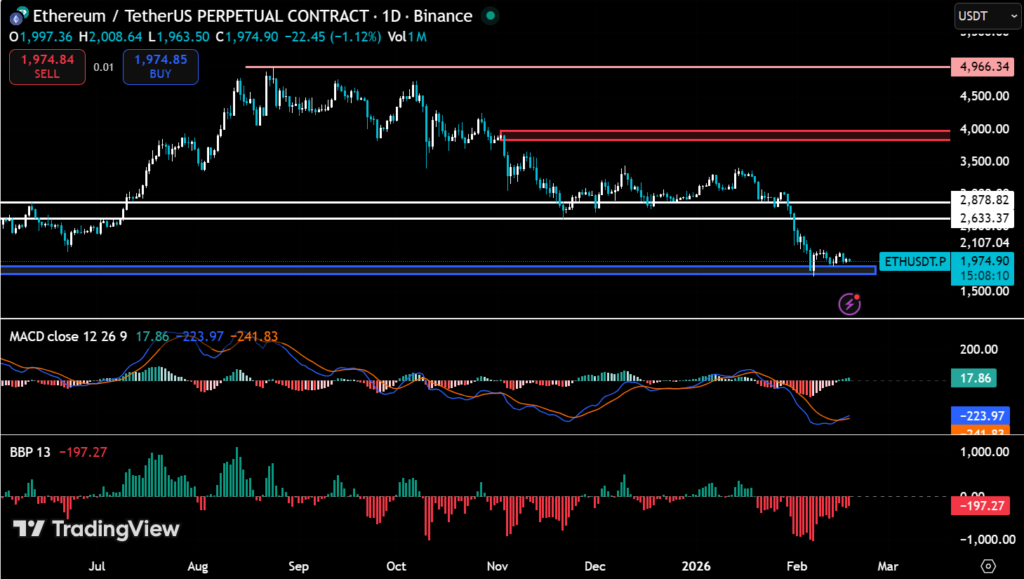

Ethereum experienced another decline in its most recent session, with the current trading price of $1,974.90 marking it a 1.12% decrease. The price slump brought the value of the asset down to below the psychological level of $2,000, which had been working as a temporary support level during the previous weeks. According to sources like Coinalyze, the asset’s open interest is now at $10.2 billion, which indicates that market activity had risen because of stop-loss triggers and short covering. The market has seen increased trading activity yet no affirmative reversal indications have shown up while the bears continue to dominate.

Price action confirms a new lower low near $1,963.50, which extends the multi-month descending channel that has shaped Ethereum’s performance since early 2026. Before this drop, ETH had been trading in a range of about $1,900 to $2,100, which was a temporary trading range. The $2,000 support level has been broken, which is a key floor. This plunge in price makes the market more vulnerable to retracing deeper if the selling pressure holds strong.

Momentum Indicators Show a Bearish Picture

Technical indicators show the sell side mounting, creating downside market pressure. The momentum indicators like MACD (12,26,9) show developing negative divergence by means of its current histogram value of 17.86 and MACD line value of -223.97. The market demonstrates increasing downward momentum through its developing bearish crossover and ongoing negative bar patterns. The current market state shows no signs that would suggest an upcoming pause or temporary relief bounce.

The Bull Bear Power (BBP 13) figure of -197.27 points towards the strong downside pressure, with price being tracked near the lower band. Measures of these extreme levels can frequently precede short-term bounces in sideways markets, but the broader price pattern of lower highs and lower lows shows that selling pressure for the relative asset remains dominant.

Key Support and Resistance Levels to Watch

The first real obstacle is the old support-flip zone around $2,107, which is still far away from overhead resistance. There is more congestion between $2,633 and $2,878, and there are big supply clusters from the 2025 peak between $3,500 and $4,000. On the other hand, there isn’t much immediate support below current levels. The next important floor is in the $1,500–$1,600 range. This range is based on a mix of psychological levels and chart-based support if selling pressure doesn’t stop. Without support nearby, the risk of bigger drops goes up if bears stay in charge.

On-Chain Metrics Show Market “Coldness”

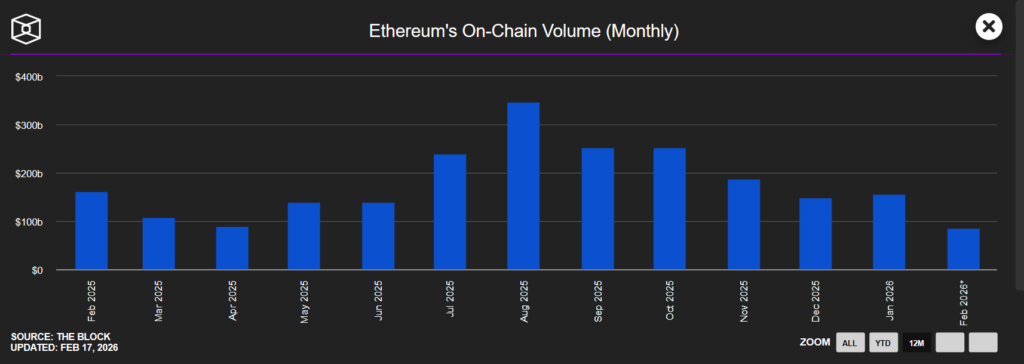

Ethereum’s on-chain volume has collapsed dramatically into 2026, with January closing close to $155 billion and February (mid-month) tracking at 85.57 billion USD volume. This steep drop from 2025 peaks above $345 billion indicates diminishing network usage and transactional demand. Such low activity levels signal a bear market slowdown, with users and capital moving out of the chain. ETH may continue to face price suppression until there is any revival in the on-chain flows.

Price Changes and Short-Term Outlook

Ethereum is still technically weak in the short term. The break below $2,000, along with the growing negative MACD divergence and compression along the lower Bollinger Band, gives bears short-term control. If there isn’t enough buying volume, ETH could test the support range between $1,600 and $1,800. Still, oversold technical readings and steady whale behavior suggest that this area may attract strategic accumulation, which could set the stage for a future recovery.

The first step in changing the short-term bias would be to get back $2,000 on strong volume. Ideally, this would unfold at the same time as the MACD histogram and momentum indicators gradually begin to move closer to neutral territory. If the trading price of Ethereum stays above this level, it could target the zones close to $2,400 or higher. Until that happens, $1,975 is the immediate line in the sand for traders, and they should be careful with their short-term positions.

Things to Think About When It Comes to Volume and Liquidity

Trading volume has significantly impacted the current downtrend. Lack of liquidity leads to larger price movements due to stop-loss cascades and opportunistic trading. The effects of the market rallies and corrections are likely to be more intense when leverage in derivative markets is leaning on the higher side and liquidity on exchanges is not adequate to fill up the larger orders. So, short-term volatility may stay high even if the core fundamentals stabilize.

What This Factor Means for Traders and Investors

The ongoing bearish structure shows traders how important it is to manage their risks carefully. Position sizing, stop placement, and paying attention to derivative funding rates are still essential in a market with faster downward momentum. Long-term investors should monitor the on-chain accumulation patterns among large holders. These patterns can show where there might be support that fits with the bigger market cycles.

The Big Picture and the Market

The cryptocurrency market currently exercises caution toward the digital assets like Ethereum because of its persistent decline. The market experiences heightened bearish pressure due to the less speculative behavior of the traders while major positive market drivers are absent and investors prefer to stay away from equity and cryptocurrency assets. Macro conditions determine a recovery path since institutions continue to allocate funds steadily and large holders broaden their positions, which will create market stability after brief price fluctuations. Ethereum remains in a technically weak position, with sellers controlling the short-term trend and key support levels under pressure. The move lower is reinforced by negative MACD divergence, continued compression along the lower band, and the formation of a fresh lower low.