Cryptocurrency Weekly Summary

- Cryptocurrency weekly performance turned positive as no fears from the U.S. shutdown, dovish Fed bias, and mixed data weakened the Dollar.

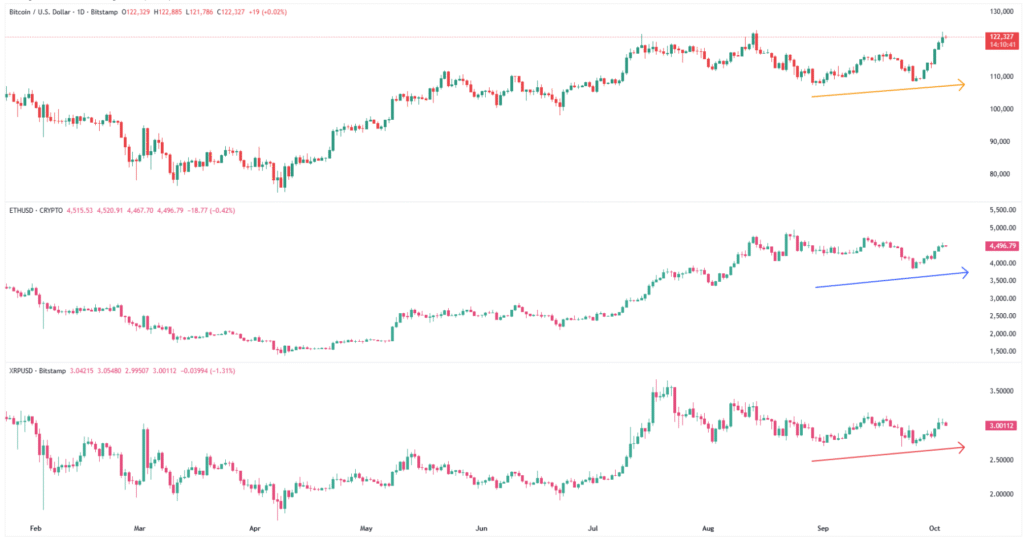

- Bitcoin, Ethereum, and Ripple break two-week losing streak, following the positive trend in risk assets.

- Rising altcoin ETF talk and pro-industry news spark renewed institutional interest in BTC and ETH.

- Trump announced a tax rebate from tariff gains amid political struggles and shutdown woes.

- Putin showed readiness to discuss the Ukraine peace plan, with conditions.

- Gold and S&P 500 hit new highs as traders bet U.S. policymakers will overcome the shutdown.

- Pending U.S. data, shutdown updates, and global news will guide the market’s next moves.

Cryptocurrency Weekly Snapshot

Cryptocurrency markets witnessed a positive week, despite the U.S. government shutdown, as traders cheered a weaker U.S. Dollar and the return of institutional inflows. Optimism grew as traders believed U.S. policymakers would eventually resolve the shutdown. Mixed U.S. data and dovish comments from Federal Reserve (Fed) officials also pressured the Dollar. Additionally, discussion surrounding the U.S. Securities and Exchange Commission’s (SEC) approval of various altcoin Exchange-Traded Funds (ETFs) also contributed to the crypto market optimism, helping major coins recover from a two-week downtrend.

That said, Bitcoin (BTC) rallies 9.0%, Ethereum (ETH) jumps 8.5%, and Ripple (XRP) gains 4.5% in their first positive week in three. Meanwhile, the U.S. Dollar Index (DXY) stalled its two-week uptrend to post the biggest weekly loss since late July. Meanwhile, the spot Gold (XAU) rose for the seventh consecutive week, reaching a record top, and the S&P 500 reached a new all-time high (ATH) in a strong weekly performance.

Bitcoin Recalls Bulls: Bitcoin (BTC) recorded its biggest weekly gain since early May, with a slight over 9.0% rally to $122,500 by press time. With this, the BTC is up over 7.0% for the month.

Ethereum Also Jumps: Ethereum (ETH) also posted a stellar jump, its steepest since early August, by rising around 8.5% over a week. With this, the second-largest cryptocurrency is on track to reverse the previous monthly loss, as bulls keep the reins near the $4,500 threshold as we write.

Ripple Rises Too: Ripple (XRP) traces BTC and ETH while snapping a two-week downtrend, up nearly 4.5% to $3.00 at the latest. This allows the XRP to begin October on a firmer footing after an upbeat September.

The Weekly Moves

Key Macro Catalysts

The ongoing U.S. government shutdown delayed key economic data and also raised concerns over Federal Reserve (Fed) rate decisions, adding to the market’s uncertainty. The shutdown halted the release of the weekly jobless claims, factory orders data, and the monthly U.S. jobs report. However, the dovish Fed talks and chatter that the policymakers will eventually overcome the U.S. government shutdown helped the cryptocurrencies.

Out of the released U.S. data, the ISM Services PMI for September dropped to a four-month low of 50.00, versus 51.7 expected and 52.0 prior. Still, the details suggest an improvement in the inflation and employment components. That said, final readings of the U.S. S&P Global Composite PMI for September rose past initial forecasts of 53.6 to 53.9, backed by upbeat Services PMI. Meanwhile, the U.S. ADP Employment change marked a downbeat figure and bolstered the likelihood of a Federal Reserve rate cut in October, as well as in December.

Talking about speeches from Fed officials, Dallas Fed President Lorie Logan and Chicago Fed President Austan Goolsbee expressed caution about future rate cuts. Meanwhile, St. Louis Fed President Alberto Musalem highlighted the need to fight against inflation, while New York Fed President John Williams noted that monetary policy remains restrictive and that it will take time to achieve the 2% inflation target. Further, Federal Reserve Governor Michelle Bowman said inflation is still too high and the trend is moving in the wrong direction, though the impact of tariffs on inflation has been less than expected.

With this, the Fed’s October rate cut of 0.25% is almost certain, per the interest rate futures, while there prevails a 89% chance that the U.S. central bank will cut rates by 25 basis points (bps) in December as well.

Elsewhere, the Asian Development Bank (ADB) has reduced its 2025 growth forecast for developing Asia to 4.8% from 4.9%, primarily due to the effects of steep U.S. tariffs. The ADB also warned that momentum is likely to slow further next year.

Notably, the global rating agency, Fitch Ratings, reaffirmed the U.S. credit rating at AA+/Stable, noting that the government shutdown doesn’t have near-term implications for the rating.

On the political front, Trump repeated that the shutdown is a good opportunity to cut costs, saying “billions of dollars can be saved.” Other reports also indicated that the White House is preparing federal agencies for mass layoffs. Trump also eyes $1,000–$2,000 stimulus checks to taxpayers, funded by tariff revenues, allegedly trying to gain favor for the 2026 mid-term elections.

U.S. Treasury Secretary Scott Bessent told CNBC that they could see a hit to the GDP (Gross Domestic Product) from the shutdown.

The U.S. Senate Majority Leader John Thune ruled out the possibility of a vote this weekend to reopen the government.

The Supreme Court declined to immediately allow Trump to fire Federal Reserve Governor Lisa Cook but confirmed it will hear arguments in January.

On the geopolitical front, Ukraine is likely to use the U.S. long-range missiles to strike deep into Russian territory, damaging key energy infrastructure. Reuters cited anonymous U.S. officials to confirm that Washington will now provide Kyiv with intelligence to support such long-range strikes.

That said, Russian President Vladimir Putin showed readiness to continue talks on the Ukraine peace deal. Still, he ruled out the idea that Moscow is a threat to the North Atlantic Treaty Organization (NATO) and instead, blamed the West for the lack of peace in Ukraine.

Further, the G7 (Group of Seven) vowed to increase enforcement of sanctions against Russia. In a statement, the group said it will work to phase out remaining Russian imports, including hydrocarbons, and warned of penalties for third-party countries and firms that help finance Russia’s war effort.

For more macro updates like this, please check our news section here!

Crypto Market News

In the crypto universe, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all gained over 4.0%, with BTC leading the rise. A downbeat U.S. Dollar, cautious optimism, and return of the ETF inflows seem to have favored the crypto bulls.

Notably, the Bitcoin Dominance improved to 58.3%, from 57.8% reported last week, but the crypto market capitalization (market cap) jumped over 10.0% on the week to $4.21 trillion by press time, per CoinMarketCap.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our Coin Bytes.

On Friday, the global electronics giant Samsung announced a deeper collaboration with Coinbase, the largest crypto exchange in the U.S., to ease crypto access for its 75 million users.

Read Details: Just-In: Samsung Taps Coinbase to Offer Bitcoin, Crypto Access for 75M Users

New York lawmakers, State Senator Liz Krueger and Assembly member Anna Kelles, introduced Senate Bill S8518 on October 1. The bill proposes a tax on crypto mining firms based on their annual power consumption, aiming to address the rising electricity costs linked to crypto mining.

Telegram Wallet listing tokenized U.S. stocks will begin trading by the end of October, bringing 24/5 trading of major U.S. equities to the messaging app’s massive user base. Details suggest that the program is a partnership with crypto exchange Kraken and tokenization platform Backed, offering over 60 fully-backed stocks and ETFs.

Peru announced the use of Bitcoin-based blockchain technology for its national elections in 2026. The country will debut the pilot of its new digital voting system, backed by Syscoin’s blockchain, to include historically excluded groups like military staff and overseas citizens, ensuring secure, immutable, and transparent voting rights.

Read More: Peru Presidential Elections 2026 to Pioneer Blockchain Voting with Syscoin

A Trump-backed cryptocurrency venture, World Liberty Financial Institute (WLFI), eyes rollout of crypto debit card and tokenized commodities amid alleged instability. The firm’s WLFI token struggles for the second consecutive week and backs the market’s fears.

Read More: World Liberty Financial Eyes Debit Cards, Tokenized Commodities as WLFI Battles for Stability

Meanwhile, Kazakhstan introduced the first state-supported digital asset investment fund, the Alem Crypto Fund, with the key focus on the Binance Coin (BNB), fueling the BNB price by 5% the previous day.

Also Read: Kazakhstan Buys BNB for State Crypto Fund, Price Soars 5%

A U.S.-based global asset management company, Vanguard Group Inc., seems to be eyeing the crypto-based exchange-traded funds (ETFs) for its investors, after multiple years of a conservative approach. The firm’s alleged approach is likely taking clues from the market’s rush toward digital assets and the proximity to the U.S. SEC’s crypto ETF approvals.

Read More: Vanguard Mulls Crypto ETF Trading As SEC Deadlines Loom

Poland passed a bill to regulate crypto markets and set up a dedicated watchdog while following the broad European Union (EU) footsteps. In doing so, the EU nation faced criticism from the crypto advocates as it defined guidelines for crypto companies, imposing limitations on their operations and ensuring greater investor protection.

The world’s top payment network, SWIFT, is bracing for a blockchain-based ledger that will be accessible in more than 200 nations and territories. This will improve the security and ease of digital finance.

On a different page, speculations surrounding the crypto ETFs gained pace as the deadline of the U.S. SEC’s XRP, DOGE, and SOL ETF approval approaches. On the same line is chatter about BlackRock’s filing of the Bitcoin Premium Income ETF.

Also read: ADA, SUI, HYPE, XLM & 17 Other Altcoin ETFs Filed with SEC

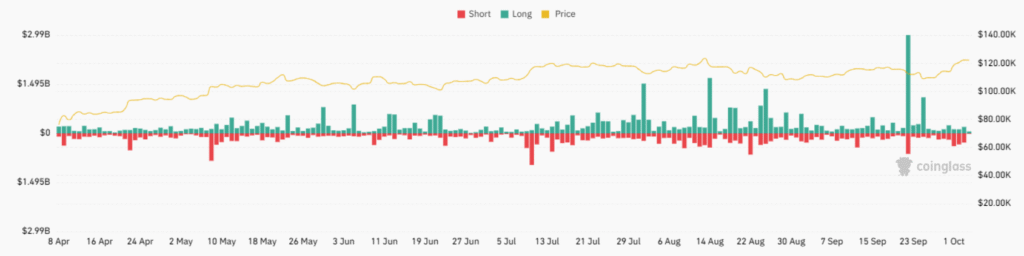

Meanwhile, position liquidation also gained major attention, with short liquidations grabbing the bull’s eye. That said, position liquidation is the forced closing of a trader’s positions by a broker due to insufficient margin. This data reveals whether long (buy) or short (sell) positions were closed, helping explain recent price movements. Typically, heavy long liquidations happen during a downtrend and suggest short-term bearish sentiment, and vice versa.

Position Liquidations

During the September 28 to October 04 period, a total of $2.51 billion of positions were liquidated, per the CoinGlass data. Out of which, “Long Positions” contributed a meager $929.47 million, whereas “Short Positions” accounted for $1.58 billion, suggesting a heavy flow of short liquidations and justifying the latest jump in the crypto prices.

Bitcoin, Equities, and Gold Back in Sync

Bitcoin (BTC) notched the biggest weekly gain since early May as a broad cautious optimism and softer U.S. Dollar joined ETF inflows and technical rebound. Elsewhere, the spot Gold (XAU) rose for the seventh consecutive week and refreshed a record high before ending the week with over 3.0% weekly gains to near $3,886. Meanwhile, the S&P 500 (SPX) refreshed a record high, with 1.08% weekly upside.

With this, the BTC is back in sync with the equities and Gold, and reinforces expectations of its fresh ATH, like XAU and SPX.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the clearly linear relations between Bitcoin, Gold, and the U.S. equities, the BTC traders should be optimistic as dovish bias about the Fed interest rate decisions, concerns over the Fed’s independence, the ongoing Ukraine-Russia war, and the impact of President Donald Trump’s tariffs contribute to the market outlook.

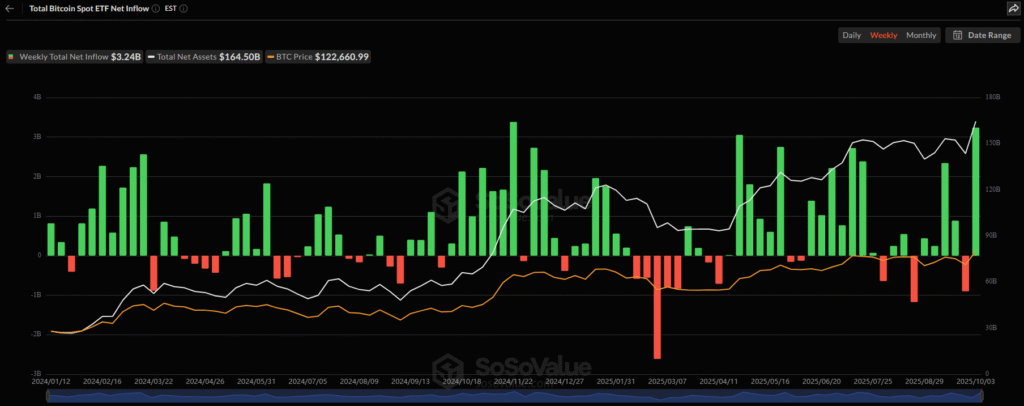

BTC ETF, Whale, and Options Signals

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a five-day pattern, with a daily inflow of $985.08 million on Friday, the highest daily inflow in 12 weeks.

With this, the spot BTC ETF performance marked the biggest weekly inflow since late November 2024, worth $3.24 billion for the last week.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but September’s inflows were stellar with the $3.53 billion figures, whereas the October inflows have been $2.29 billion by press time.

With this magnitude of surprise from the ETF flows on a monthly basis, the BTC bulls seem to be keeping the reins for a while.

Additionally, whale activities, wallets holding over 10,000 BTC, also appear to be upbeat, as InvestingHaven points to heavy Bitcoin buying from whales. As per the report, BTC whales have bought around $3.3 billion worth of the crypto major coin in just one week.

On the flip side, a $3.28 billion options expiry couldn’t challenge the Bitcoin buyers last week. That said, the total number of options expiring was $3.28 billion on Friday, the day of expiry. Notably, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $114,000, down from the latest jump to $120K. This could be considered a pullback sign for the BTC.

Also read: Crypto Options: BTC Touches $120K amid $3.2B Bitcoin Options Expiry ahead of “Uptober” Rally

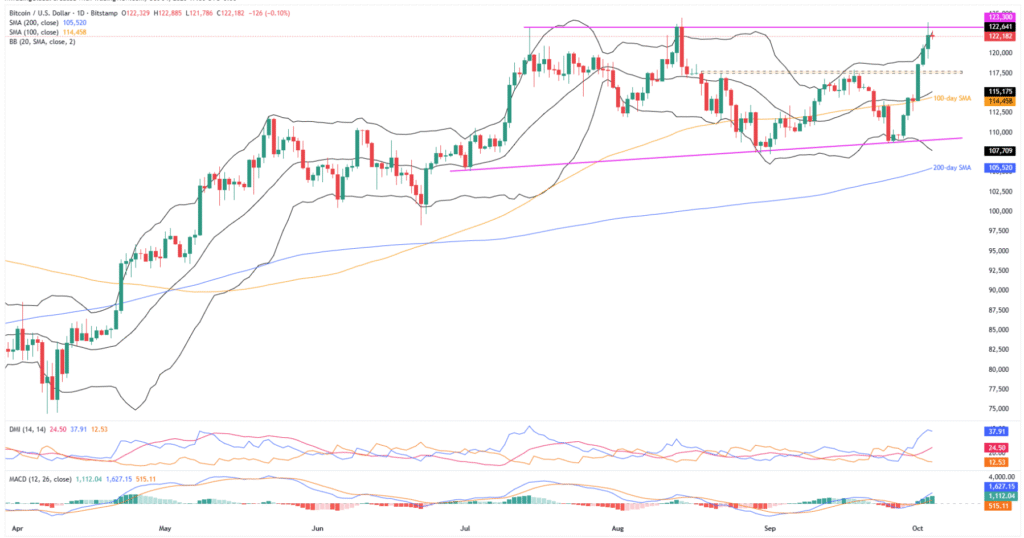

Technical Analysis Signals Fresh BTC ATH

Bitcoin’s stellar jump could be linked to its upside break of a six-week-old horizontal resistance area, and bullish signals from the Moving Average Convergence Divergence (MACD) and Directional Movement Index (DMI) momentum indicators. Notably, this comes despite the U.S. government shutdown dampening recent crypto market optimism, with a corrective bounce in the U.S. Dollar.

Bitcoin Price: Daily chart suggests further upside

Despite the latest inaction, Bitcoin defends the previous breakout of a six-week-old horizontal resistance area and the 100-day SMA, backed by a bullish MACD signal (green) and upbeat DMI clues.

That said, the DMI’s Upmove (D+, blue) line tops both the Downmove (D-, orange) line and the Average Directional Index (ADX, red) line, staying well past the neutral 25.00 level. This suggests increasing upside momentum even if the price remains lackluster of late.

Adding strength to the BTC’s bullish bias is the successful rebound from an ascending support line from July, the lower Bollinger Band (BB), and sustained trading past the 200-day SMA.

With this, the Bitcoin buyers appear to be set to approach a 2.5-month-old horizontal resistance near $123,300, despite facing rejection on Friday. Beyond that, the all-time high around $124,500, and the $130K psychological magnet could flash on the bull’s radar.

On the flip side, a daily close beneath a six-week-old horizontal resistance area, now support surrounding $117,500-$117,800, could trigger a short-term pullback in the BTC prices.

In that case, the 100-day SMA support of $114,450 will be the key, as a break of which could direct the BTC sellers toward the multi-week support line and lower BB, mentioned above, respectively near $109,100 and $107,700.

It’s worth noting that Bitcoin’s downside past $107,700 seems unlikely, but if it happens, the 200-day SMA support at $105,500 will be the last line of defense for bulls. A break below this could shift control to the sellers, threatening the broader upside trend.

Ethereum Jumps Back!

Ethereum (ETH) marked a notable jump of above 8.0% last week, snapping a two-week downtrend, despite wavering near $4,500 by press time. The second-largest cryptocurrency’s slump could be linked to the market’s overall optimism, a heavy ETF inflow, and growing optimism around altcoins like Ethereum (ETH), Solana (SOL), Dogecoin (DOGE), and Avalanche (AVAX), fueled by ETF enthusiasm and rising corporate interest in diversifying crypto treasury reserves.

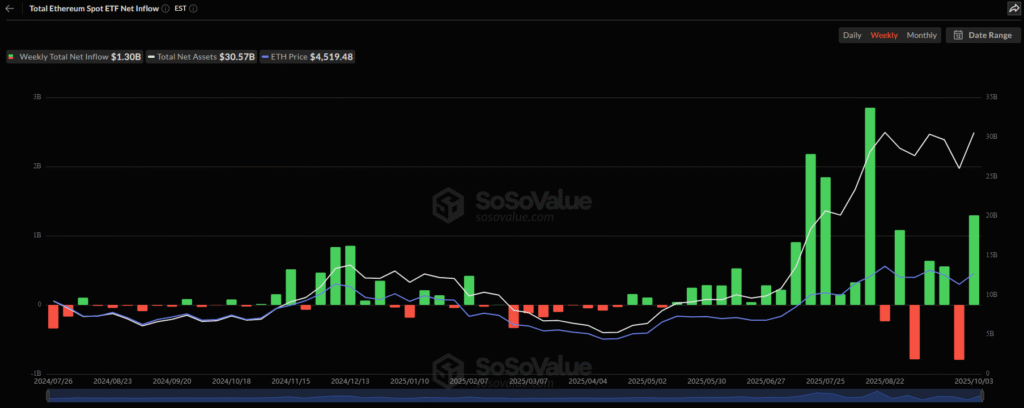

ETH ETFs Report Heavy Inflows, But Whales Keep Buying

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported the biggest weekly inflows in seven weeks. That said, the ETH ETFs reported consecutive five-day inflows, resulting in the heavy weekly inflows and a seven-month inflow streak, while justifying ETH’s recent strength in prices.

On October 03, the U.S. Spot ETH ETFs reported its fifth daily inflow, with a $233.55 million figure.

This also resulted in the seven-week high ETH ETF inflows, with a total of $1.30 billion for the week, challenging the previous weekly outflow.

Meanwhile, the monthly ETH ETF scenario is also upbeat as it reports the seven-month inflow pattern, with October’s inflows being $621.39 million by press time.

Additionally, whale wallets, holding over 10,000 to 100,000 ETH, showed resilient buying and bolstered the bullish bias. That said, Inverstinghaven stated on Friday that whales have added about 431,018 ETH, worth roughly $1.73 billion, into private wallets in one week.

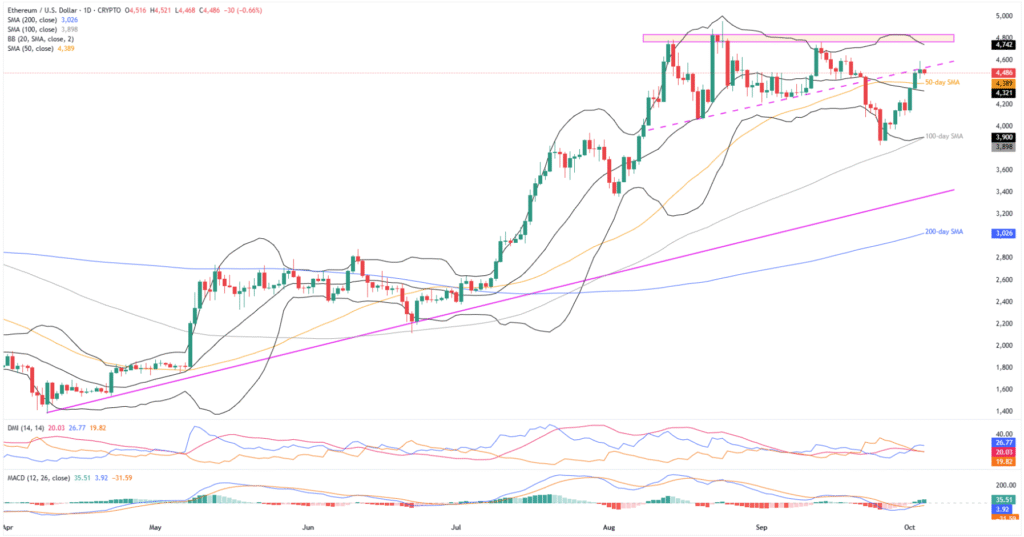

Ethereum Technical Analysis Teases Buyers

Ethereum’s break above the 50-day Simple Moving Average (EMA), its first in over a week, keeps buyers hopeful even as the quote currently jostles with a six-week support-turned-resistance. Adding strength to the upside bias is the ETH’s successful breakout of the middle Bollinger Band (BB), backed by the strengthening bullish bias of the Directional Movement Index (DMI) and Moving Average Convergence Divergence (MACD) momentum indicators, which keeps buyers optimistic.

Ethereum Price: Daily Chart Points To Growing Bullish Bias

Ethereum’s strong rebound from the lower Bollinger Band (BB), combined with the recent breakout of the middle BB and the 50-day SMA, joins a growing bullish bias in the MACD and DMI to support a positive upside outlook.

That said, MACD’s histogram (green) posts the strongest bullish sign in over seven weeks. On the same line, the DMI’s Downmove (D-, Orange) line and the ADX (Average Directional Index, red) line are both below the 25.00 neutral level, pointing to a weaker downside bias. That said, the Upmove (D+, Blue) line is on the top and well past the 25.00 threshold, suggesting upbeat bullish momentum.

However, a daily closing beyond the previous support line from mid-August, close to $4,535 as we write, becomes necessary for the buyers.

As Ethereum bulls push past $4,535, a key resistance zone between $4,765 and $4,830, formed on August 13, poses a major challenge for those targeting a new all-time high (ATH) near $5,000. The recent ATH of $4,955 may also serve as an intermediate resistance on the way up.

Alternatively, the ETH pullback may aim for the 50-day SMA support of $4,389 and the middle BB of $4,330, as well as the $4,000 threshold, before approaching the key $3,900-$3,898 support confluence, comprising the 100-day SMA and the lower BB.

Below that, an ascending trend line from early April and the 200-day SMA, around $3,360 and $3,026 in that order, will be critical levels that could determine the fate of Ethereum’s bearish trend.

Ripple Justifies ETF Optimism…

Ripple (XRP) posted its first weekly gain in three, rising around 4.5% over a week to $3.0 by the press time. That said, the altcoin remains on the way to posting a second monthly gain, following a downbeat August.

Increased chatter surrounding BlackRock’s potential XRP ETF filing, a notable volume in the REX-Osprey XRP ETF, and news about Grayscale’s spot XRP ETF approval garnered Ripple buyers’ attention. Additionally, nearness to the U.S. SEC’s October deadline for key XRP ETFs approvals and growing institutional interest in the Ripple ecosystem also keep the buyers on the lookout.

Furthermore, news surrounding heavy whale buying also underpins bullish bias surrounding the XRP. A well-known crypto wizard, Ali Martinez, quoted Santiment data to point out that Ripple whales are bullish on the altcoin. Ali’s post on X signalled that whale wallets, holding 100 million to 1 billion XRP, have purchased 250 million tokens over the past 48 hours.

Meanwhile, news about Ripple’s CTO, David Schwartz, failed to dampen XRP optimism. That said, the crypto industry’s longest-serving executive, Ripple’s CTO, David Schwartz, announced stepping down to the role of board member after 13 years. The crypto wizard will still be a strategic advisor to the firm.

More Details: Ripple’s CTO Steps Down, Shifting to Board Role After 13 Years

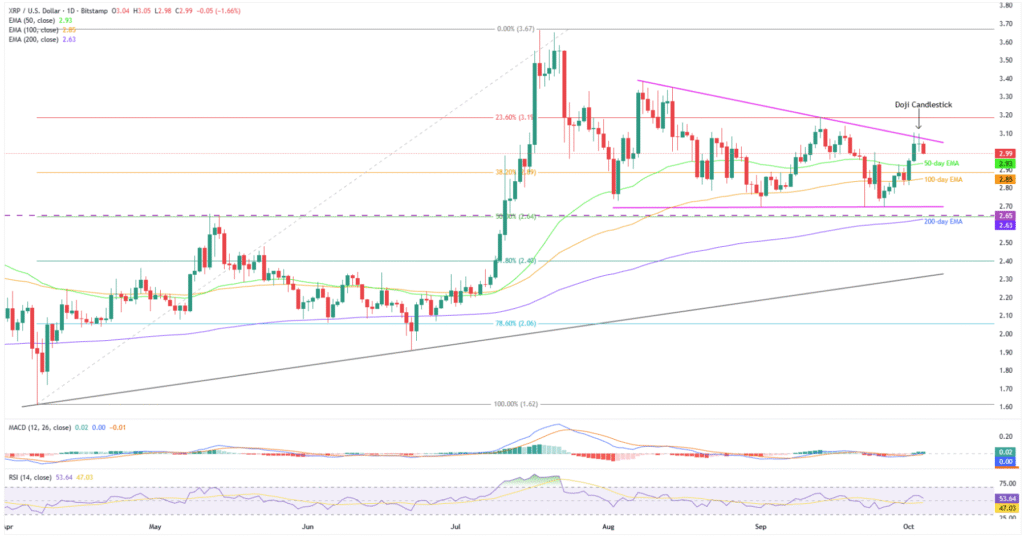

Ripple Technical Analysis Lures Short-term Bears

The XRP buyers defend previous breakouts of the 50-day and 100-day Exponential Moving Average (EMA) within a seven-week-old descending triangle pattern. That said, the quote presently attacks the $3.00 threshold, while gaining support from bullish signals from the Moving Average Convergence and Divergence (MACD) and the 14-day Relative Strength Index (RSI), suggesting further upside momentum.

However, its retreat from the stated triangle on Friday, coupled with the Doji candlestick formation on the daily chart, suggests a short-term pullback in prices.

Ripple Price: Daily Chart Tests Bulls

Ripple’s clear upside break of 50-day and 100-day EMAs joins a sustained rebound from the 100-day EMA, bullish MACD signals, and upbeat RSI line, way past the 50.00 neutral level, to underpin the XRP’s bullish bias.

Adding strength to the upside bias is the quote’s early July breakout of a seven-month horizontal resistance, now support, as well as June’s U-turn from the 200-day EMA.

However, the quote’s latest retreat from an upper boundary of the seven-week-old triangle formation, as well as Friday’s Doji candlestick, challenge the short-term XRP bulls.

With this, the XRP is likely to revisit the 50-day and 100-day EMA supports, respectively near $2.93 and $2.82.

However, the quote’s downside past $2.82 becomes interesting as the aforementioned triangle’s bottom of $2.69, previous resistance line from March around $2.65, and the 200-day EMA support of $2.63 will be tough nuts to crack for bears before taking control. Above all, the XRP buyers can stay optimistic as long as the price holds an ascending support line from April, close to $2.32 as we write.

Alternatively, a daily closing beyond the triangle’s top, close to $3.08, could direct prices to the August peak of $3.38. Beyond that, the all-time high (ATH) of $3.67 and the bullish triangle breakout’s theoretical target of $3.81 can entertain the bulls before the $4.00 threshold.

Conclusion

Having witnessed a volatile week, the crypto market participants could keep their eyes on the pending U.S. data that has been delayed/postponed due to the U.S. government shutdown. Apart from the pending monthly employment report for September, the U.S. Federal Open Market Committee (FOMC) Minutes, and a speech from Fed Chairman Jerome Powell, up for publishing on Thursday, will also be crucial to follow.

That said, the developments about the U.S. tariffs and geopolitical tensions surrounding Russia, Israel, and U.S. President Donald Trump could also entertain the momentum traders. Furthermore, fears about the negative economic impact of the U.S. government shutdown could also affect the risk assets, including cryptocurrencies, if it materializes next week.

Given the market’s recently bullish reaction to the Fed rate cut bias, coupled with the ignorance of the shutdown woes, the cryptocurrency bulls are likely to keep the reins. That said, a surprise weakness in the U.S. employment figures and/or optimism surrounding the U.S. SEC’s ETF approvals, as well as sturdy ETF flows, might propel the run-up in the key coins.

In that case, Ethereum, Solana, and Dogecoin are likely to gain the major attention of buyers, while Ripple and Bitcoin may not be able to rise much, due to mixed technical analysis.

Also read: Stablecoin Cap Hits $300B, How Will It Impact Crypto Market?