Key Takeaways

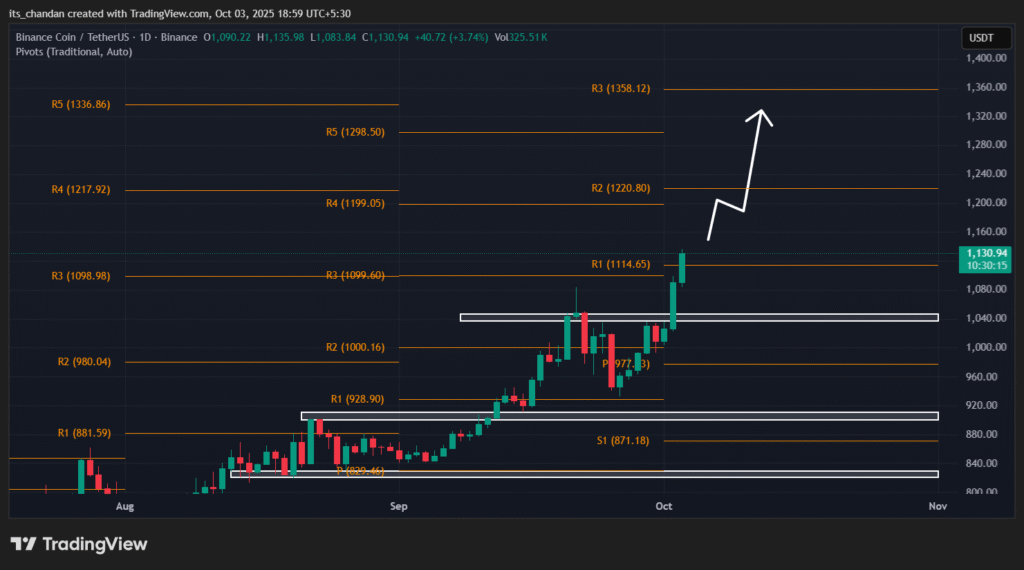

- BNB price hit a new high of $1,130, with technical indicators suggesting $1,220.80 and $1,358 are on the horizon.

- BNB’s ADX has reached 32, indicating a strong directional move in the asset.

- The key catalysts driving BNB’s price appear to be strong fundamentals and its strategic reserve.

Binance’s native chain token, BNB, seems unstoppable as it continues to hit new highs every month. After reaching $1,083 on September 21, the asset posted another new high today, on October 3, 2025, climbing to the $1,130 level.

BNB Price Action and Market Performance

Looking at BNB’s recent performance, several questions are looming among market participants that how long will BNB continue its upward momentum, and is there a chance of a market correction before its next leg up?

At press time, BNB stands strong above $1,130 with an impressive gain of 3.85%, while the major rally that pushed the asset to a new high was yesterday’s 8% surge, according to TradingView data.

Currently, BNB’s market capitalization has reached $154 billion, allowing it to maintain its fifth spot among the largest cryptocurrencies.

With its impressive performance, market participants have shown strong interest in the asset, as reflected in the trading volume as which jumped 59% to $5.55 billion over the past 24 hours, as per CoinMarketCap data.

BNB Technical Outlook: Upcoming Levels to Watch

According to the TradingView chart, BNB on the daily time frame has broken a key resistance at the $1,049 level, triggering the recent price uptick. This pattern is similar to when the asset previously broke out of the $911 resistance level before hitting its previous all-time high of $1,083.

Based on the current price action, forecasting the next level is challenging due to limited historical data. However, the Average Directional Index (ADX) has reached 32, indicating that BNB has a strong directional move and may continue its ongoing rally.

The pivot point indicates that BNB is currently facing resistance at $1,137. If it breaks this level, the asset could move to the next R1 at $1,220.80 and R2 at $1,358 in the future.

Why is BNB Price Rising?

You might be wondering what is triggering BNB’s continued upside momentum are whales or institutions accumulating? The answer is yes, and several other factors are driving the price higher and strengthening BNB’s bullish outlook.

BNB’s Strong Fundamental

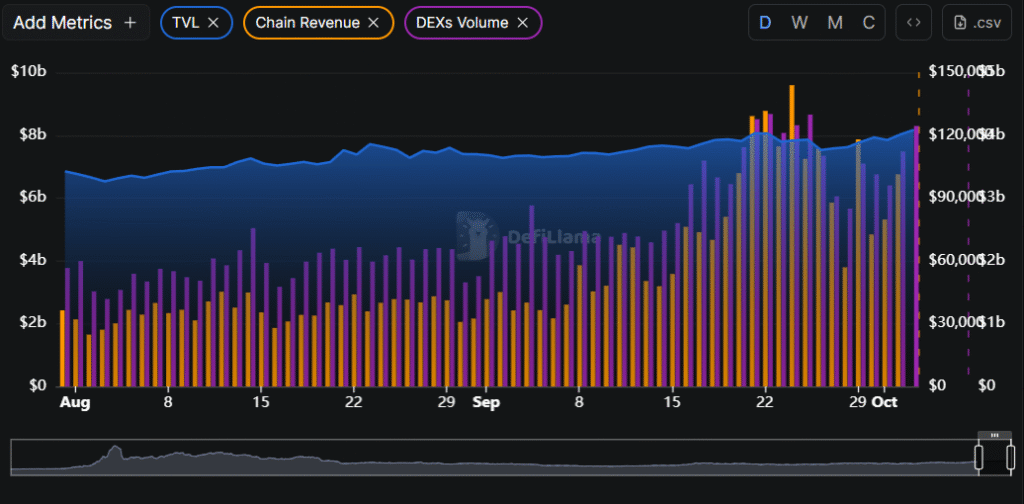

According to DeFiLlama, an on-chain analytics platform, Binance Smart Chain (BSC) Total Value Locked (TVL), chain revenue, and DEX volume have continued to rise since August 2025.

At press time, TVL has increased from $6.761 billion to $8.176 billion, chain revenue has surged from $32,061 to $101,408, and DEX volume has climbed from $1.997 billion to $4.159 billion.

This indicates that BSC is in a growth phase, attracting more liquidity, users, and trading activity, which appears to be a bullish factor for BNB.

BNB Strategic Reserve

Another key factor supporting BNB’s bullish outlook is its strategic reserve. Recently, it appears that not only private companies but also countries like Bhutan and Kazakhstan are building BNB as part of their strategic reserves.

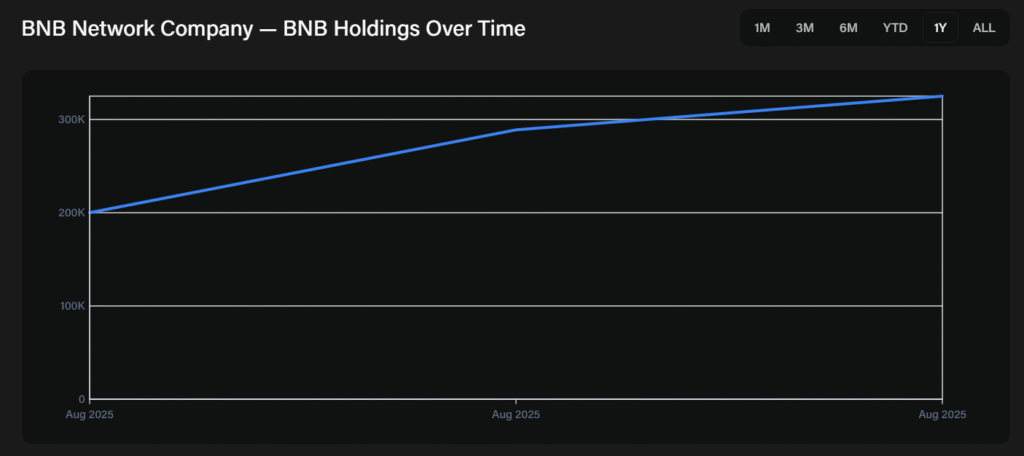

This trend is driven by Binance’s strong financial standing, the practical value of its token, and its position as the largest crypto exchange. At press time, companies like BNB Network Company, a subsidiary of CEA Industries, Windtree Therapeutics, and Nano Labs are aggressively buying BNB.

According to reports, CEA Industries is building the largest corporate treasury, aiming to hold 1% of the total BNB supply by the end of 2025. So far, the company’s treasury holds 418,888 BNB worth $368 million, making it the world’s largest BNB corporate treasury.

In July 2025, Windtree Therapeutics announced plans to purchase $60 million of BNB to launch its BNB treasury strategy.

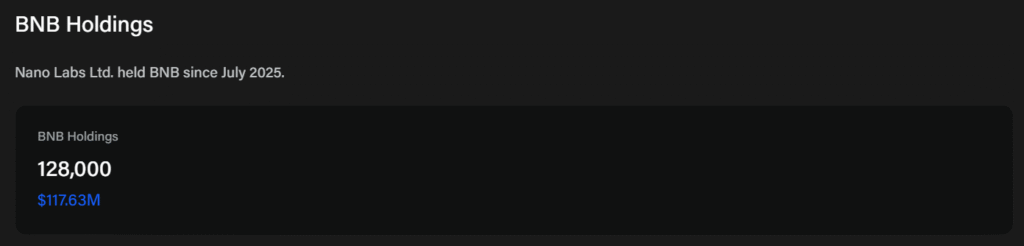

Whereas, Nano Labs holds 128,000 BNB worth $117.63 million, with acquisitions starting on July 3, 2025, and continuing over time. A report reveals that Nano Labs plans to initially acquire $1 billion worth of BNB through financing and private placement, aiming to hold 5%–10% of the total circulating supply of BNB long-term.

With strong technical momentum, solid fundamentals, and aggressive corporate accumulation, BNB is poised for further gains.