- Bitcoin picks up bids after rough week as mixed on-chain signals cloud trading.

- Trump-Musk feud pressured BTC/USD before rebound on US-china trade optimism.

- Rising retail participation vs. ETF outflows, low funding rates, and network profits show mixed on-chain picture for BTC.

- Rising MVRV ratio, falling exchange balances, and correlation with equities join MicroStrategy plans to keep Bitcoin buyers hopeful of crossing 21-day SMA hurdle.

Bitcoin (BTC/USD) is currently trading near $107,000 during Monday’s European session, following a volatile week that saw the price dip to a monthly low before closing with modest gains.

Mixed on-chain signals, coupled with uncertainty surrounding macroeconomic factors, continue to challenge market participants.

Notably, increased retail wallet activity contrasts with declining ETF inflows, subdued funding rates, and network profits, which have garnered significant attention.

Additionally, ongoing US-China trade negotiations in London remain a focal point. That said, the BTC/USD pair’s recent correlation with equities and its technical rebound maintain investor optimism for surpassing immediate resistance levels, contingent upon positive developments in ETF flows and on-chain indicators.

Let’s take a closer look at the key catalysts:

BTC’s Harmony With SPX

Reduced focus on the Trump-Musk disagreement over the “Big, Beautiful Bill,” alongside improving prospects for US-China trade harmony, supports cautious market optimism, particularly following Friday’s positive US employment data.

This optimistic sentiment has buoyed equities, led by the S&P 500 Index (SPX), and encouraged Bitcoin (BTC/USD) to recover losses and gain during Monday’s early trading, sustaining buyer confidence. However, ongoing challenges regarding the Ukraine-Russia ceasefire and the US-Iran nuclear deal, combined with likely persistent inflationary pressures in the US, which may reinforce a hawkish Federal Reserve stance, pose potential risks for Bitcoin bulls, especially if BTC continues to track the SPX.

Source: TradingView

ETF Outflows

Despite a positive shift in the market sentiment, spot BTC ETFs keep signaling outflows for the second consecutive week and challenge the Bitcoin buyer’s optimism. According to the latest SoSoValue data, total BTC spot ETF net outflows reached $128.81 million last week.

Source: SoSoValue.com

On-Chain Metrics

While positive sentiment favored BTC rebound and ETF outflows challenged buyers, several on-chain metrics flash mixed signals and trouble the Bitcoin traders. Notably, declining exchange supply, sturdy MVRV ratio and increasing retail wallets vs. falling whale participation are drawing investor attention.

Bitcoin Balance on Exchanges

A CoinGlass chart shows that Bitcoin exchange balance marks historical low even as prices rise—signaling reduced supply and strong investor holding, which points to a bullish bias for BTC/USD. Latest data shows total exchange balances at 2.09 million coins.

Source: CoinGlass.com

BTC Wallet Data: Retail traders fight whales

According to Santiment’s latest Bitcoin wallet data, small wallets holding up to 1 BTC have been accumulating at an aggressive rate. Since May 22, these retail holders have added nearly 33,000 BTC to their balances, signaling increased participation from retail traders.

In contrast, holders of 10 to 10,000 BTC—typically considered whales—have shown a retreat over the past three days, despite a generally volatile upward trend. It is important to note that this trend offers limited credibility for BTC/USD buyers, suggesting caution despite retail accumulation.

Source: Santiment.com

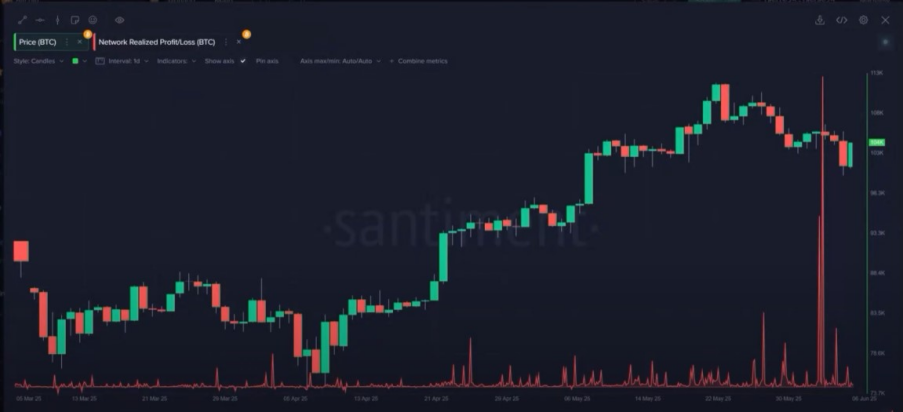

Network Realized Profits

The latest Santiment report highlights a spike in Network Realized Profit, indicating that many holders recently sold their coins at a profit.

The above metric warrants close monitoring: if profit-taking activity subsides, it could reflect growing market confidence and support the next upward move. Conversely, repeated spikes in realized profits may signal a sustained downtrend, as investors continue to exit their positions.

Source: Santiment.com

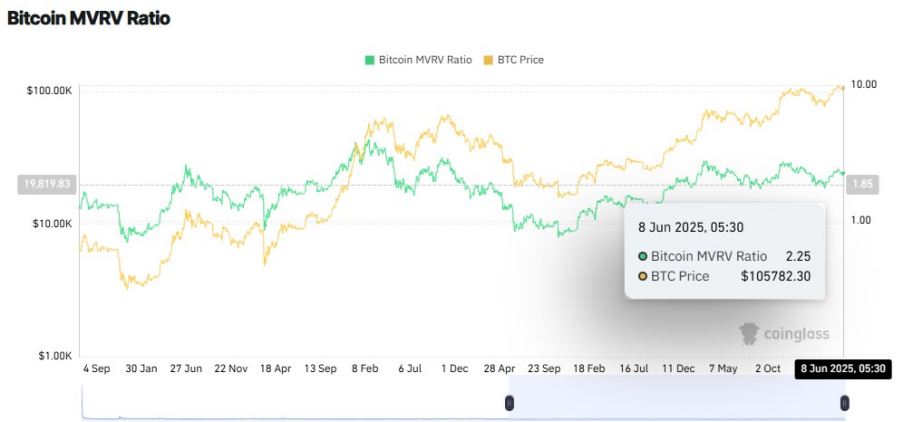

MVRV and Funding Rates

MVRV (Market Value vs. Realized Value) Ratio is an on-chain metric that helps identify if Bitcoin is overvalued or undervalued during market cycles, indicating potential price tops and bottoms for BTC/USD. The latest chart from the CoinGlass shows the MVRV Ratio at 2.25, above 1.00, indicating BTC/USD is slightly overvalued. It’s worth noting that the ratio is still lower than November 2024, suggesting underlying BTC price strength.

Source: CoinGlass.com

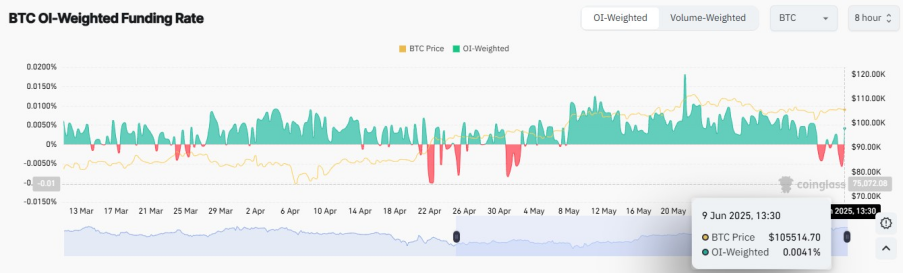

Moving forward, the rise in the Open Interest (OI) weighted funding rate suggests that traders are increasingly willing to pay to maintain long positions.

According to CoinGlass data, the latest OI-weighted funding rate stands at 0.0041%, after fluctuating and briefly turning negative in recent days. Notably, this rate remained positive throughout May, reinforcing the bullish outlook for BTC/USD.

Source: CoinGlass.com

Technical Analysis

Bitcoin (BTC/USD) extends the previous week’s rebound from the 50-day Simple Moving Average (SMA) backed by the 14-day Relative Strength Index (RSI) hovering above the neutral 50.0 level and a looming bullish cross from the Moving Average Convergence and Divergence (MACD) indicator—together suggesting further recovery in BTC price.

BTC/USD: Daily Chart Signals Further Recovery

Source: Tradingview

With BTC/USD recently rebounding from the 50-day Simple Moving Average (SMA), supported by a strengthening RSI and a potential bullish MACD crossover, the pair appears poised to challenge the immediate resistance at the 21-day SMA, located near $106,600 on a daily closing basis.

A successful breakout above this level could encourage buyers to target a new all-time high (ATH), with the next key resistance being a six-month-old trendline near $112,600. If momentum continues beyond this point, attention would shift to the support-turned-resistance line from April, currently around $117,200.

On the downside, sellers may remain cautious as long as BTC/USD holds above the 50-day SMA at $101,900. A break below this support would expose the monthly low around $100,000, followed by May’s bottom near $93,300.

Conclusion

In conclusion, Bitcoin’s outlook remains cautiously optimistic as several supportive factors work to counterbalance ongoing risks. Retail accumulation has intensified, with wallets holding up to 1 BTC adding nearly 33,000 BTC since May 22, reflecting growing participation from individual traders.

At the same time, a consistently positive OI-weighted funding rate throughout May signals traders’ willingness to maintain long positions, further supporting bullish sentiment.

Meanwhile, broader market optimism fueled by improving US-China trade prospects and MicroStrategy’s ongoing BTC purchases continues to underpin sentiment, even as ETF outflows, weak network profits, and uncertain macro factors like inflation and geopolitical tensions pose downside risks. If selling pressure remains subdued and on-chain signals stabilize, Bitcoin could be poised for a renewed upward trajectory toward a fresh ATH.