- Bitcoin price reverses three-session gains on Tuesday.

- Rising futures open interest and BTC ETF inflows hint at a potential price surge.

- Fall in active addresses, contrasting moves on decentralized exchanges test BTC/USD bulls.

- Technical hurdles like nearly overbought RSI and key resistance cap Bitcoin’s upside momentum.

Bitcoin (BTC/USD) bulls took a breather and reversed their three-day winning streak, trading around $108K during Tuesday’s opening European session. BTC’s rebound on May 24 follows the biggest single-day drop in over six weeks, marked on Friday, and reflects renewed investor confidence. The BTC/USD’s upward momentum is fueled by mostly positive on-chain data, such as rising futures open interest and steady ETF inflows.

Still, the Bitcoin rally faces headwinds from declining retail participation, mixed signals from decentralized exchanges, and technical chart challenges like overbought RSI and key resistance levels.

Bitcoin Bulls Justify Mostly Upbeat On-Chain Metric

Most of the latest signals from the chain analysis suggest the market loves Bitcoin, even if a few catalysts want BTC/USD bulls to remain cautious.

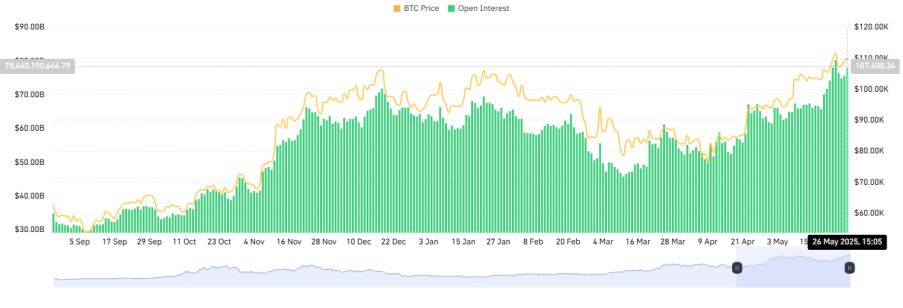

CoinGlass data reveals a fresh uptick in Bitcoin Futures Open Interest (OI) following Friday’s pullback. The OI, which tracks the total value of outstanding Bitcoin futures contracts, hit a record high of nearly $80 billion on Thursday. As of today, the total BTC Futures OI across all exchanges stands at around $78 billion on Monday, marking a second consecutive day of growth.

BTC Futures Open Interest (OI)

Source: Coinglass

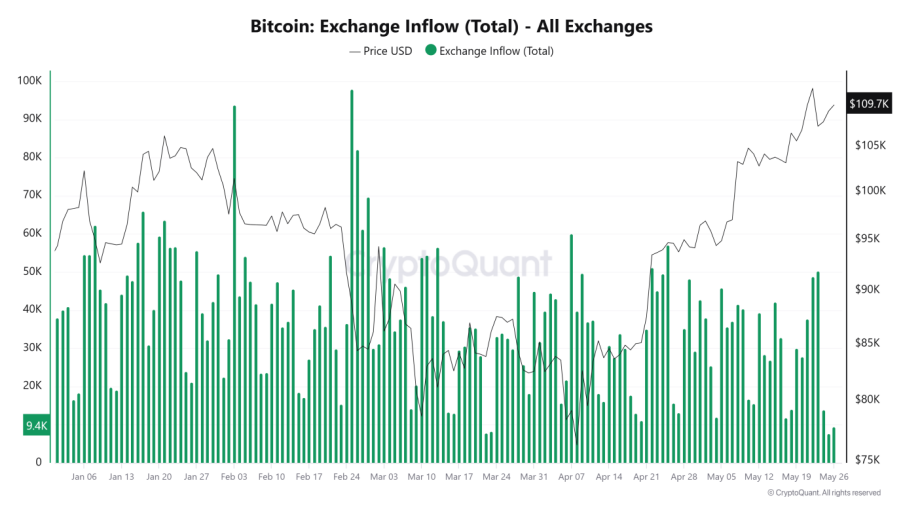

The increase in Bitcoin Futures Open Interest (OI) signals growing market participation, while CryptoQuant data shows a drop in exchange inflows and individual deposits, suggesting that selling pressure is fading. This combination favors the BTC/USD pair buyers.

Source: CryptoQuant

Recent data shows total exchange inflows have dropped significantly to 9,400, down from nearly 100K in February. This decline suggests lower exchange inflows, with an optimistic BTC holding pattern supporting the bullish outlook.

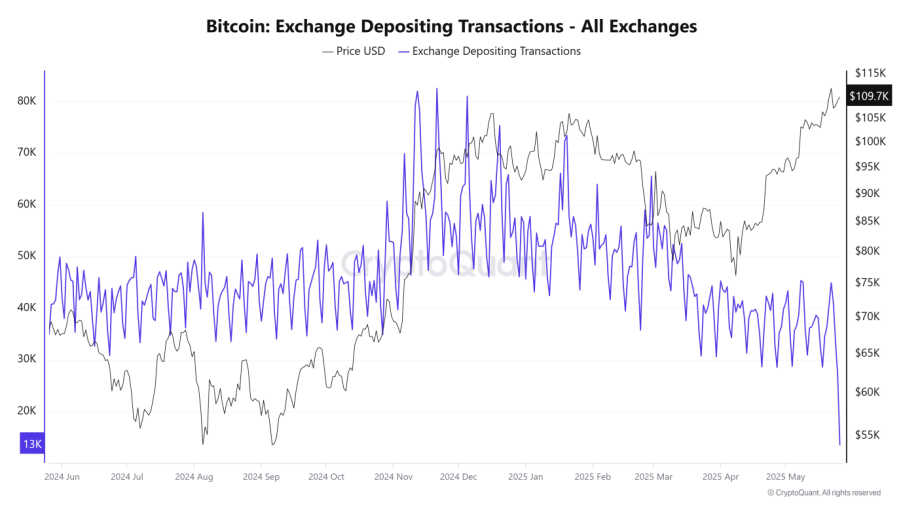

Source: CryptoQuant

In line with the drop in exchange inflows, CryptoQuant data on exchange depositing transactions also points to reduced selling activity and a stronger holding pattern, with the latest figures hitting an all-time low of just 13,000.

Source: Total Bitcoin Spot ETFs Weekly chart per SoSoValue

Having confirmed higher OI and reduced selling pressure, it’s good to take a note of a jump in the US Spot BTC ETF inflows. As per the SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded a net inflow of $2.75 billion during the week ending on May 23. This was the fifth consecutive weekly BTC ETF inflow and the third biggest in the history of BTC ETFs.

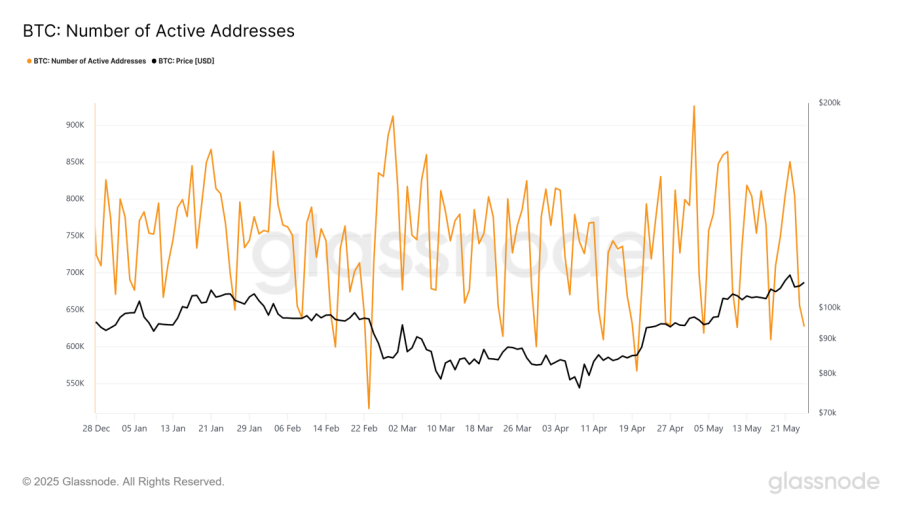

However, not all on-chain signals are in favor of Bitcoin buyers. GlassNode , an On-chain analytical platform, data shows a sharp decline in active addresses, dropping to 627K by May 25 from 850K on May 22.

Source: Glassnode

Technical Analysis Hints At Bumpy Road For BTC Buyers

While the mostly upbeat on-chain signals join optimistic fundamentals to defend the Bitcoin buyers, the technical analysis suggests a long and bumpy road for the BTC/USD pair upside momentum before hitting a new All-Time High (ATH).

BTC/USD: Daily chart cites multiple challenges for Bulls

Source: Tradingview

Bitcoin’s recent rebound is supported by a confluence of technical factors, including a five-month-old former resistance-turned-support, an ascending trend line from early April, and a bullish “Golden Cross” between the 50-day and 200-day SMAs. These signals favor the BTC/USD pair bulls.

However, caution among BTC traders prevails as the 14-day Relative Strength Index (RSI) flirts with overbought territory, while the Moving Average Convergence and Divergence (MACD) indicator offers mixed cues. Additionally, an ascending trend line connecting highs since December 2024 creates key resistance near the $112,000 level for the Bitcoin bulls.

A decisive break above $112K could open the door for the BTC/USD rally toward the 78.6% Fibonacci Extension (FE) of the August 2024 to April 2025 move at around $121,400, followed by the 100% FE level near $134,000. That said, the $120K and $130K marks act as interim resistance levels for the BTC bulls to follow.

On the downside, immediate support for the BTC/USD pair lies near the $107,700 level—marked by a six-week-old rising trend line—followed by the $107,000 level, which represents the previous five-month-old resistance. Further BTC declines could expose the 50% and 38.2% FE levels at $104,300 and $97,300, respectively, before testing the 50-day and 200-day SMAs around $95,600 and $94,150.

Conclusion

Bitcoin’s rebound is backed by strong fundamentals and bullish on-chain data; however, breaking past $112K and setting a new all-time high would require a major catalyst.