A broader crypto weekly play was sideways, as major coins traded mixed despite a dovish bias surrounding the U.S. Federal Reserve (Fed), possibly due to mixed on-chain clues and institutional demand.

The crypto market’s confidence dwindled even as the U.S. inflation numbers and dovish Fed commentary bolstered concerns about the Federal Open Market Committee (FOMC) rate cut. The Bank of England’s (BoE) interest rate reduction and the dovish commentary from the European Central Bank should have favored crypto buyers.

However, a firmer U.S. dollar, outflows from the spot Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Fund (ETF), and the Bank of Japan’s (BoJ) rate hike might have played their role to tame the cryptocurrency buyers ahead of the holiday season.

Against this backdrop, Bitcoin (BTC) posts modest gains, while Ethereum (ETH) and Ripple (XRP) are both down nearly 3.0%. Meanwhile, the gold price (XAU/USD) posted a weekly gain, the U.S. equities ended the week with meager gains, and the U.S. Dollar Index (DXY) snapped a three-week downtrend.

Bitcoin Dribbles: Bitcoin (BTC) remains sidelined around $88,500 by press time, up 0.20% on the week, even as the digital asset looks almost set to face its first yearly loss in three.

Ethereum Snaps Three-Week Uptrend: Ethereum (ETH) posts its first weekly loss in four, down 2.70% on the week, around $2,980 at the time of writing.

Ripple Drops for Third Straight Week: Ripple (XRP) posts its third consecutive weekly loss, despite lacking downside momentum, as sellers face a 3.00% downside for the week, closing near $1.95 as we write.

The Weekly Moves

Key Macro Catalysts

Looking at the week’s major catalysts, the lowest U.S. inflation since 2021 and mixed statements from the Fed officials suggested the U.S. central bank’s further rate cuts in 2026. The dovish Fed bias, however, couldn’t weigh on the U.S. dollar, maybe because of the dovish actions from the BoE and the ECB, as well as the market’s discomfort with the BoJ’s rate hike. Apart from the U.S. dollar, the gold price also benefited from the market’s uncertainty. The U.S. equities ended the week mostly flat, heading into the year-end holiday season, even as the momentum was sluggish.

The following are some of last week’s key data/news:

The headline U.S. inflation gauge, namely the Consumer Price Index (CPI), for November hit a three-month low of 2.7% on a year-over-year (YoY) basis, versus 3.1% expected and 3.0% prior. That said, the CPI ex Food & Energy, also known as the Core CPI, slumped to the lowest level since April 2021, while posting a 2.6% YoY figure compared to the market estimation and prior release of 3.0%.

Meanwhile, the U.S. weekly Initial Jobless Claims eased to 224K from 237K (revised), versus 225K expected, while the Philadelphia Fed Manufacturing Index for December dropped to -10.7, compared to 3.0 expected and the previous monthly release of -1.7.

The New York Empire State Manufacturing Index for December hit a three-month low of -3.9 versus 10.9 market forecasts and 18.7 prior.

U.S. ADP Employment Change 4-Week Average rose to 16.25K from 4.75K.

Average hourly earnings for October improved month-over-month (MoM) to 0.4% from 0.2%, but eased on a year-over-year (YoY) basis to 3.7% from 3.8%. However, the November figures eased to 0.1% MoM and to 3.5% YoY.

Nonfarm Payrolls (NFP) for October slumped from 108K to -105K, while improving to 64K in November, compared to 50K expected.

The unemployment rate for November hit its highest level since November 2021 by rising to 4.6% versus 4.5% expected and 4.4% prior.

Meanwhile, the retail sales growth for October stalled at 0.0% MoM compared to 0.1% market forecasts and prior (revised), while the YoY growth eased to 3.5% from 4.2%.

Furthermore, the preliminary readings of the U.S. S&P Global Manufacturing PMI eased to 51.8 compared to the market forecasts of 52.0 and 52.2 prior, while the S&P Global Services PMI slid to 52.9 versus 54.1 expected and prior. With this, the S&P Global Composite PMI came in at 53.0, from 54.2 prior.

Following the mostly downbeat U.S. data, White House Economic Advisor Kevin Hassett, the frontrunner for the next Federal Reserve (Fed) Chairman position, said that there is plenty of room to cut rates.

Federal Reserve Governor Stephen Miran said that the prices are once again stable, while also adding that the Fed policy should reflect that.

Federal Reserve (Fed) Governor Christopher Waller said, “The jobs market is very soft,” while adding that current payroll growth is not positive. That said, Waller’s comments might have taken clues from Tuesday’s downbeat employment data.

New York Fed President John C. Williams said that the Fed policy is ‘mildly restrictive,’ while adding that it has some room to get back to neutral. Williams is a permanent voter of the Federal Open Market Committee (FOMC) and surprised markets by supporting the December rate cut. His latest comments are also slightly dovish and hence tested the U.S. dollar buyers.

As per the latest interest rate futures data, the market players are betting big on the U.S. Federal Reserve (Fed) rate cuts in 2026, making it the most dovish central bank among the top-tier ones. That said, the Chicago Mercantile Exchange’s (CME) Interest Rate Futures, the Fed is likely to offer 0.65% of rate cuts in 2026.

Elsewhere, the European Central Bank (ECB) matched market forecasts of keeping the current monetary policy unchanged, while the Bank of England (BoE) proved the analysts right by cutting the benchmark rate by 0.25%. Furthermore, the Bank of Japan (BoJ) raised the benchmark interest rate by 0.25%, matching market forecasts, to mark the highest rates in 30 years. Following the decision, the 10-year Japanese Government Bond (JGB) yields hit the highest level since May 2006. Notably, dovish actions and clues from the BoE and the ECB should have favored crypto buyers because they suggest increased market liquidity; however, the BoJ’s rate hike, which challenges market liquidity, may have dampened optimism in the crypto market.

On the geopolitical front, Ukrainian President Volodymyr Zelenskiy signaled readiness to drop the nation’s bid for the North Atlantic Treaty Organization (NATO), following long talks with the U.S. envoys, including Steve Witkoff and Jared Kushner. This becomes a positive point for the Ukraine-Russia peace deal and might have added to the market’s slight optimism.

U.S. President Donald Trump raised optimism surrounding the Ukraine-Russia peace deal by suggesting the closest proximity to the ceasefire talks. Trump also said that he has positive discussions with European leaders, Ukrainian President Volodymyr Zelenskyy, and Russian President Vladimir Putin.

Trump also raised geopolitical fears by ordering a blockade of sanctioned Venezuelan oil tankers while calling the nation “a foreign terrorist organization.”

Crypto Market News

In the crypto universe, Bitcoin (BTC) remained mildly bid, but Ripple (XRP) and Ethereum (ETH) posted a weekly loss. That said, Bittensor (TAO) slumped over 18% to grab the bear’s attention, while Monero (XMR) bucked the downtrend with nearly 10% weekly gains.

Meanwhile, the crypto market capitalization (market cap) dropped 2.61% to $2.99 trillion, whereas the Bitcoin Dominance improved to 59.0% from 58.8% during the last week.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our Coin Bytes.

The Doha Bank utilized the Distributed Ledger Technology (DLT) to list $150 million worth of Digitally Native Notes (DNN), the digital bonds, on the London Stock Exchange’s (LSE) International Securities Market.

Read More: Doha Bank Lists $150M Digital Bonds on London Stock Exchange Using DLT

U.S. President Donald Trump’s family-backed American Bitcoin Corporation boosted its total Bitcoin (BTC) holdings to 5,044 by adding 261 BTC, per the Bitcoin Treasury.

Japan’s SBI Holdings collaborated with blockchain firm Startale Group, co-developer of the Soneium blockchain, to develop a regulated yen-denominated stablecoin for use in Japan and overseas.

Read Details: Japanese Giant SBI Taps Startale to Build Regulated Yen-backed Stablecoin

Abu Dhabi Projects and Infrastructure Centre (ADPIC) signed two new cooperation agreements with China during the Abu Dhabi Infrastructure Summit (ADIS) International Roadshow in Shanghai. The agreements were concluded with “Q Home” and “3Enovator Technology,” two Chinese firms specializing in next-generation construction and smart-city innovation.

Also Read: Abu Dhabi Taps Q Home and 3Enovator to Bring AI-Powered Smart Cities to Life

The United States Financial Stability Oversight Council (FSOC) stated in its 2025 annual report that it has softened its stance on crypto assets and stablecoins, no longer viewing them as an imminent systemic danger.

The Bank of Canada (BoC) conveyed details of its planned stablecoin laws, due in 2026, while suggesting approval only for high-quality stablecoins related to central bank currencies, ensuring that stablecoins function as “good money.”

A U.S. securities clearing and settlement firm, Depository Trust and Clearing Corporation (DTCC), announced the tokenization of some U.S. Treasury securities held at its Depository Trust Company unit on the Canton Network. The digitalization of the core financial assets will start in 2026 and aims for an initial minimum viable product (MVP) in a controlled production setting during the first half of the year.

More Details: DTCC to Tokenize U.S. Treasuries on Canton Network After SEC Nod

China’s fresh crackdown on illegal crypto mining in Xinjiang caused 400,000 mining machines to turn offline, resulting in an 8–10% decrease in Bitcoin’s network hashrate. Notably, the Asian major’s new laws forced miners to sell at a record-low hash price.

A business venture of U.S. President Donald Trump’s family, World Liberty Financial (WLFI), proposed investing 5% of the project’s treasury to promote the USD1 stablecoin supplies through strategic partnerships and ecosystem incentives.

Furthermore, the U.S. Federal Reserve (Fed) defied a 2023 guidance that restricted how Fed-supervised banks, including uninsured ones, dealt with cryptocurrency. The 2023 guidance required uninsured banks to follow the same standards as federally insured institutions, based on the premise that similar activities pose similar risks and should be subject to the same regulation.

The latest report from a research platform, Chainalysis, signaled that more than $3.4 billion in cryptocurrency was stolen globally so far during 2025. Out of the heavy figure, a single compromise at the trading platform Bybit in February accounted for around $1.5 billion and gained the market’s attention. Additionally, North Korean cyber operators drained about $2.02 billion in digital assets in 2025, a rise of roughly 51% from the previous year, making it the most lucrative period yet for the Korean groups.

Read More: Crypto Thieves Have Stolen Over $3.4 Billion So Far in 2025, Chainalysis Says

A blockchain linked to messaging app Telegram, The Open Network (TON), allows access to tokenized US shares through a new product called xStocks. The official statement mentioned that users of TON Wallet, Tonkeeper, and MyTONWallet can now buy and sell tokens that mirror shares in companies such as Apple, Tesla, and Microsoft directly inside their existing wallets, without opening a separate brokerage account or switching to a different trading platform.

Also Read: TON Brings US Stocks Into Telegram-linked Wallets with xStocks Launch

Elsewhere, Coinbase sues regulators in Connecticut, Illinois, and Michigan to secure federal protection for its planned prediction markets. The firm’s lawsuit caused a new debate over whether event contracts are financial or gambling.

Bitcoin Dribbles, Equities Trade Mixed, But Gold Edges Higher

Bitcoin (BTC) remained lackluster, posting mild gains, as crypto market sentiment dwindles amid mixed clues and the year-end inaction, despite dovish Fed clues.

Meanwhile, major U.S. equity indices traded mixed with the Dow Jones Industrial Average (DJI) falling 0.67% on the week, while the S&P 500 (SPX) posted mild weekly gains of 0.10%, and the Nasdaq Composite (NQ100) rose 0.74% on the week. Notably, SPX is up over 16% for the year.

Elsewhere, the spot Gold (XAU/USD) rose 0.92% on the week, up for the second consecutive week, before ending a positive performance around $4,340. It’s worth observing that Gold faces a stellar 65% jump for 2025 and lured the bull’s attention.

This raises doubts about Bitcoin’s historical linear relationship with equities and Gold, favoring concerns of a probable recovery in the BTC price once the U.S. equities and Gold extend their broad bullish trend.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the recent doubts about the previous linear relations between Bitcoin, Gold, and the U.S. equities, BTC traders should remain cautious while blindly following the price action of such assets.

BTC ETF and On-Chain Data Flash Mixed Signals

Bitcoin’s (BTC) latest inaction could be tied to a slew of mixed signals from the ETF, news, and on-chain sources.

That said, the buzz surrounding Bitcoin’s return to the exchanges and mixed performance of whales, wallets holding more than 10,000 BTC, as well as the ETF outflows, could be linked to BTC’s latest mixed play.

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a four-day outflow pattern last week. That said, Friday’s softer daily outflows of $158.25 million could portray a grim picture of the institutional interest.

With this, the spot BTC ETFs faced the biggest weekly outflow in five weeks, worth $497.05 million by the end of Friday.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but there were inflows in September and October, whereas the November Outflows have been $3.48 billion by press time, the biggest since February. Meanwhile, December faces a modest outflow of $298.22 million.

With a noticeable magnitude of the ETF outflow for the week, as well as the previous heavy monthly outflows, the BTC optimists should remain cautious going forward.

Meanwhile, Santiment cites a spike in the whale transactions, but a mixed play of actions from the second-tier large holders. Transactions worth $1 million or more recently hit a four-week high of 4,394 transactions on December 17, suggesting some very large players made moves. However, transactions in the $100k+ range have been declining, per the on-chain data provider.

Also important to watch was the flow of Bitcoin back to exchanges, which is generally considered negative for the crypto price. Santiment said, “Over the past 10 days, a net total of over 17,700 BTC has moved onto exchange wallets.”

On the flip side, a $2.65 billion BTC options expiry also troubled the crypto traders with mild signals. Notably, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $88,000, close to the late Friday’s trading price. Meanwhile, put options (the right to sell) accounted for 44% of the total market share and demonstrated a slight improvement in the market confidence.

Technical Analysis Teases Bitcoin Sellers

On a technical side, the Bitcoin price rebound during the late week lacks credence as the crypto major is yet to defy the previous breakdown of a month-old support line, now immediate resistance. The bearish breakdown also joins bearish signals from the 14-day Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) momentum indicators to lure sellers.

Bitcoin Price: Daily Chart Keeps Sellers Hopeful

Even if the Bitcoin price bounces off the 78.6% Fibonacci retracement level of its April-October rise, Monday’s clear downside break of a month-old ascending support line, now immediate resistance near $89K, keeps BTC sellers optimistic.

Also keeping the crypto bears in play is November’s first “Death Cross” since January 2022, a bearish moving average crossover wherein the 50-day Exponential Moving Average (EMA) crosses the 200-day EMA from above. On the same line, the mid-November downside break of horizontal support from May adds strength to the bearish outlook surrounding the Bitcoin price.

Looking at the momentum indicators, the RSI grinds near the 50.00 neutral threshold, despite being softer of late, while the MACD flashes bearish signals (red histograms).

Against this backdrop, BTC rebound remains elusive as long as it stays below the $90.0K support-turned-resistance.

Beyond that, the 61.8% Fibonacci retracement level around $94,250, also known as the “Golden Fibonacci Ratio,” and the 50-day EMA of $93,970 could test BTC bulls before giving them control.

Above all, Bitcoin buyers may find it challenging to overcome previous support from May and the 200-day EMA, which are close to $98K and $102,255, respectively.

On the flip side, the 78.6% Fibonacci ratio of $85,540 and an ascending trendline from April, close to $84,600, could restrict short-term declines of the Bitcoin price.

Below that, a broad support zone from late March, between $81,500 and $80,500, will act as the final line of defense for BTC buyers, a break of which could direct the Bitcoin price toward April’s yearly low of $74,451.

Ethereum Drifts Lower Despite Whale Accumulation, Upbeat Network Growth

Ethereum (ETH) outplayed Bitcoin, but joined Ripple’s XRP, as it posted a 2.70% weekly fall to $2,980 at the latest.

If we look at the major catalysts, the U.S. spot ETH ETFs faced the outflows, similar to the BTC, but the Ethereum Whales, wallets holding between 1,000 and 1 million ETH, showed accumulation. Meanwhile, Ethereum’s network growth also pushed back against the bearish bias.

ETH ETFs Report Outflows

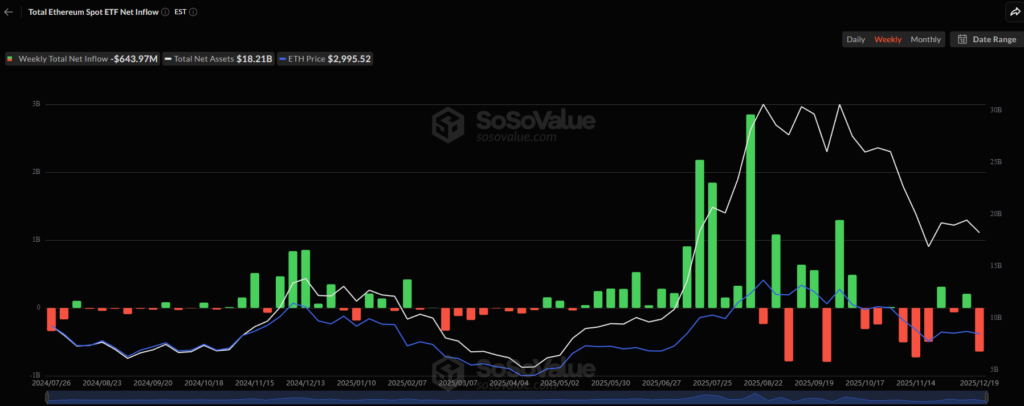

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported the fourth weekly inflow pattern in the last six, reversing the previous weekly inflow, suggesting a weakness in institutional demand.

On December 19, the U.S. Spot ETH ETFs reported its seventh consecutive daily outflow, worth $75.89 million.

As a result, the second-largest coin reversed the previous weekly ETH ETF inflow pattern, with last week’s total outflow of $643.97 million, the biggest weekly outflow in five weeks.

Notably, the monthly figures also remained red after November posted the first monthly outflow since March, as well as the biggest monthly outflow on record, with the $1.42 billion outflow. Meanwhile, December’s outflows have been $500.62 million so far.

ETH Whales Suggests Accumulation, Network Growth Accelerates

Contrary to the downbeat signals from the ETF fund flows, the ETH whale behavior and network data look positive.

Santiment said, “Wallets holding between 1,000 and 1 million ETH have been steadily increasing their balances since mid-November.” The on-chain data provider also mentioned that the smaller retail-sized wallets have been selling, which in turn is generally considered a bullish signal.

Meanwhile, the 50-day average of new addresses being created on the Ethereum network jumped to its highest point of the year, close to 200K. Similar moves were spotted during mid-2025 when the Ethereum price posted a stellar two-month rally to almost double the price.

Technical Analysis Tests ETH Bears

Ethereum’s technical analysis highlights the trader’s dilemma as it defends the five-week-old symmetrical triangle formation. That said, a symmetrical triangle formation suggests consolidation in the Ethereum price, despite the latest rebound, amid the year-end holiday mood.

Still, sluggish trading volume, sustained trading beneath the 200-day Exponential Moving Average (EMA), and bearish clues from the Directional Movement Index (DMI) momentum indicator keep ETH sellers optimistic.

Meanwhile, an ascending support line from late June acts as an additional downside filter for the Ethereum price watchers to follow, apart from the symmetrical triangle’s support.

Ethereum Price: Daily Chart Portrays Trader’s Confusion

On the daily chart, the Ethereum price keeps recovering from the bottom line of a five-week symmetrical triangle formation.

However, the quote’s early-month U-turn from the 200-day EMA and a downside break of the 50% Fibonacci retracement of April-August upside, as well as the bearish DMI clues, keep the ETH bears optimistic.

That said, the DMI’s Average Direction Index (ADX, Red) line tops the Downmove (D-, Orange) line to suggest a presence of downside momentum. Additionally, the ADX and the D- are both near the 25.00 neutral threshold and keep the sellers hopeful.

With this, the Ethereum price may not hold the latest recovery as long as the quote stays below the 200-day EMA hurdle of $3,414.

Still, a corrective bounce can aim for the 50% Fibonacci retracement and the aforementioned triangle’s top boundary, near $3,170 and $3,390, respectively.

If ETH rises past $3,414, we cannot rule out the odds of a rally toward the late October swing high around $4,253. That said, the $4,000 threshold may act as an intermediate stop during the potential rise to $4,253.

Alternatively, the stated triangle’s bottom, surrounding $2,830, restricts immediate ETH downside ahead of an ascending support line from June, close to $2,780. Also acting as a downside filter is the 61.8% Fibonacci retracement level, close to $2,750.

Should the Ethereum price remain weak past $2,750, which is more likely considering the aforementioned bearish catalysts, the sellers will be able to cheer meeting the 78.6% Fibonacci ratio of $2,149 and add to the annual loss, currently around 12%.

Ripple Continues to Ignore Institutional Optimism

Ripple (XRP) dropped the most among the major three cryptocurrencies, down over 3.00% on the week to $1.94 as we write, while posting the third consecutive weekly loss. In doing so, the altcoin ignores a sustained institutional interest in the XRP.

Strong inflows into the U.S. Ripple (XRP) spot ETFs failed to favor the XRP buyers. As per the latest SoSoValue data, the U.S. Ripple (XRP) spot ETFs reported a consecutive 25 days of inflow, with the latest daily figures being $13.21 million. Notably, the XRP’s weekly inflows were $82.04 million during a five-week inflow pattern.

Apart from the ETF inflows, wallets holding large quantities of Ripple’s XRP, generally more than 1.0 million, also show a strong accumulation trend for XRP and lure buyers. Such wallets are called ‘whales’ in crypto terms and command significant power in price directions.

As per the latest on-chain signals, 800 million XRP tokens were moved off exchanges in December 2025. Such moves generally suggest that traders are interested in locking the tokens rather than trading, highlighting the bullish bias among the market players.

On the same line is a buzz that the XRP exchange balance dropped 45% in the past two months, and 400 million XRPs are locked in the ETF custody vaults during the said 60-day period. Such moves confirm that XRP traders are more interested in storing the altcoin.

XRP Technical Analysis Lures Sellers

Although growing institutional interest and whale performance keep XRP buyers hopeful, technical analysis suggests further downside in the Ripple price, mainly due to its early-week breakdown of an 11-week-old symmetrical triangle and bearish signals from the Directional Movement Index (DMI) momentum indicator. That said, the symmetrical triangle has portrayed the ripple’s price consolidation since early October amid a bearish undertone.

Ripple Price: Daily Chart Suggests Gradual Weakness

Ripple price moves inside a multi-week symmetrical triangle, backed by downbeat signals from the DMI and moving-average crossover.

That said, the DMI’s Downmove (D-, orange) tops the Average Directional Index (ADX, red) line and the Upmove (D+, blue) lines, with the D- being closer to the 25.00 neutral limit and hence portraying a slightly bearish directional momentum.

Meanwhile, the 100-day Simple Moving Average (SMA) crossed the 200-day SMA from above during late November and portrayed the bearish moving average crossover.

As a result, the XRP sellers are keeping an eye on the February low of $1.77 as an immediate support during the quote’s fresh fall, a break of which could direct the Ripple price toward April’s low of $1.61.

Notably, a downward-sloping trendline from February, near $1.50, appears to be a tough nut to crack for XRP bears afterward.

Alternatively, the Ripple price recovery remains elusive below the previously stated symmetrical triangle’s bottom line, close to $2.00 by press time.

Beyond that, a descending trendline from early October, near $2.08, and a late November swing high near $2.30, could lure XRP bulls.

In a case where the Ripple price remains firmer past $2.30, the 100-day and 200-day SMA levels, respectively near $2.44 and $2.59, will act as the bear’s last line of defences.

Holiday-Shortened Week Ahead

Given the Fed-linked uncertainty and a light calendar due to the Christmas holidays, crypto traders will closely observe the preliminary readings of the U.S. third quarter (Q3) Gross Domestic Product (GDP) for clear directions.

Meanwhile, the People’s Bank of China’s (PBoC) Interest Rate Decision and the U.S. Durable Goods Orders for October, along with the trade/political news, will also try to entertain the momentum traders amid a likely sluggish week.