Key Takeaways

- SEI’s hourly chart flashes a bullish divergence, and price action hints at a potential 11% jump on the horizon.

- SEI’s unique wallet addresses have jumped by 130%, signaling rising investor interest in the asset.

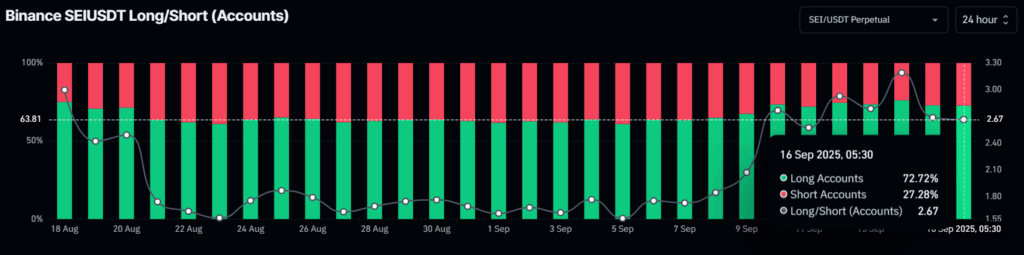

- 72.72% of Binance traders are betting on long positions.

After plunging 13% over the past 36 hours, Sei (SEI) is poised for a price reversal as a bullish pattern has been spotted on the daily chart. On-chain metrics suggest that both traders and investors have stepped in, pushing the asset’s price to higher levels.

SEI Current Price Momentum

At press time, SEI is trading near $0.32, up 1.15% over the past 24 hours. However, market participation remains lower than the previous day, causing the asset’s trading volume to plunge 25% to $140 million.

Despite the decline, SEI’s trading volume is nearly double that of ICP and KAVA combined, according to a crypto expert on X. This suggests that SEI is still garnering the attention of the market despite weaker participation.

Technical Analysis and Key Levels to Watch

TimesCrypto’s technical analysis reveals that SEI’s hourly chart is flashing a bullish divergence on the Relative Strength Index (RSI). This typically occurs when the price of an asset forms a lower low while the RSI forms a higher high. Such a pattern suggests growing buying momentum that could trigger a short-term price rebound.

Despite a bullish pattern, SEI’s price is facing strong resistance from the descending trendline, the 50-day Exponential Moving Average (EMA), and a horizontal level at $0.322. These resistances appear to be the only barriers for SEI at press time.

Based on the current price action, if SEI breaks out of this resistance level, there is a strong possibility the asset could see an impressive 11% uptick and reach the $0.36 level in the near future.

Also Read: 21Shares Joins Race to Launch First Spot SEI ETF

130% Jump in SEI’s Unique Wallet Addresses

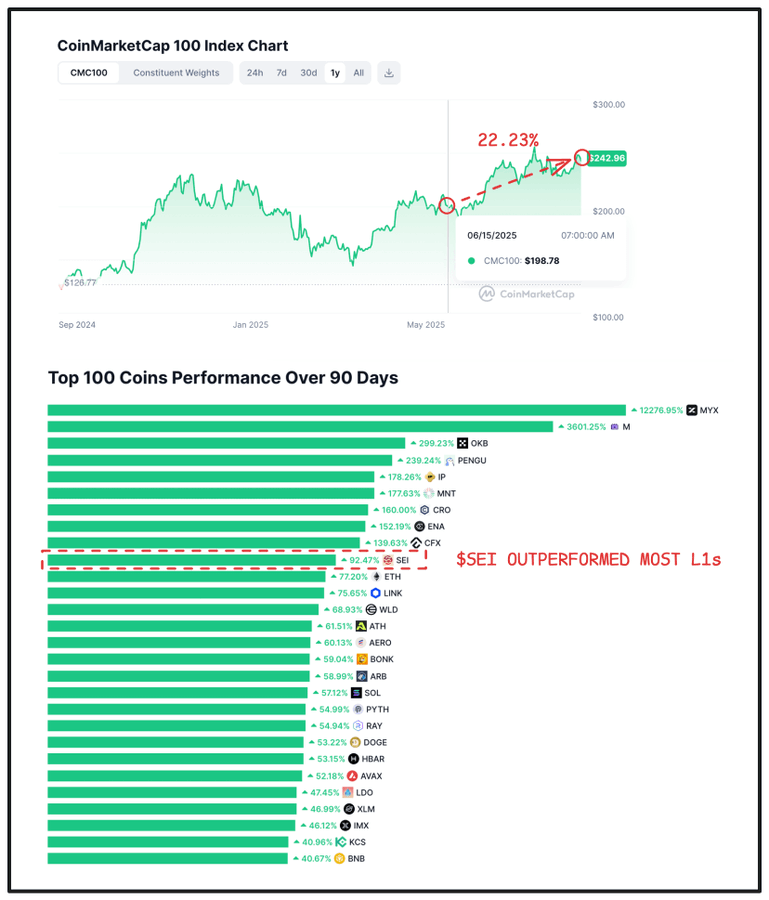

The sentiment around SEI remains bullish due to its recent performance. An expert recently shared that SEI has gained 92.47% over the past 90 days, outperforming the CMC100 index, which holds an average gain of 22.23%.

The expert also noted that SEI has recorded a significant 130% spike in unique wallet addresses, which have now reached 65.85 million.

On-Chain Metrics Flashes Bullish Signal

With all these factors, investors and traders appear to be following the bullish trend, as revealed by on-chain analytics tool Coinglass.

Data from spot inflow/outflow reveals that exchanges have witnessed a significant $6.45 million outflow of SEI tokens over the past 48 hours. This massive outflow suggests potential accumulation and could help the asset breach key resistance.

In addition, traders on Binance are also betting significantly on long positions. Coinglass data reveals that the Binance SEIUSDT Long/Short ratio has reached 2.67, indicating strong bullish sentiment among traders. The data further shows that 72.72% of Binance traders are betting on long positions, while 27.28% are holding short positions.

When combining these metrics with SEI’s price action, it appears that bulls are dominating the asset and may end its prolonged hurdle with an impressive price uptick.