The native token SUI has undergone a period of notable volatility. It is important to closely monitor price movements as well as key support and resistance levels. Equally critical for market participants is tracking how shifts in token supply influence overall price dynamics. The asset is changing hands close to $0.9664 at the time of writing, and it could extend the pattern till early March 2026.

Market Overview

Since its peak value of approximately $3.50 in September 2025, SUI has witnessed continuous price declines. The market structure has been in a pattern of lower highs and lower lows, and it has experienced a drop of over 70% at its current level. The macroeconomic factors potentially influence the global crypto market, including these specific sectors of layer-1 ecosystems in terms of price volatility.

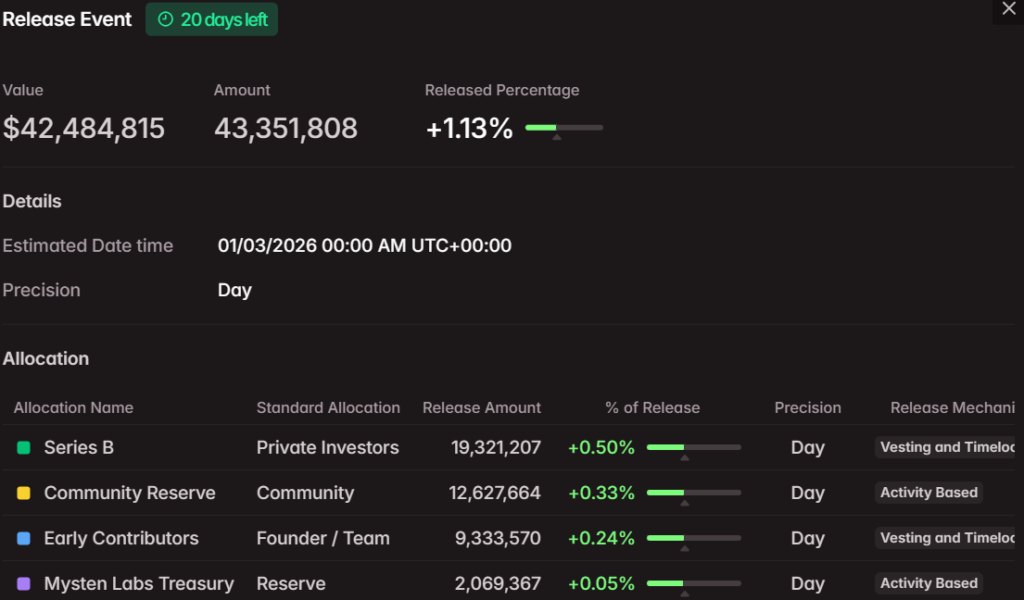

The unlock event for the asset combined with the extensive circulating supply could create significant selling pressure. The unlock portion will have 0.5% allocated for the private investors. SUI has a current bearish market sentiment since it went through a price decline below crucial psychological price levels. The asset has now entered the oversold region, as per momentum indicators like the RSI (Relative Strength Index).

The Technical Perspective

The daily chart for the asset shows a sharp drop from the $3.50 resistance zone (back from Oct 2025), followed by a failed recovery attempt around $2.00 in late 2025. SUI fell below a key support level of $1.2851 in January 2026 and is now trading near $0.9664. Resistance is still at $1.2851, and any further gains would have to get past $2.00 and $3.50. It is crucial to regain the respective zone, as it will create a deviation for the price, ultimately helping the price to shift to a bullish structure. Historical lows around $0.80-$0.90 may provide support below current levels, but a drop and weekly close below $0.88 could speed up the drop toward $0.70. The bearish trend channel is clear, with lower highs controlling price action, and moderate volume suggesting that moves could be bigger when there isn’t much liquidity.

The RSI is close to 28 on the momentum indicators, which means the market is oversold. This could lead to a short-term bounce of relief, but oversold readings can stay in strong downtrends. A small difference in the RSI lines could mean that bearish momentum is slowing down, but price action above $1.285 is needed to confirm this. On the whole, the chart indicates that bearish sentiment is still on the dominating side in the short term, but there is a likelihood of small rebounds if the momentum changes.

Event to Unlock Tokens Soon

The next scheduled unlock for SUI is set for March 1, 2026, and represents approximately 1.13% of the total circulating supply. The total capped supply for the asset is 10 billion tokens. This event carries a significant value since it could create a noticeable impact on the asset’s price. The effect will depend largely on how holders behave and how the unlocked tokens are distributed. If a large portion of the tokens is controlled by price-sensitive participants, such as early investors or speculative traders, selling pressure could increase and worsen the current downtrend, similar to previous unlock events in projects like APT or SOL. If most of the unlocked tokens are allocated to long-term staking, ecosystem development, or participation in Sui’s DeFi and NFT programs, the immediate selling impact may be limited. Traders may also try to sell before the unlock to avoid potential declines, which could cause short-term weakness in the days leading up to March 1.

Post unlock, if the market absorbs the selling pressure from the unlocked supply efficiently, it could fuel optimism among traders by marking a local bottom. It’s important to closely watch on-chain activity, such as staking participation, wallet inflows and outflows, and overall transaction volumes. These values, furthermore, keep records of how the market feels about the asset relative to its price post-unlock.

Future Outlook and Risk Assessment

SUI is exhibiting a bearish pattern in the short term, indicating that it will likely test support levels ranging from $0.80 to $0.90 in the near term. If the RSI reading is still under 30, there may be a possibility for rebound opportunities that aim for a bounce back to $1.20 to $1.30. On the other hand, SUI could drop below $0.70. The challenges that still hold significant value include significant sell-offs from the institutions, competition with other L1s, or delays in carrying out the roadmap in terms of development upgrades. Sui’s high throughput, like Max TPS (1 block), is 11,543 tx/s, which implies strong ecosystem development over time.