger Band of $0.2158.

Even if the DOGE bears break the $0.2158 support, the 200-day SMA support of $0.2020 and the $0.2000 will be the last defense for bulls, before threatening the three-month uptrend.

Notably, Dogecoin’s sustained weakness past $0.2000 makes it vulnerable to revisit the yearly low of $0.1300, with multiple support levels around $0.1900 and $0.1480 likely acting as buffers.

On the flip side, DOGE’s upside break of the 50-day SMA hurdle of $0.2366 enables it to aim for the multi-month horizontal resistance area comprising the middle BB, near $0.2500-$0.2600.

Beyond that, Dogecoin may initially aim for July’s peak of $0.2875 before marking another battle with an ascending resistance line from March, near $0.2940. Also acting as an upside hurdle is the $0.3000 threshold.

It’s worth observing that DOGE buyers’ dominance past $0.3000 allows them to aim for the monthly high near $0.3070, a break of which could activate a gradual rise toward the yearly peak surrounding $0.4340.

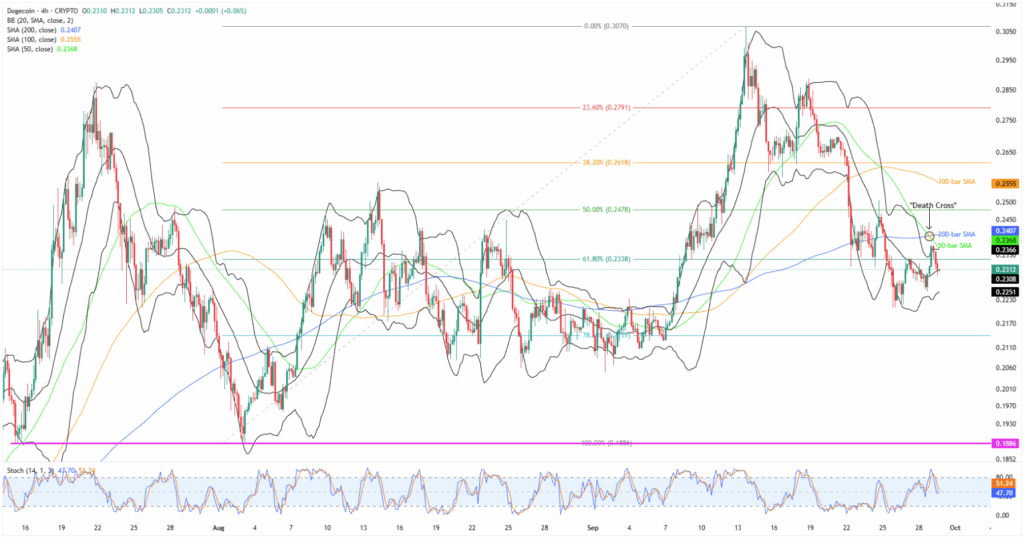

Dogecoin Price: Four-Hour Chart Lures Short-Term Sellers

Dogecoin’s four-hour chart becomes more interesting, with a “Death Cross” signaling further downside. This occurs when the 50-bar SMA crosses below the 200-bar SMA, typically a signal for sellers to take control.

This draws DOGE sellers’ attention to the lower BB support of $0.2250 and 78.6% Fibonacci Retracement of its August-September up-moves, near $0.2140.

Should the quote remain weak past $0.2140, the $0.2000 threshold and a 2.5-month-long horizontal support area near $0.1880 will be in the spotlight ahead of the daily chart’s deeper levels.

Conversely, 50-bar and 200-bar SMAs, respectively near $0.2370 and $0.2410, guard short-term Dogecoin recovery ahead of the 100-bar SMA hurdle of $0.2555.

Beyond that, the 38.2% Fibonacci retracement level near $0.2620 and the daily chart’s resistance levels will gain the market’s attention.

Conclusion

Dogecoin is likely to witness short-term downside pressure, despite lacking momentum, making it indecisive for a while. However, its three-month recovery pattern escalates hopes among the buyers, who in turn need a strong fundamental catalyst to regain control. Hence, DOGE traders should stay cautious amid mixed updates surrounding the memecoin and broad crypto market conosolidation.

Also read: Is Dogecoin Price at Risk? Whales Sell 40 Million DOGE