The first U.S. spot XRP ETF started trading three months ago, on November 13, 2025, when Canary Capital’s XRPC went live. The first rollout achieved excellent results through its trading activity and incoming financial resources. Four additional products launched shortly thereafter to provide institutional and individual access to the relative asset.

Canary Capital’s fund has attracted the most capital so far, with over $410 million, followed by Bitwise with around $360 million and Franklin Templeton’s XRPZ at $328 million. After more than a month of steady positive inflows, the total net assets of XRP ETFs topped $1 billion, showing strong early interest from institutional investors.

Is the institutional demand cooling off?

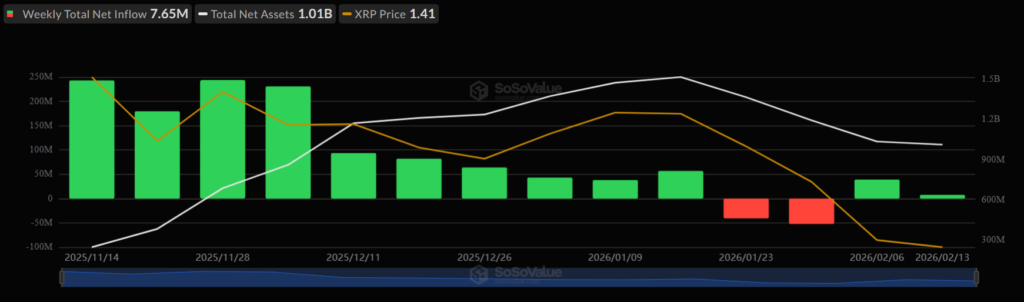

The steady stream of money coming in stopped on January 7, and there were more outflow sessions on January 20 and 29. Weekly data now clearly shows that things are slowing down. Net inflows for the week ending February 13 were $7.65 million. By the end of the week, total net assets had settled at about $1.01 billion. The metric has experienced small inflows, but the growth rate is still much slower when compared to late 2025 and early January.

Price action is different from ETF trends

Even though ETF flows have gone down, XRP prices have stayed pretty stable. In early February, the token dropped to about $1.11 before starting to rise again. Resistance near $1.55 was tested several times during the consolidation phase, but the asset has been moving up in recent sessions.

XRP hit a multi-week high of just over $1.65 in the last few days, but then it was rejected and fell back. As of February 16, 2026, the asset is trading for about $1.45 on major exchanges, which is a drop of about 5% in the last 24 hours. The range for the day has been from a high of about $1.66 to a low of about $1.45. The market participants have shown their high interest in the asset, wherein some sessions experienced the trading volume of over $5 billion. XRP still makes it on the list of top 5 cryptocurrencies by market cap with $89.32 billion.

Strong long-term downtrend

The daily XRP/USDT chart shows a longer-term downtrend that started in late 2025 when prices were above $2.50. Through December and January, the price made a series of lower highs and lower lows, ending with the low in February near $1.10 to $1.20. The following rebound caused a sharp rise toward previous swing areas, and the move to $1.65 marked a significant attempt to recover. But momentum didn’t last, and the price fell back into the $1.45 to $1.55 consolidation zone, where it is now trading.

Indicators of Momentum Reflect Mixed Signals

Technical indicators on the daily time frame show a balanced view. The MACD (12, 26, 9) is still above the signal line, and the histogram is positive. This means that there is short-term bullish momentum during the recovery phase. But the recent flattening makes it look like the rally is losing steam.

The Bull Bear Power (BBP 13) shows a reading of -0.017, which means it currently exists close to the neutral territory. This digital asset reached oversold conditions during its decline from $1.65, but it has fully regained value. The current market situation shows both low volatility and market stability as an active state.

The price movement in the upcoming period hinges on two main horizontal support and resistance points: the current resistance stands at $1.65, while stronger resistance exists between

From the resistance perspective, the price is close to its previous short-term lower high of $1.65; if the price flips the respective zone, the asset can target its next horizontal resistance levels between $2.00 and $2.50, which served as both market consolidation and breakdown points during 2025.

On the other hand, $1.27 is a short-term support level, and $1.00 is a major psychological and structural floor. If the market as a whole gets weaker, a drop below $1.27 could speed up selling pressure toward $1.00 or lower. On the other hand, a sustained close above $1.67 with a decent volume would show that bullish momentum is back and that higher resistance clusters are on the way.

Volume data shows that participation was average to above average during the advance. The recent retreat happened on steady volume instead of spikes, which suggests that profit-taking was done in a controlled way instead of panic-driven liquidation.

Changes in the ecosystem and the story of institutions

Long-term fundamentals are still being shaped by bigger changes on the XRP Ledger. In February, Ripple released updates that showed how far they had come in building institutional DeFi infrastructure. They said that XRP would be a key part of scaling real-world financial applications.

Changes to the XRP Ledger could increase demand for utility over time, but the price impact is still small right now. Regulatory clarity from previous years continues to support institutional engagement, as seen in the launch of ETFs and the continued allocation of capital. However, macroeconomic uncertainty and the rotation of altcoins are slowing down momentum.

Key issuers still lead the way in ETF inflows. Canary Capital is still the leader in total inflows, followed by Bitwise and Franklin Templeton. The market investors are still following the risk management strategies with the altcoin investments. The overall flows are still experienced slowdown but the current flows show the hidden but cautious interest from the market.

XRP’s transitional phase

XRP is still stuck between $1.45 and $1.55 because it couldn’t hold onto gains above $1.65. ETF inflows have slowed down a lot, but the asset has avoided bigger drops and keeps trying to recover every so often.

The current downtrend from the highs of 2025 is still in place. To break through $1.65 and move toward higher resistance zones, volume and momentum need to keep growing. If selling pressure grows, the biggest risks are still around $1.27 and $1.00.