Key Takeaways

- Cardano (ADA) price action hints at an 11% uptick on the horizon.

- Santiment data reveals that crypto whales have added 120 million ADA tokens.

- Coinglass data shows that traders betting on long positions are dominating.

Bullish sentiment around Cardano (ADA) is heating up as price action turns positive, market sentiment shifts, and interest from whales and experts rises. The token has started moving upward, signaling a potential massive price surge on the horizon.

Cardano (ADA) Price and Current Market Sentiment

Over the past 24 hours, the overall crypto market sentiment has shifted, with major assets including Bitcoin (BTC) and Ethereum (ETH) soaring 2% and 2.10%, respectively. Amid this recovery, ADA climbed 2.55% during the same period and is currently trading near the $0.8762 level.

However, market participants have shown less interest in the asset, as a result, ADA’s 24-hour trading volume slipped by 35% compared to the previous day. This decline in trading volume is gradually recovering, suggesting that interest is slowly rising, as indicated by recent whale accumulation.

Whales Accumulation and Buy Signal

Today, on-chain analytics platform Santiment revealed whale accumulation. According to the data, crypto whales have added 120 million ADA tokens. This massive accumulation was recorded at a key support level, suggesting that a quick recovery may be on the horizon. In addition, a crypto expert noted that the TD Sequential technical indicator is flashing a buy signal for ADA.

Cardano (ADA) Technical Outlook and Upcoming Levels

According to TimesCrypto’s technical analysis, ADA appears bullish and is poised for a price uptick. On the daily chart, the asset seems to be forming an ascending triangle pattern, and with the recent price dip, ADA has tested the lower boundary of the pattern, which has a history of price reversals.

Historically, ADA has reached this ascending triangle support more than five times, and each time it has recorded an impressive price uptick.

Based on the current price action, if ADA holds this trendline support, there is a strong possibility the asset could see a price surge of over 10% and reach the neckline at $0.963. If a breakout occurs, another 25% rally could be possible, pushing ADA’s price toward the $1.21 level.

At press time, the asset’s 50 Exponential Moving Average (EMA) appears to be providing support, holding the price above a key level and preventing further downside.

Meanwhile, with buying pressure, ADA’s Relative Strength Index (RSI) is moving toward the overbought territory and currently stands at 53. This indicates that the asset has enough room to continue its price uptick until it reaches key resistance levels.

Traders’ Eyes on Long Positions

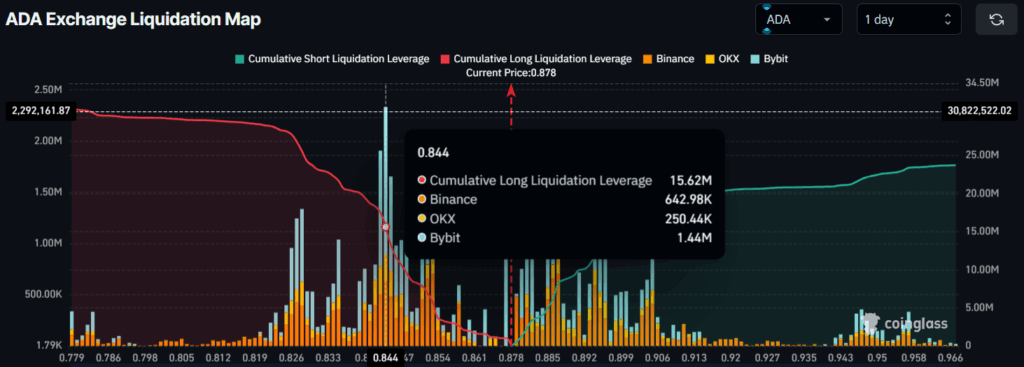

As of writing, ADA’s major liquidation levels stand at $0.844 on the lower side and $0.887 on the upper side, where traders are over-leveraged, according to on-chain analytics platform Coinglass.

Data further reveals that traders at these levels have built $15.62 million worth of long positions and $8.23 million worth of short positions.

This indicates that the current market sentiment is bullish, and $8.23 million worth of short positions could be liquidated if the asset’s price crosses the $0.887 mark.