- Bitcoin gains ground, reverses weekly loss despite geopolitical jitters and mixed on-chain signals.

- BTC shows stronger ties to equities than gold, hinting at a sharper rebound if tensions ease, Fed stays dovish

- ETF inflows, whale addresses rise while wallet flows signal holding pattern but MVRV ratio, Fear & Greed Index challenge BTC/USD bulls.

- Sustained trading above the 50-day SMA, ETF inflows, and whale activity signal another attempt to break key resistance.

Bitcoin (BTC/USD) stays on the front foot, rising over 1.0% intraday to $107,000 during Monday’s European session. In doing so, the crypto leader shrugs off broader market gloom and mixed on-chain signals while reversing last week’s losses. Still, traders remain cautious ahead of Wednesday’s FOMC policy decision, the ongoing Israel-Iran conflict, and key industry developments that could support prices.

Last week, tensions between Israel and Iran intensified after Jerusalem launched pre-emptive strikes on Tehran’s nuclear sites, rattling global sentiment. This sparked demand for traditional safe-haven assets like the U.S. Dollar, Japanese Yen (JPY), Swiss Franc (CHF), and Gold (XAU/USD), while putting pressure on riskier assets, including equities and cryptocurrencies.

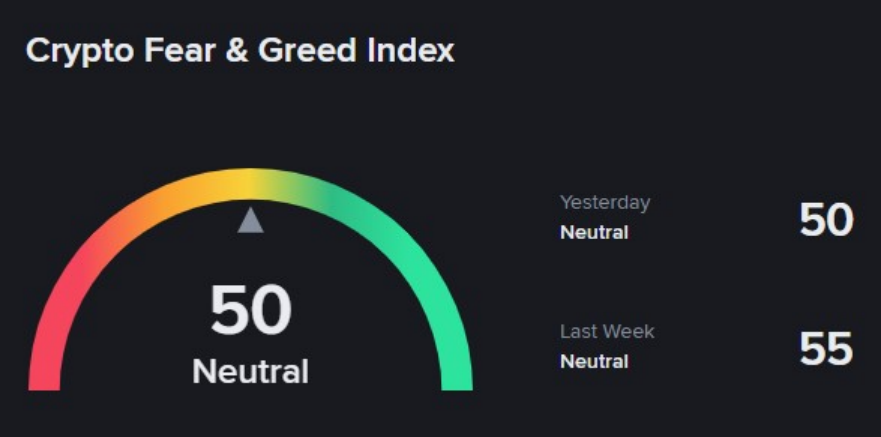

As a result, BTC/USD faced headwinds, despite rising spot Bitcoin ETF inflows and wallet outflows suggesting a holding pattern. Bitcoin’s rebound may be partly driven by news of Coinbase’s partnership with American Express to launch the “Coinbase One Card,” offering users up to 4% back in BTC—a major step toward mainstream crypto adoption. Still, the ‘Neutral’ reading on the Fear & Greed Index contrasts with Bitcoin’s sustained position above the 50-day SMA, testing the confidence of crypto buyers.

Crypto Fear & Greed Index

Despite recent BTC/USD price gains, Binance’s “Fear & Greed Index” remains ‘Neutral,’ unchanged from the previous day and last week. This reflects trader indecision and a lack of strong bullish confidence in Bitcoin.

Source: Binance

BTC racks Stocks Over Gold

It’s worth noting that easing tensions between Trump and Musk over the “Big, Beautiful Bill,” along with improving U.S.-China trade prospects, support cautioU.S. market optimism despite negative headlines from the Middle East. Optimism around trade deals ahead of the upcoming G7 meeting in Canada adds to this positive sentiment, helping Bitcoin align more closely with equities than gold.

This was reflected last week as both the S&P 500 (SPX) and BTC/USD posted mild weekly losses, while gold surged, marking its biggest weekly gain in four weeks due to its safe-haven appeal. This suggests Bitcoin’s connection with gold is fading, while its stronger ties to equities could offer buyers optimism when share prices rally on easing geopolitical and trade tensions—fueled by rising ETF inflows and whale activity.

Additionally, a likely dovish pause by the U.S. Federal Reserve at this week’s policy meeting could further support BTC/USD bulls.

Source: TradingView

ETF Inflows

Although Bitcoin price showed a weekly loss, spot BTC ETFs recorded their first weekly gain in three weeks and a recent four-day winning streak, indicating growing buyer optimism for BTC/USD. According to the latest SoSoValue data, total BTC spot ETF net inflows reached $1.07 billion last week.

Source: SoSoValue.com

On-Chain Metrics

Even if mixed sentiment weighed on BTC/USD prices last week before the recent rebound fueled by industry optimism, mixed on-chain signals keep traders cautious ahead of this week’s major events, including the FOMC meeting and the G7 summit in Canada.

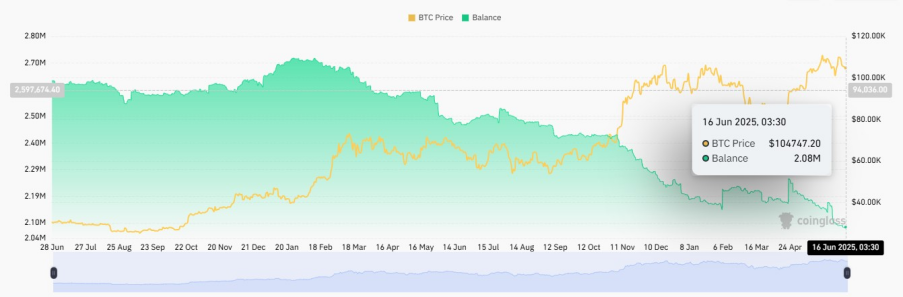

Bitcoin Balance on Exchanges

A CoinGlass chart shows that Bitcoin exchange balance marks historical low even as prices dropped the last week—signaling reduced supply and strong investor holding, which points to a bullish bias for BTC/USD. Latest data shows total exchange balances at 2.08 million coins.

Source: CoinGlass.com

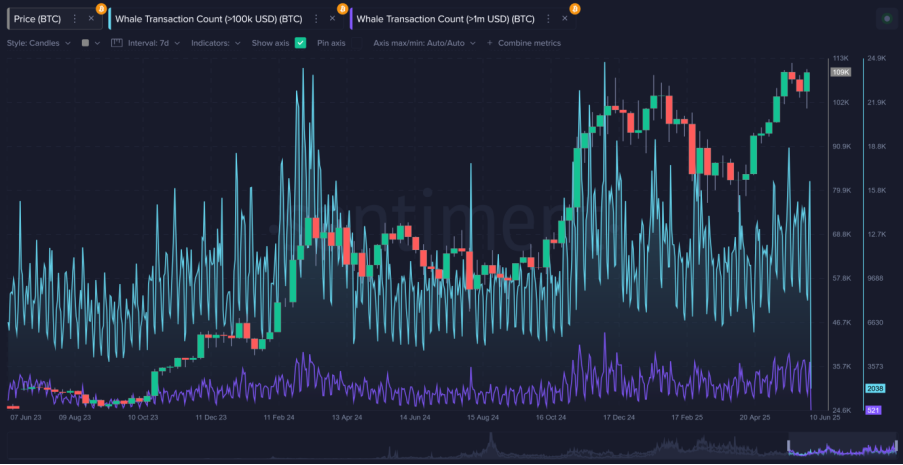

BTC Wallet Data: Retail traders track whales

According to Santiment’s latest Bitcoin wallet data, transactions from the holders of $100K and $1.0 million USD BTC, generally known as the whales, have deteriorated of late. Generally, it is considered a sign of big player’s exhaustion and a cap in the asset price but there are caveats to it that needs to be addressed. It should be noted that the Santiment also cited an approximately 37,400 BTC offloading from whales since June 3.

Source: Santiment.com

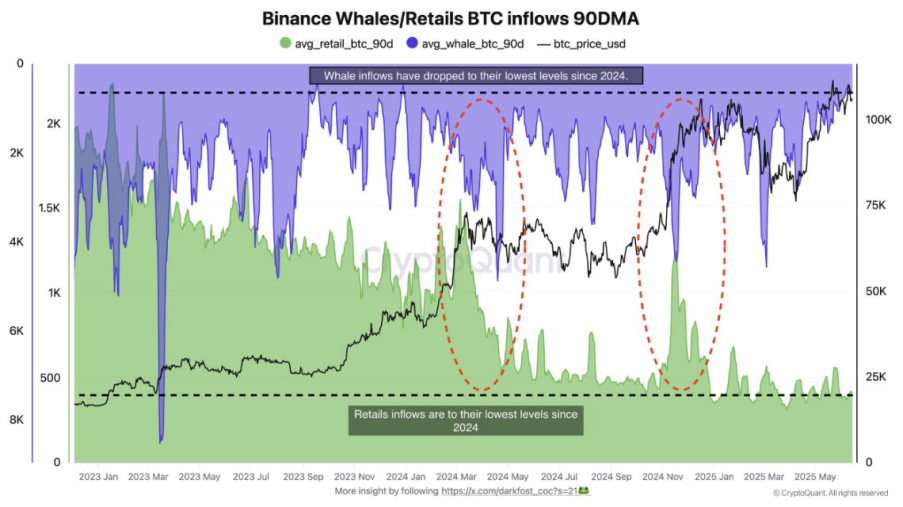

On a different page, a chart from cryptoquant showing 90-Day Moving Average (DMA) of whale versus retail inflows on Binance shows that both the key players have been inactive of late, citing the cautious market mood and a likely pullback in the prices in case of major negatives. That said, the chart mentioned the lowest inflows from whales and retail since 2024.

Source: Cryptoquant.com

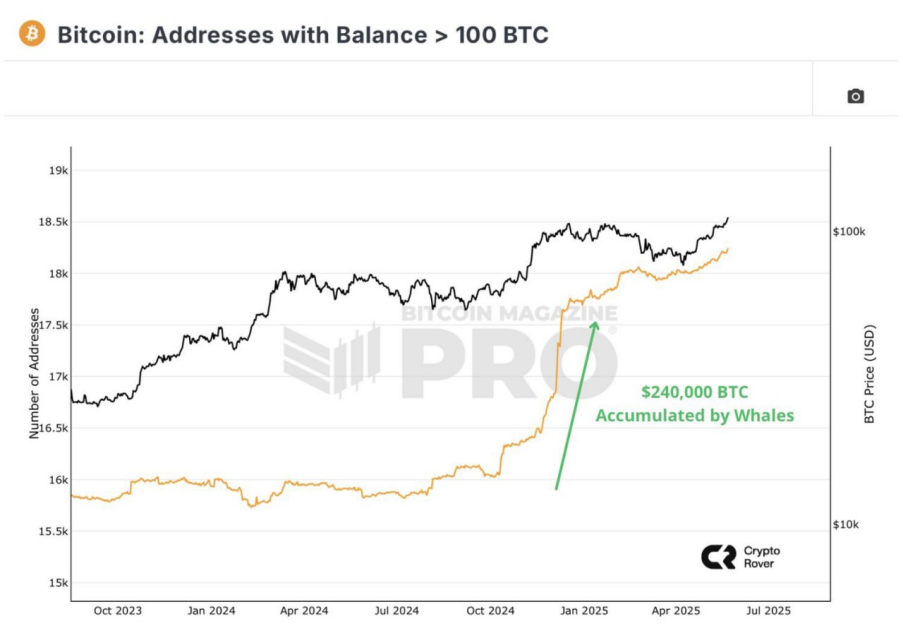

Meanwhile, a CryptoRover chart shows a steady rise in whale addresses following the year-start accumulation of 240,000 BTC, indicating growing bullish sentiment toward Bitcoin (BTC/USD).

Wallet Inflow/Outflow

The latest Bitcoin Wallet Inflow/Outflow chart from the CoinGlass shows the outflows have increased of late, suggesting holding pattern among the investors and a bullish bias for the BTC/USD pair.

Source: CoinGlass.com

MVRV and Funding Rates

Moving toward more on-chain signals, the MVRV (Market Value vs. Realized Value) Ratio is an on-chain metric that helps identify if Bitcoin is overvalued or undervalued during market cycles, indicating potential price tops and bottoms for BTC/USD. The latest chart from the CoinGlass shows the MVRV Ratio at 2.24, above 1.00, indicating BTC/USD is slightly overvalued. It’s worth noting that the ratio is still lower than November 2024, suggesting underlying BTC price strength.

Source: CoinGlass.com

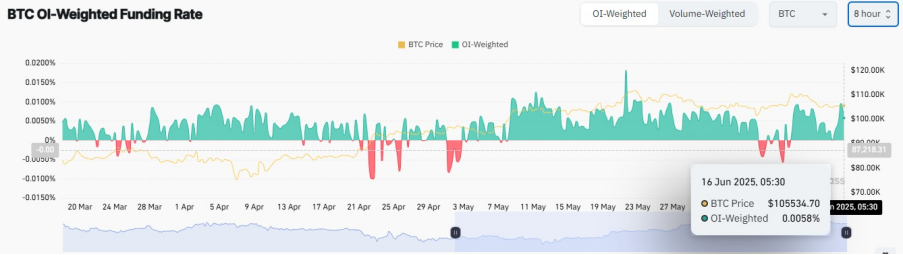

Moving forward, the rise in the Open Interest (OI) weighted funding rate suggests that traders are increasingly willing to pay to maintain long positions. According to CoinGlass data, the latest OI-weighted funding rate stands at 0.0058%, after fluctuating and briefly turning negative earlier in the last week. Notably, this rate remained positive throughout May and has been firmer since June 09, reinforcing the bullish outlook for BTC/USD.

Source: CoinGlass.com

Technical Analysis

Bitcoin (BTC/USD) repeats the previous week’s rebound from the 50-day Simple Moving Average (SMA) backed by the 14-day Relative Strength Index (RSI) hovering above the neutral 50.0 level and a looming bullish cross from the Moving Average Convergence and Divergence (MACD) indicator—together suggesting further recovery in BTC price.

BTC/USD: Daily chart signals another run towards key resistance

Source: Tradingview

With BTC/USD recently rebounding from the 50-day Simple Moving Average (SMA), supported by a strengthening RSI and a potential bullish MACD crossover, the pair appears poised to challenge the immediate resistance at a three-week-old horizontal resistance line, located near $111,000 on a daily closing basis.

A successful breakout above this level could encourage buyers to target a new all-time high (ATH), with the next key resistance being a six-month-old trendline near $112,700. This could help the Bitcoin buyers to aim for the $120K and materialized the $150K market chatters for the year.

On the downside, sellers may remain cautious as long as BTC/USD holds above the 50-day SMA at $103,900. A break below this support would expose the seven-week-old support line surrounding $102,600 and monthly low around $100,000, followed by May’s bottom near $93,300.

Conclusion

In conclusion, Bitcoin buyers seem poised to maintain control as the crypto benefits from sustained ETF inflows, increasing whale activity, and positive industry developments like Coinbase’s partnership with American Express.

Despite lingering trader caution reflected in the neutral Fear & Greed Index and mixed on-chain signals, BTC’s stronger alignment with equities over gold suggests it could benefit from easing geopolitical tensions and improving US-China trade prospects.

However, Bitcoin faces key technical resistance levels that may cause short-term pullbacks, especially given the absence of major new catalysts from the Trump administration and ongoing global uncertainties. The upcoming FOMC meeting and G7 summit remain critical events that could significantly influence BTC/USD’s near-term trajectory.