Cryptocurrency Weekly Summary

- Cryptocurrency weekly performance turned bearish as solid U.S. data and Powell’s remarks weakened Fed rate cut bets, strengthening the U.S. Dollar.

- Bitcoin, Ethereum, and Ripple all dropped as the U.S. Dollar saw its biggest weekly gain in two months.

- Bitcoin’s $22.6 billion options expiry also pressured BTC prices, while ETH sank 10% weekly on track for its first monthly loss in three.

- BTC, ETH spot ETFs faced heavy weekly outflows, while XRP ETF buzz failed to defend bulls.

- Position liquidations also fueled bearish pressure in the crypto market.

- Equities eased, while gold posted a six-week uptrend as the September close approaches.

- U.S. jobs data, government shutdown talks, and China PMI will be key market drivers to watch.

Cryptocurrency Weekly Snapshot

Cryptocurrency markets faced a downbeat week as strong U.S. data and hawkish statements from Federal Reserve (Fed) Chairman Jerome Powell challenged bets on Fed rate cuts and fueled the U.S. Dollar. Adding to the bearish momentum were a major Bitcoin (BTC) options expiry, fears of the U.S. government shutdown, and position liquidations.

That said, Bitcoin (BTC) fell 5.0%, Ethereum (ETH) plunged 10%, and Ripple (XRP) slid 6.0% during the last week. Meanwhile, the U.S. Dollar Index (DXY) posted its biggest weekly jump in two months, despite Friday’s retreat to 98.20.

Bitcoin Lures Bears: Bitcoin (BTC) recorded its biggest weekly loss since early March, with a slight decline of over 5.0% to $109,400 by press time. Despite this, the BTC is still up 1.0% for the month.

Ethereum Plummets: Ethereum (ETH) also faced its steepest weekly drop since early March, falling around 10% on a weekly basis. With this, the second-largest cryptocurrency is on track for its first monthly loss in three years, as bears maintain control near the $4,000 threshold as we write.

Ripple Holds Lower Grounds: Ripple (XRP) fell for the second consecutive week, down over 6.0% to $2.78 at the latest. Still, the XRP aims for modest gains in September after a downbeat August.

The Weekly Moves

Key Macro Catalysts

Several U.S. data points raised doubts on the market’s pre-set bias towards witnessing two more interest rate cuts from the Federal Reserve (Fed) and bolstered the U.S. Dollar, challenging the risk assets like equities and cryptocurrencies. Also challenging the dovish Fed bias was a speech from Fed Chairman Jerome Powell. Elsewhere, looming fears of the U.S. government shutdown contrasted with receding fears of global economic weakness to underpin the U.S. Dollar’s strength, especially amid firmer Treasury bond yields.

U.S. Treasury bond yields rose across all maturities, extending the previous recovery in longer-dated bond coupons and the short-term bond yields, as financial market traders doubt the U.S. central bank’s ability to announce two further rate cuts in 2025.

Federal Reserve Chairman Jerome Powell crossed wires for the first time after surprising markets following the latest monetary policy meeting. Powell ruled out concerns that the policy is on a preset course while also citing risks to both inflation and employment, repeating a cautious and data-dependent approach. Not only Powell, but several other Fed officials also spoke during the week, and some of them were also hawkish, which in turn reinforced the U.S. Dollar’s strength.

Talking about data, the final readings of Q2 Gross Domestic Product (GDP) and Weekly Initial Jobless Claims gained major attention, while the Fed’s favorite inflation gauge, namely the U.S. Core Personal Consumption Expenditure (PCE) Price Index for August, matched market expectations.

The U.S. Q2 GDP growth rate surged to 3.8%, versus 3.3% prior estimations, whereas the Weekly Initial Jobless Claims dropped to an eight-week low of 218K. Further, the Core PCE Price Index matched Month-over-Month (MoM) and Year-over-Year (YoY) market forecasts, by staying unchanged at 0.2% and 2.9% respectively.

Elsewhere, after U.S. President Donald Trump unveiled several tariffs set to take effect on October 1, and boosted trade war fears. Further, the European Commission is preparing to impose tariffs ranging from 25% to 50% on steel and related products imported from China.

On a political front, U.S. government shutdown fears loom even as President Trump meets with Democratic leaders and tries to break the deadlock after the Senate rejected plans for stopgap funding. The matter gains attention as the September 30 deadline looms and the White House has instructed the federal agencies to prepare for mass layoffs in the event of a government shutdown. Notably, Trump’s speech at the United Nations (UN) General Assembly and a show of readiness to end the wars in Gaza and Ukraine didn’t gain major attention.

Meanwhile, the Organization for Economic Co-operation and Development’s (OECD) upward revision to its 2025 global growth forecast, to 3.2%, up from 2.9%, gives a ray of hope to the markets. However, the OECD also flagged downbeat impacts of tariffs and highlighted the trade war fears looming.

For more macro updates like this, please check our news section here!

Crypto Market News

In the crypto universe, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all slide over 5.0%, with ETH taking the biggest hit. A stronger U.S. Dollar, cautious sentiment, heavy position liquidations, and a major BTC options expiry together drove the sell-off.

Notably, the Bitcoin Dominance improved to 57.8%, from 57.1% reported last week, but the crypto market capitalization (market cap) dropped over 7.0% on the week to $3.77 trillion by press time.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our Coin Bytes.

U.S. SEC Crypto Task Force met with crypto company VanEck on September 25 to discuss regulatory concerns in the digital assets sector. Some of the topics were liquid staking tokens, crypto ETFs, and the tokenisation of investment funds.

Tether, the firm backing the world’s largest stablecoin USDT, eyes raising worth $15–20 billion through the sale of a 3% ownership interest, marking its valuation around $500 billion. The crypto-leader institution is anticipated to use the fresh funds for business expansion.

Avalanche, the parent company of AVAX, joins hands with Mirae Asset to tokenize investment funds. The collaboration will introduce a novel method to fund management.

Netherlands’ Member of Parliament (MP), as well as leader of the Forum of Democracy (FvD), Thierry Baudet, proposed a strategic Bitcoin reserve bill, up for voting in the Dutch House of Representatives.

Also Read: Thierry Baudet Proposes National Strategic Bitcoin Reserve After US Success

The U.S. Senate’s readiness to hold a hearing on the high-profile Digital Asset Taxation in the next week gained the market’s attention as it will put tax attorneys, policy activists, and cryptocurrency executives in the hot seat.

Further, nine European banks, including the top-tiers like ING, UNICREDIT, AND CAIXABANK, unveiled a plan to launch Markets in Crypto-Assets Regulation (MiCA) complaint Euro stablecoin by the second half of 2026.

The executive board of a Chinese electric vehicle charging company, Jiuzi Holdings, approved the use of up to $1 billion from its treasury to form a crypto reserve, mainly focusing on Bitcoin (BTC), Ethereum (ETH), and Binance coin (BNB).

For Details: Jiuzi Holdings $1B Crypto Treasury Strategy Approved

The United Arab Emirates’ (UAE’s) signing of an agreement to standardize the cross-border sharing of tax-related information on crypto assets, on a framework developed by the OECD, gained major attention.

Also Read: UAE Signs Crypto Data-Sharing Agreement under CARF, First Swap in 2028

Helius Medical Technologies Inc. (NASDAQ: HSDT) has entered the Solana ecosystem by acquiring 760,190 SOL tokens, valued at $175 million, as part of its initiative to build the Solana Treasury.

Read More: Helius Launches Solana Treasury With 760,190 SOL, Worth $175 Million.

On a different page, speculations surrounding the crypto Exchange-Traded Funds (ETF) gained pace as the deadline of the U.S. Securities and Exchange Commission’s (SEC) XRP ETF approval approaches. On the same line is chatter about BlackRock’s filing of the Bitcoin Premium Income ETF.

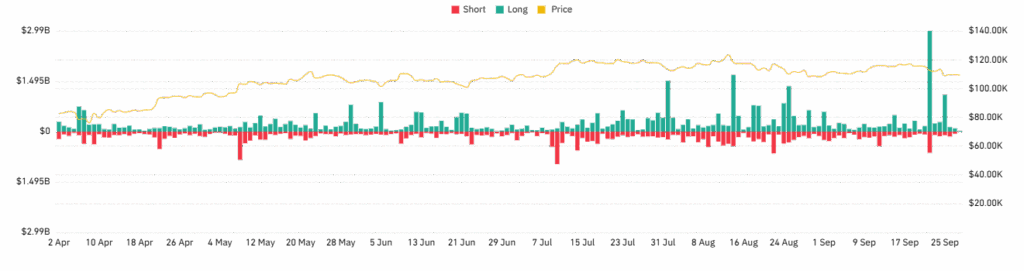

Meanwhile, position liquidation also gained major attention, with long liquidations grabbing the bear’s eyes. That said, position liquidation is the forced closing of a trader’s positions by a broker due to insufficient margin. This data reveals whether long (buy) or short (sell) positions were closed, helping explain recent price movements. Typically, heavy long liquidations happen during a downtrend and suggest short-term bearish sentiment.

Position Liquidations

During the September 21-27 period, a total of $6.26 billion of positions were liquidated, per the CoinGlass data. Out of which, “Long Positions” contributed $4.97 billion, whereas “Short Positions” accounted for $1.29 billion, suggesting a heavy flow of long liquidations and justifying the latest fall in the crypto prices.

Bitcoin and Equities Trade in Sync, But Gold Parts Ways

Bitcoin (BTC) notched the biggest weekly loss since March as Fed rate cut concerns joined major options expiry and technical breakdown. Elsewhere, the spot Gold (XAU) rose for the sixth consecutive week and refreshed a record high before ending the week with around 2.0% weekly gains to near $3,760. Meanwhile, the S&P 500 (SPX) refreshed a record high earlier in the week but ended on a negative note, with 0.30% weekly downside.

With this, the BTC is in sync with the equities, but not Gold, and hence raised doubts on hopes of its fresh ATH, like XAU and SPX.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the clearly linear relations between Bitcoin and the U.S. equities, the BTC traders should be cautious as uncertainties around the Fed interest rate decisions, concerns over the Fed’s independence, the ongoing Ukraine-Russia war, and the impact of President Donald Trump’s tariffs cloud the market outlook.

BTC ETF, Whale, and Options Signals

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a two-day outflow pattern, with a daily outflow of $418.25 million on Friday.

With this, the weekly ETF performance marked the first outflow in five, worth $902.50 million for the last week.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but September’s inflows have been stellar, with the latest figures of $2.57 billion.

With this magnitude of surprise from the ETF flows on a monthly basis, the BTC bulls seem to be keeping the reins for a while.

On the flip side, whale activities, wallets holding over 10,000 BTC, appear to be downbeat as CryptoQuant data points to the biggest offloading since the bull cycle began in early 2023. As per the report, BTC whales have offloaded 147,000 BTC since August 21.

A $22.6 billion options expiry also weighed on Bitcoin price last week. That said, the total number of options expiring was $22.6 billion on Friday, the day of expiry, with Deribit’s share of $17.4 billion of open interest. Notably, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $110,000. This could be linked to the BTC’s sidelined performance around $110K of late.

Also read: Crypto Options: BTC remains Sideline amid $22.6 Billion September Options Expiry Today!

Technical Analysis Signals Further BTC Weakness

As per Bitcoin’s daily chart, BTC’s decisive break below the five-month trend line support, now resistance, joins bearish signals from the Moving Average Convergence and Divergence (MACD) and the Directional Movement Index (DMI) momentum indicators, keeping sellers confident.

Bitcoin Price: Daily Chart Points To Short-Term Downside

Bitcoin bounces off a 12-week rising support line as the market braces for the key U.S. data and month-end moves. However, Thursday’s clear break below a five-month trendline support, now immediate resistance, joins bearish signals from DMI and MACD to defend the downside bias.

That said, the MACD posts the strongest bearish signals (red) in a month. Meanwhile, the DMI’s Downmove (D-, orange) line tops both the Average Directional Index (ADX, red) and the Upmove (D+, blue) lines, staying close to the neutral 25.00 level. This suggests strong downside momentum and no upside bias, despite the recent rebound.

As a result, BTC’s rebound from the immediate support near $109,000 looks unconvincing while it remains below the former support–now resistance–line from April, seen around $111,600 at press time.

Even if Bitcoin clears the $111,500 hurdle, the 50-day SMA and a six-week horizontal resistance, respectively near $113,785 and $117,500-$117,800, could challenge the upside momentum.

Beyond that, a two-month-old horizontal resistance near $123,300, the all-time high around $124,500, and the $130K psychological magnet could flash on the bull’s radar.

On the flip side, a daily close beneath the $109,000 support could quickly drag the Bitcoin price to the 200-day SMA support of $104,440.

Should the BTC remain bearish past $104,440, June’s low of $98,240 and late April swing lows around $91,800 could act as the final defense of the buyers ahead of highlighting April’s bottom of $74,434 for the bears.

Ethereum Plummets!

Ethereum (ETH) marked a notable drop of around 10% last week, despite wavering near $4,000 by press time. With this, the ETH also faces its first weekly loss in three. The second-largest cryptocurrency’s slump could be linked to a heavy ETF outflow and growing optimism around altcoins like Solana (SOL), Cardano (ADA), and Avalanche (AVAX), fueled by ETF enthusiasm and rising corporate interest in diversifying crypto treasury reserves.

ETH ETFs Report Heavy Outflows, But Whales Keep Buying

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported the biggest weekly outflows on record. That said, the ETH ETFs reported consecutive five-day outflows, resulting in the heavy weekly outflows and the first monthly outflows in six, while justifying ETH’s latest weakness in prices.

On September 26, the U.S. Spot ETH ETFs reported its fifth daily outflow, with a $248.31 million figure.

This also resulted in the record weekly ETH ETF outflows, with a total of $795.56 million for the week, challenging the previous two-week inflow pattern.

Meanwhile, the monthly ETH ETF scenario is downbeat as it reports the first monthly outflow in six, worth a meagre $388.69 million.

On the contrary, whale wallets, holding over 10,000 to 100,000 ETH, showed resilient buying and pushed back against the bearish bias. That said, crypto transaction tracker Lookonchain stated on Friday that 16 whales have made a total purchase of 431,018 ETH, worth $1.73 billion, between September 25 and 27.

Ethereum Technical Analysis Teases Sellers

Ethereum’s break below the 50-day Exponential Moving Average (EMA), its first in three months, initially flashed the bearish sign. Adding strength to the downside bias are bearish signals from the DMI and the MACD momentum indicators. Still, the lower Bollinger Band (BB) and the 100-day EMA challenge the ETH bears as they aim for the previous monthly low.

Ethereum Price: Daily Chart Keeps Bears Hopeful

A clear breakdown from a six-week ascending triangle and the 50-day EMA joins bearish MACD signals (red), and downbeat momentum clues from the DMI indicator to attract short-term Ethereum sellers.

That said, the DMI’s Downmove (D-, Orange) line stays firmer past the 25.00 neutral level to 31.00 as we write, suggesting an increase in the downside momentum. Meanwhile, the ADX (Average Directional Index, red) line is near the 25.00 mark, but the D+ (Upmove, blue) is way below the 25.00 neutral level, pointing to very weak upside bias.

With this, the ETH looks poised to revisit the lower Bollinger Band (BB) and the 100-day EMA, close to $3,875 and $3,857 in that order.

In a case where the bears dominate past $3,857, it becomes vulnerable to revisit the previous monthly low of around $3,355. Additionally, the 200-day EMA level of $3,409 will precede an ascending support line from April, close to $3,250, to act as the final line of defence for the Ethereum buyers.

Alternatively, the altcoin’s fresh recovery remains elusive beneath the 50-day EMA level surrounding $4,208 and the stated triangle’s bottom surrounding $4,475.

Beyond that, a horizontal resistance zone from August 13, which also includes the upper BB, around $4,765-$4,845, and the recent ATH of around $4,955, could challenge the ETH bulls. It’s worth noting that Ethereum’s successful trading past $4,955 won’t hesitate to aim for the $5,000 psychological magnet.

Ripple Fails to Justify ETF Optimism…

Ripple (XRP) posted its second consecutive weekly loss, falling around 6.0% over a week to $2.79 by the press time. Still, the altcoin remains on the way to posting a monthly gain, following a downbeat August.

Increased chatter surrounding BlackRock’s potential XRP ETF filing, a notable volume in the REX-Osprey XRP ETF, and news about Grayscale’s spot XRP ETF approval garnered Ripple buyers’ attention. Additionally, nearness to the U.S. SEC’s October deadline for key XRP ETFs approvals and growing institutional interest in the Ripple ecosystem also keep the buyers on the lookout. However, the broad crypto market selling and the firmer U.S. Dollar exert downside pressure on the XRP.

Ripple Technical Analysis Lures Short-term Bears

Ripple remains pressured within an eight-week descending triangle formation, currently hovering around the triangle’s bottom and the lower BB. The downside bias gains momentum from a sustained trading beneath the 100-day SMA and bearish MACD signals, even as the 14-day Relative Strength Index (RSI) points to sluggish momentum.

Ripple Price: Daily Chart Points To Bearish Consolidation

Ripple’s corrective bounce from an eight-week-old triangle’s support surrounding $2.70 fades upside momentum near the lower Bollinger Band (BB) close to $2.73, as RSI backs the latest consolidation by staying beneath the 50.0 neutral level.

Even if the XRP manages to offer a daily closing beyond the $2.86 immediate hurdle, comprising the 100-day SMA, the bearish MACD signals, and the middle BB hurdle of $2.95 could challenge buyers.

Beyond that, the stated triangle’s top surrounding $3.05, the upper BB of $3.18, and the monthly high of $3.19 might test the XRP bulls before giving them control.

In that case, the altcoin’s further upside could aim for the previous monthly high of $3.38 and the all-time high (ATH) of $3.67 before highlighting the $4.00 on the bull’s radar.

Meanwhile, the lower BB and the stated triangle’s support, respectively near $2.73 and $2.70, could restrict short-term XRP downside ahead of a previous horizontal resistance from March, now support near $2.65.

After that, the 200-day SMA support of $2.55 and an ascending trend line from April, close to $2.28, will be the last line of defense for Ripple buyers before surrendering to the bears.

If the XRP bears dominate past $2.28, the quote becomes vulnerable to break the $2.00 threshold and test June’s low of $1.91 before approaching the yearly low marked in April around $1.60.

Conclusion

Having witnessed a volatile week, the crypto market participants could keep their eyes on the month-start busy economic calendar and developments about the U.S. tariffs and geopolitical tensions surrounding Russia, Israel, and U.S. President Donald Trump. Furthermore, fears about the U.S. government shutdown could also affect the risk assets, including cryptocurrencies.

Among the key data, the preliminary readings of China’s September PMIs and the U.S. ISM PMIs for the said month will precede the monthly employment report, comprising the key Nonfarm Payrolls (NFP), to gain major attention.

Given the market’s recently bearish reaction to the Fed rate cut developments, coupled with the month-end flow, cryptocurrency sellers are likely to keep the reins. However, a surprise weakness in the U.S. employment figures and/or optimism surrounding the U.S. SEC’s ETF approvals, as well as a rebound in the ETF flows, might trigger the much needed recovery in the key coins.

In that case, Ethereum, Ripple, Solana and Dogecoin are likely to gain major attention of buyers, while Bitcoin may not be able to rise much, due to its mixed ties with gold and equities, as well as downbeat technical analysis.

Also read: Eric Trump: Stablecoins Can Reinforce U.S. Dollar as America’s New Bitcoin Venture Expands