- Bitcoin struggles to justify optimism surrounding GENIUS Bill in the U.S. House of Representatives.

- Congress pushes the key Stablecoin bill to floor following Tuesday turbulence and 9-hour debate marathon.

- CLARITY Act may advance next, but Anti-CBDC bill won’t reach Trump anytime soon.

- On-chain data fuels buyer optimism, but technicals hint at BTC consolidation before the next breakout.

Bitcoin (BTC/USD) remains lackluster around $118K early Thursday, unable to ride the wave of optimism sparked by the U.S. House of Representatives’ progress on the key stablecoin bill, despite the earlier hiccups and a record-long debate. This latest pause follows Monday’s all-time high and serves as a reminder of the old trading wisdom: “Buy the Rumors, Sell the News.” Technical charts point to a short-term consolidation phase, suggesting Bitcoin may hold steady before its next move. Yet, strong on-chain data and widespread bullish sentiment keep buyers hopeful that the rally isn’t over.

The Progress

“The Republican-controlled U.S. House of Representatives cleared major hurdles on crypto legislation Wednesday, following President Trump’s intervention to save the effort,” Reuters reported. According to ABC News, “The GOP-led House narrowly advanced three crypto bills for debate with a close 217-212 vote late Wednesday night.”

This optimistic breakthrough came after a marathon nine-hour private session to win over skeptical lawmakers and recover from Tuesday’s setbacks. The spotlight is on the “GENIUS Bill” — officially the Guiding and Establishing National Innovation for U.S. Stablecoins Act — set to become the first federal crypto law passed by the House. With Senate approval already secured, House Speaker Mike Johnson indicated the bill could reach Trump’s desk soon, marking a major milestone for the crypto industry.

Besides the GENIUS Bill, two other important proposals—the CLARITY Act and the Anti-CBDC Act—are also under discussion during this highly anticipated “Crypto Week,” which has fueled optimism for leading cryptocurrencies like Bitcoin, Ethereum, and Ripple.

However, the vote on the CLARITY Act might be delayed until early next week. Meanwhile, the Anti-CBDC Surveillance State Act is tied to the must-pass National Defense Authorization Act as a Republican compromise, meaning it could take longer before becoming law.

The Reaction

Despite the wave of positive news, BTC/USD is struggling to gain momentum, staying flat after hitting a record high near $123K on Monday and currently showing a weekly loss. It appears traders had already priced in the optimism during the earlier rumor phase and are now waiting for the actual passage of the crypto bills into law before making their next move. Technical analysis also signals that the bulls may be overheated, suggesting Bitcoin needs a breather before another rally. Still, strong on-chain metrics and steady institutional inflows are keeping buyer sentiment alive and the bullish outlook intact.

On-Chain, ETF Signals Favor BTC Bulls

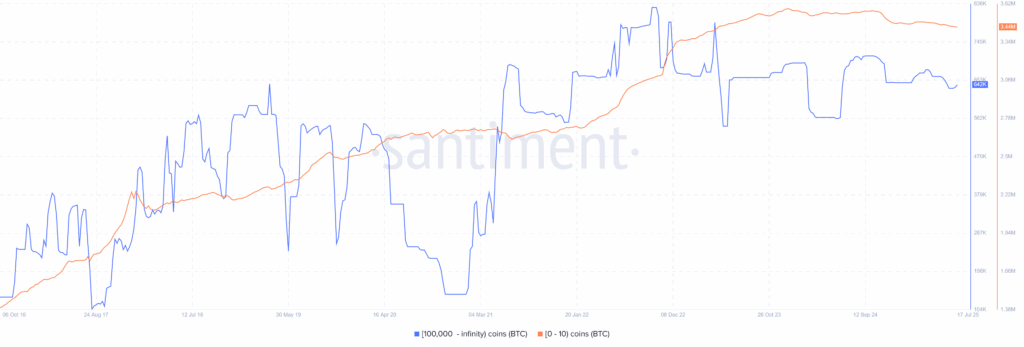

Among the key on-chain signals, the Bitcoin (BTC) Supply Distribution by Balance of Address gains major attention as it cites the accumulation of balance by the whales, wallets holding more than 100K BTC, up for the second consecutive week to 642K per the latest Santiment data. Meanwhile, the retail clients holding less than 10 BTC defend the gradual fall since April to 3.44 million at the latest.

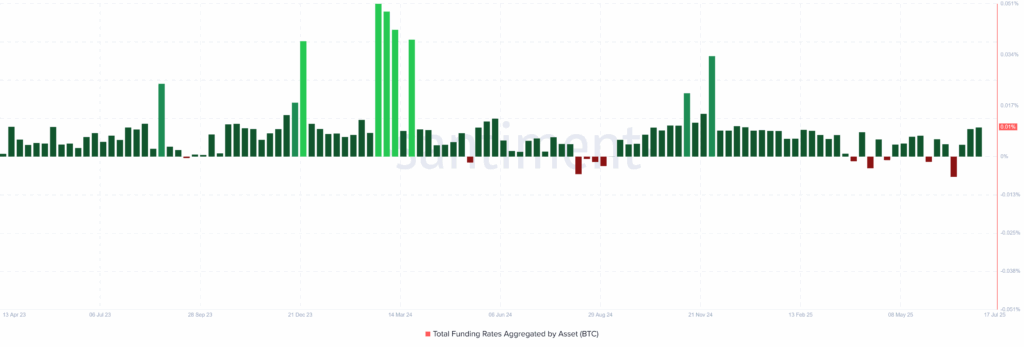

Additionally, the highest Funding Rates since late December 2024, to 0.009723% at the latest, also shows optimism among the BTC/USD buyers.

Furthermore, the Spot BTC ETFs mark the 10-day inflow streak while portraying the institutional buyers’ likeness for the crypto major. That said, the SosoValue data marks the latest inflow figure of $799.40 million for July 16.

Technical Analysis

While Bitcoin’s fundamentals remain strong and continue to support a bullish bias, technical analysis signals a possible short-term pause in the rally. This is mainly due to overbought conditions reflected by the 14-day Relative Strength Index (RSI) on the daily chart, suggesting that BTC may be running too hot for now. However, the recent breakout above key resistance levels, along with bullish cues from the Moving Average Convergence Divergence (MACD) indicator, still give buyers a reason to stay optimistic about further upside.

BTC/USD: Daily chart keeps buyers hopeful

Despite its recent pause, Bitcoin (BTC/USD) is holding strong above the former resistance near $114,000 — a key level that flipped into support after the July 10 breakout. This sustained strength, combined with bullish signals from the MACD indicator, continues to fuel optimism among buyers.

However, the 14-day RSI is hovering near overbought territory at 68.00, suggesting a potential short-term pullback before Bitcoin attempts its next leg higher.

On the downside, immediate support rests at $114,000, followed by previous highs at $112,000 (May), $109,350 (January), and the former yearly peak at $108,364 — levels that are likely to cushion any strong bearish pressure.

If upside momentum resumes, Bitcoin will first aim for the recent high around $123,240. A break above that could open the door toward the 78.6% Fibonacci Extension (FE) of the April–June rally near $127,800, and further up to the ascending trendline resistance from March 2024, currently around $135,000.

Conclusion

Bitcoin is holding steady around $118K after Monday’s record high, as traders await concrete outcomes from key U.S. crypto legislation. The GENIUS Bill—set to become the first federal law for stablecoins—is expected to reach President Trump’s desk soon, while the CLARITY Act vote may be delayed to next week. The Anti-CBDC Act, tied to the National Defense Authorization Act, could take longer but remains crucial for broader market sentiment. Technically, BTC shows signs of a short-term breather, with the 14-day RSI near overbought. Still, strong support above $114K, bullish MACD signals, whale accumulation, and continued ETF inflows keep the bullish outlook intact.

Looking ahead, all eyes are on the House floor vote and Trump’s signature—events that could mark a historic shift for crypto policy and potentially spark Bitcoin’s next breakout.