- Cardano snaps two-day winning streak, trims weekly gains amid 30% YoY loss.

- Failure to cross 21-day EMA joins mixed on-chain signals to drag ADA price.

- ETF hype, profitable supply & funding rates lift ADA sentiment despite cooler whale metrics, MDIA and MVRV numbers.

- ADA/USD faces a key test as US holiday dampens activity, though sentiment still challenges the bears.

Cardano (ADA/USD) slips to $0.5820 in Friday’s European session, snapping a two-day rally. Mixed on-chain signals and US holiday jitters weigh on sentiment, but bullish ETF buzz, market optimism, and a supportive chart setup hint at a possible rebound from ADA’s 31% drop in 2025.

On-chain signals test ADA bulls

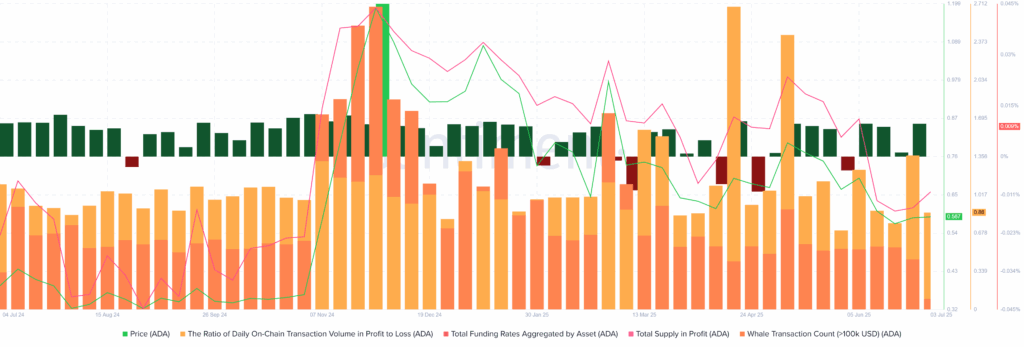

Cardano’s bullish momentum has cooled this week after posting its first weekly gain in seven. A mix of on-chain signals is at play—on the bullish side, total supply in profit, the ratio of on-chain transaction volume in profit to loss, whale transactions and positive funding rates are keeping buyers optimistic. However, a lower Market Value to Realised Value (MVRV) Z Score, and a rise in Mean Dollar Invested Age (MDIA) are adding pressure and fueling ADA’s latest retreat.

The ADA Supporters

As per the latest data from Santiment, Cardano’s Total Supply in Profit increased for the second consecutive week, reaching $18.16 billion after bottoming out in mid-June. Similarly, the Ratio of Daily On-Chain Transaction Volume in Profit to Loss jumped to a two-month high on a weekly basis by July 2. Furthermore, Total Funding Rates Aggregated by Asset rose to a three-week peak while Whale Transaction Count (>100K USD, ADA) eased for the third consecutive week, suggesting a holding pattern among the whales and bullish outlook for the ADA/USD.

These catalysts together signal more profitable traders, stronger positive volume, and positive funding rates—boosting optimism for the ADA/USD price.

Source: Santiment

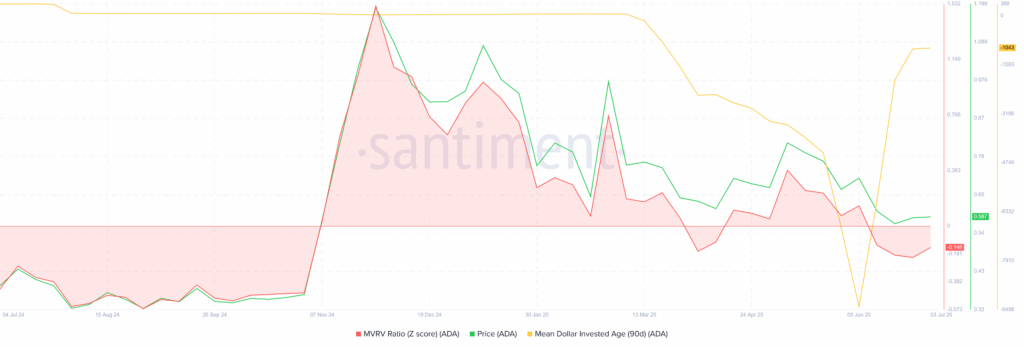

The Challengers

The Market Value to Realised Value (MVRV) Z Score is mildly negative at -0.1458 as of press time, indicating some bearish exhaustion among traders. However, the score isn’t deeply negative, so it doesn’t signal an immediate recovery. Additionally, the Mean Dollar Invested Age (MDIA) is improving, suggesting a shorter shelf life for the ADA/USD pair. This points to less bullish sentiment and favors profit-booking whenever prices rise.

Source: Santiment

ETF odds, market optimism favor ADA/USD optimists

Odds for a Cardano Spot ETF gaining approval in 2025 jumped to 86% on Polymarket as of July 3, before easing slightly to 83%—a clear sign of growing market confidence in ADA.

However, the US Securities and Exchange Commission (SEC) has sent mixed signals regarding ETF approvals, especially for Grayscale’s application. While the SEC approved the ETF conversion of the Grayscale Digital Large Cap Fund (GDLC) on an accelerated basis, Bloomberg ETF analyst James Seyffart noted a key attachment indicating the approval is stayed—or paused—”until the Commission orders otherwise.” This means that even if technically approved, trading of the ETF (which includes Solana (SOL), Ripple (XRP), Cardano (ADA), Bitcoin (BTC), and Ethereum (ETH)) remains on hold.

Beyond crypto-specific catalysts, broader market sentiment stayed upbeat. Progress in US-China trade talks, a strong US jobs report on Thursday, and the White House’s optimistic outlook for growth versus deficit concerns all helped maintain risk appetite ahead of Friday’s US holiday. Meanwhile, the announcement of a “crypto week” and plans to pass three major crypto reforms further lifted sentiment among digital asset traders.

Technical Analysis

Cardano (ADA/USD) retreats from the 21-day Exponential Moving Average (EMA) but stays well past the $0.5100 key support amid bullish signals from the 14-day Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), suggesting gradual recovery ahead.

ADA/USD: Daily Chart Suggest Gradual Rebound

Source: Tradingview

Cardano’s (ADA) retreat from the 21-day EMA isn’t a major concern unless it breaks the weekly low around $0.5368. In that case, the key support zone is around $0.5100, which has stopped the bears since late 2024. A break below this level could drag ADA/USD down to the mid-2024 high near $0.4560, with $0.5000 acting as a potential intermediate halt.

On the flip side, a daily close above the 21-day EMA at $0.5932 could set the stage for a challenge at the 50-day EMA and a four-month-old descending resistance line near $0.6350. The 200-day EMA at $0.6903 would then act as a major upside barrier, and a break above this level could propel ADA toward May’s peak around $0.8630.

Overall, the technical setup is slightly bullish, but ADA buyers face multiple resistance levels before regaining control.

Conclusion

Despite a recent pullback, Cardano’s technical and on-chain signals suggest a potential rebound if key support levels hold. Positive factors like rising ETF approval odds, increased supply in profit, and bullish funding rates keep buyers hopeful. However, ADA faces multiple resistance levels ahead, and its short-term outlook remains cautious until these hurdles are cleared.