Cryptocurrency Weekly Summary

- Cryptocurrency weekly performance turned negative as Trump bolsters trade and employment woes amid shutdown.

- Bitcoin dropped 10%, Ethereum and Ripple each fell over 15% this week, largely due to Friday’s sharp selloff.

- U.S. President Donald Trump announced 100% tariffs on China, White House OMB Director conveyed the start of “reductions in force”.

- U.S. spot BTC, ETH ETFs saw steady but slower inflows, while the crypto market cap slid over 10%, but Bitcoin Dominance rose.

- U.S. shutdown delayed crypto ETF decisions, but early-week optimism and industry updates defended major coins before a late-week slump.

- U.S. legislators will return on Tuesday, the BLS said it to publish CPI on October 24.

- Risk catalysts could entertain crypto traders amid shutdown-inflicted data gaps.

Cryptocurrency Weekly Snapshot

Cryptocurrency markets faced a dramatic week, despite the U.S. government shutdown, as traders initially cheered Bitcoin’s (BTC) all-time high (ATH) before witnessing Friday’s slump, resulting in a nearly 10% weekly fall. Other coins were also badly hit as Ethereum (ETH) and Ripple (XRP) both dropped more than 15% weekly, whereas Solana (SOL) is down 17% and Dogecoin (DOGE) plummets +20% on a week.

Meanwhile, the U.S. Dollar Index (DXY) posted the biggest weekly gain since November 2024, whereas the spot Gold (XAU) rose for the eighth consecutive week to hit a record high around $4,060, up 3.35% weekly to $4,016 by press time. Furthermore, the S&P 500 marked the biggest weekly loss in five months, despite refreshing its ATH earlier in the week.

While tracing the key catalysts, U.S. President Donald Trump’s 100% tariffs on China, mixed U.S. data, and the start of mass layoffs in the federal offices have gained major attention. Furthermore, the U.S. shutdown continues to hinder the data flow, as well as extend uncertainty surrounding the U.S. Securities and Exchange Commission’s (SEC) approval of the altcoin exchange-traded fund (ETF) approval, which in turn negatively affected the crypto performance.

On the positive side, the U.S. spot ETFs for Bitcoin (BTC) and Ethereum (ETH) saw steady but slower inflows, whereas the institutional adoption of the crypto and ecosystem updates also tried fighting the bears. Elsewhere, the Hamas-Israel ceasefire in Gaza and upbeat U.S. consumer-centric details, whatever was released, also favored the market sentiment before Friday’s risk aversion.

Bitcoin Recalls Bears: Bitcoin (BTC) recorded its biggest weekly fall since early March, with almost 10% slump to $111,800 by press time, after posting the heaviest jump since May. With this, the BTC is down over 2.0% for the month.

Ethereum Slumps: Ethereum (ETH) marked a stellar fall of 15% on the week, the heaviest since March, to $3,836 by press time. The ETH’s latest slump not only reverses its previous weekly gains but also adds more losses to suggest a 7.5% monthly loss.

Ripple Sinks Too: Ripple (XRP) also posted the heaviest fall since March, as well as refreshed the yearly low, before bouncing off to $2.50 by press time. With this, the XRP is down 16% weekly and 12% for October.

The Weekly Moves

Key Macro Catalysts

Even if the ongoing U.S. government shutdown delayed key economic data and also raised concerns over Federal Reserve (Fed) rate decisions, adding to the market’s uncertainty, U.S. President Donald Trump’s actions triggered heavy risk-off moves on Friday. It’s worth noting, however, that a few consumer-centric data points were positive and favored the sentiment before the pessimistic plays.

On Friday, U.S. President Trump’s announcements on Truth Social shook global financial markets as he unleashed 100% tariffs on China, “Over and above any Tariff that they are currently paying,” starting from November 01. The U.S. President cited, “an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large-scale Export Controls on virtually every product they make, and some not even made by them,” as the reason for his latest tariff move.

Elsewhere, the U.S. White House Office of Management and Budget (OMB) Director Russell Vought posted on his X page on Friday, “The RIFs have begun.” By RIF, he means “reductions in force”. The OMB spokesperson also confirmed to the BBC that the cuts had started and were “substantial”. Their size and scope began coming into focus later on Friday, when the administration disclosed seven agencies had started laying off more than 4,000 workers. The BBC news adds that Trump has repeatedly threatened to use the shutdown to further his long-held goal of reducing the federal workforce.

Trump also proposed a total ban on Chinese airlines from overflying Russia on all U.S. flights. U.S. President also reiterated that he will make permanent cuts to Democratic programs during the shutdown. Additionally, Trump announced plans to visit the Middle East and his intention to push Iran towards peace, while also defending his tariff policies.

Talking about the data, the preliminary readings of the U.S. University of Michigan’s (UoM) Consumer Sentiment Index (CSI) for October came in at 55.0 versus 54.2 expected and 55.1 prior. Further, the Consumer Expectations Index eased to 51.2 from the 51.7 previous release. More importantly, UoM’s one-year Consumer Inflation Expectations (CIE) eased to 4.6% from 4.7%, but the five-year CIE reprinted the 3.7% figures. Previously, Delta Airlines from the U.S. announced that consumers resumed spending in July after a pause since April and Liberation Day.

Meanwhile, Governor Michael Barr sounded hawkish on Thursday, saying he does not see tariff spillovers into services inflation, while advocating caution given uncertainty in inflation and jobs. Further, San Francisco Fed President Mary Daly said inflation has eased more than feared and expects further cuts. Meanwhile, New York Fed President John Williams supported more rate cuts this year to help a cooling labor market, while emphasizing the importance of Fed independence amid political pressure.

Also, the latest Federal Open Market Committee (FOMC) Minutes stated that most Fed officials expect to cut rates further in 2025. The statement also signaled that while inflation risks are easing, concerns about employment risks have increased.

On a positive side, the Hamas leadership claimed a permanent ceasefire and the end of the war, even as global watchers doubt the peace after they exchanged prisoners the next week.

Notably, France faces a political drama as newly appointed Prime Minister (PM) Sébastien Lecornu resigned, pushing President Emmanuel Macron to select a new candidate or hold elections again. On the same line, Japan chose its first female PM, Sanae Takaichi, but her disagreement with Komeito leader Tetsuo Saito delayed the formal vote for a successor to former Prime Minister Shigeru Ishiba.

For more macro updates like this, please check our news section here!

Crypto Market News

In the crypto universe, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all witnessed heavy selling pressure on Friday, resulting in the weekly loss. The risk-off mood, firmer U.S. Dollar, and slower ETF inflows could be tied to last week’s crypto pessimism.

Notably, the Bitcoin Dominance improved to 59.5%, from 58.0% reported last week, but the crypto market capitalization (market cap) slumped over 10.0% on the week to $3.72 trillion by press time, per CoinMarketCap.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our Coin Bytes.

A stablecoin giant, Tether Group, seeks collaboration with Vietnamese companies to promote local crypto acceptance and fuel expansion. The firm’s Vice President for Global Expansion and important Partnerships, Marco Dal Lago, said on Thursday that Vietnam is one of Tether’s “most promising and strategic markets”.

Binance Founder and ex CEO, Changpeng Zhao (also known as CZ), shared a Google security alert warning him of government-backed attackers trying to steal his password. The crypto czar raised concerns that the infamous North Korean Lazarus Group could be behind these increasingly sophisticated attacks.

Also Read: CZ Targeted by Government-Backed Hackers, Suspects North Korean Lazarus Group

The Ethereum Foundation launched the Ethereum Kohaku roadmap, a comprehensive initiative designed to enhance wallet privacy and security across the ecosystem. The ETH firm eyes developing a software development kit (SDK) that will provide strong privacy primitives, in addition to a reference wallet implementation that will target power users.

Read Details: Ethereum Kohaku Roadmap Unveils Privacy-First Wallet Solutions

The latest Chainalysis seizable crypto report mentioned that criminals and their networks control over $75 billion in potentially recoverable crypto assets. The report further states that out of $75 billion, nearly $15 billion is controlled directly by illicit actors, and more than $60 billion is held in downstream wallets that have received large inflows from criminal sources.

More Details: Chainalysis Seizable Crypto Report Reveals $75B in Illicit Assets, Mostly Bitcoin

New York’s approval to stake Ethereum (ETH) and Solana (SOL) gained attention. Following the state accord, Coinbase users in New York can stake ETH and SOL directly on the platform.

DeFi Development Corporation joined hands with Superteam Japan to launch the Asian major’s first Solana-powered treasury project.

A blockchain analytics firm, Elliptic, stated that North Korea crypto hackers have broken previous records by stealing over $2 billion in digital assets during 2025 alone, nearly tripling last year’s total. The article also cites the United Nations (UN) and several intelligence agencies confirming a significant portion of the funds is being applied to North Korea’s nuclear weapons and ballistic missile development programs.

More Details: North Korea Crypto Hackers Smash Record with $2 Billion Stolen in 2025

Bank of England (BoE) Governor Andrew Bailey praised stablecoins and their potential for public trust and innovation in payments.

The European Commission looks set to give more powers to the European Securities and Markets Authority (ESMA) in its control over cryptocurrency companies.

On a positive side, the global fund manager BlackRock’s iShares Bitcoin Trust (IBIT) becomes the first fund to hit the asset under management (AUM) of over $100 billion, in less than two years after its inception. The IBIT has also surpassed all other BlackRock Exchange Traded Funds (ETFs) in terms of profitability, with an annual revenue of more than $244 million.

Read More: BlackRock Bitcoin ETF Seizes the Limelight with $100B Milestone in Sight

On a surprise note, Teucrium XRP ETF came into existence even as the U.S. Securities and Exchange Commission (SEC) neither approved nor denied the listing. The reason could be linked to a special filing and the passage of a deadline.

Read More: XRP ETF Without SEC Approval? The Twist No One Saw Coming

A report from Crypto Rovers argues that the Russian central bank eyes Bitcoin usage as a hedge against the ruble. Talks also made rounds that Moscow is interested in developing stablecoins to benefit from the crypto rally and circumvent the global sanctions while staying financially sound and active.

Also Read: Russia’s Central Bank Eyes Bitcoin to Counter Ruble Weakness

Meanwhile, position liquidation also gained major attention, with long liquidations grabbing the bear’s eye, especially due to Friday’s heavy play. That said, position liquidation is the forced closing of a trader’s positions by a broker due to insufficient margin. This data reveals whether long (buy) or short (sell) positions were closed, helping explain recent price movements. Typically, heavy long liquidations happen during a downtrend and suggest short-term bearish sentiment, and vice versa.

Position Liquidations

During the October 05 to 11 period, a total of $21.83 billion of positions were liquidated, per the CoinGlass data. Out of which, “Long Positions” contributed $18.34 billion, whereas “Short Positions” accounted for $3.49 billion, suggesting a heavy flow of long liquidations and justifying the latest jump in the crypto prices.

Bitcoin, Equities Drop, But Gold Gains

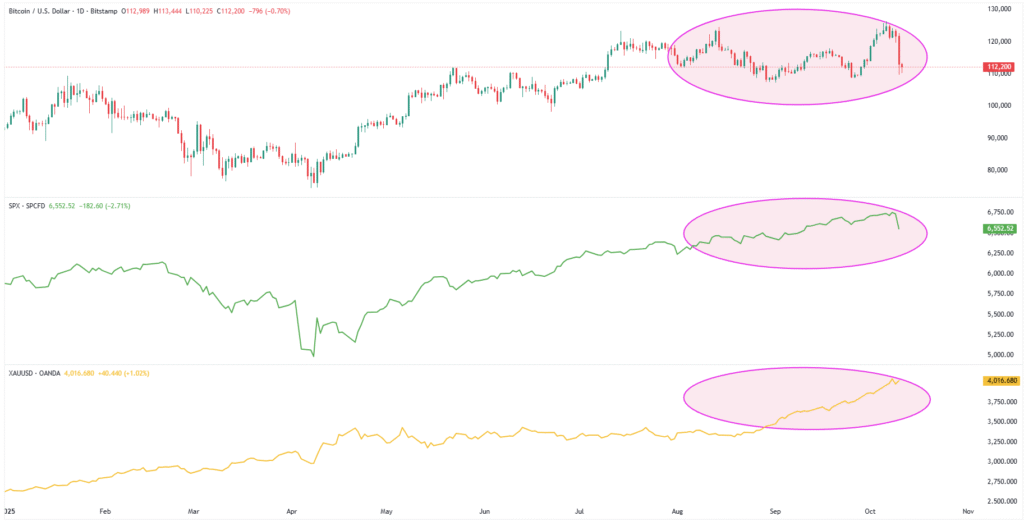

Bitcoin (BTC) notched the biggest weekly loss since March, despite refreshing an ATH early in the week, mainly driven by Friday’s slump, as risk aversion joined a firmer U.S. Dollar. The sour sentiment also dragged the U.S. equity benchmark S&P 500 (SPX), which renewed its record top, but ended the week on a negative note, down 2.43% near 6,552.

However, the spot Gold (XAU) rose for the eighth consecutive week and refreshed a record high before ending the week with over 3.0% weekly gains to near $4,016.

With this, the BTC is in sync with the equities, but the Gold differs with its record rally. This pattern reinforces expectations of fresh ATHs by BTC and SPX, like XAU.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the clearly linear relations between Bitcoin and the U.S. equities, the BTC traders should be optimistic as dovish bias about the Fed interest rate decisions, concerns over the Fed’s independence, the ongoing Ukraine-Russia war, and the impact of President Donald Trump’s tariffs contribute to the market outlook.

BTC ETF and Options Signals

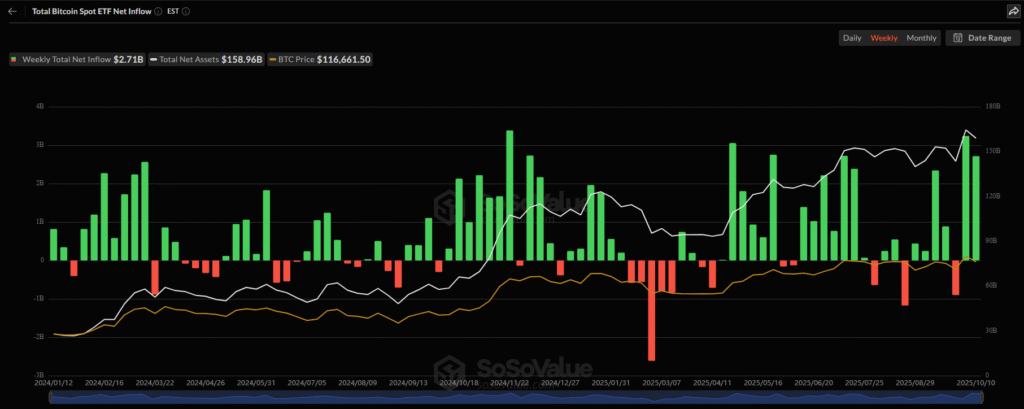

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported consecutive four-day inflows before Friday’s meagre daily outflow of $4.50 million.

With this, the spot BTC ETFs marked the second straight weekly inflow, worth $2.71 billion for the last week.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but September’s inflows were stellar with the $3.53 billion figures, whereas the October inflows have been $5.0 billion by press time.

With this magnitude of surprise from the ETF flows on a monthly basis, the BTC bulls seem to be keeping the reins for a while, despite the latest slump in prices.

On the flip side, a $4.3 billion options expiry also weighed on the Bitcoin price last week, apart from the broad risk aversion. That said, the total number of options expiring was $4.30 billion on Friday, the day of expiry. Notably, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $117,000, up from the latest slump to $110K. This could be considered a pullback sign for the BTC.

Also read: Crypto Options: Bitcoin Trades near $121K ahead of $4.3 billion BTC Options Expiry

Technical Analysis Signals BTC Rebound

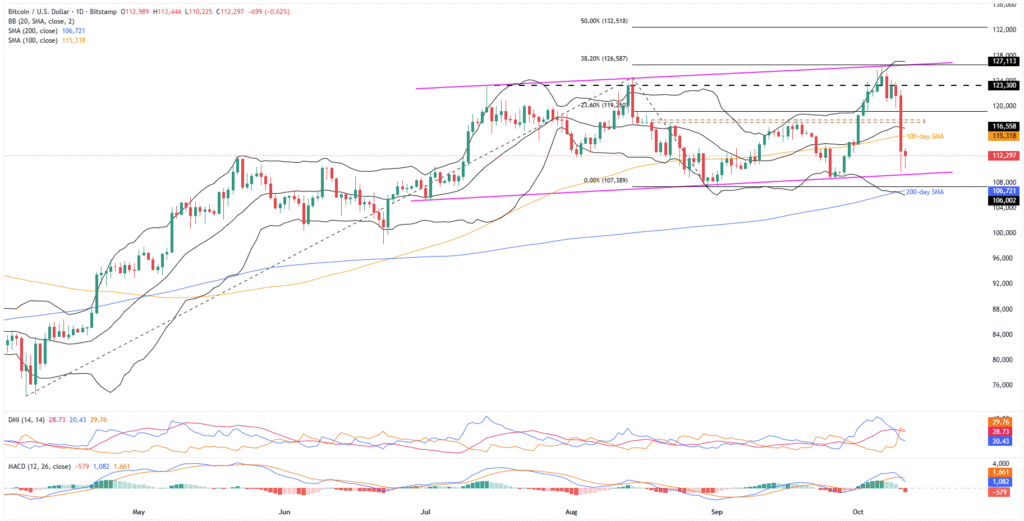

Despite Bitcoin’s stellar slump, the crypto major stays within a three-month bullish trend channel and beyond the 200-day Simple Moving Average (SMA) and the lower Bollinger Band, suggesting a recovery momentum. It’s worth noting, however, that bearish signals from the Moving Average Convergence Divergence (MACD) and Directional Movement Index (DMI) momentum indicators could challenge the buyers for a while, as long as the U.S. Dollar stays firmer.

Bitcoin Price: Daily chart suggests recovery

Bitcoin’s downside break of a two-month horizontal support, now resistance, and the 100-day SMA joins bearish MACD signals (red histograms) and downbeat DMI signals to defend short-term sellers. However, the BTC still remains within a broad bullish trend channel, in place since July, as well as beyond the 200-day SMA and the lower BB, to suggest a corrective bounce.

That said, the DMI’s Downmove (D-, orange) line tops the Average Directional Index (ADX, red) and the Upmove (D+, blue) line, in that order, suggesting a tight grip of downside momentum. Also favoring the short-term BTC sellers is the Downmove line’s position beyond the 25.00 neutral mark, currently near 29.76.

With this, the BTC looks poised to test the stated channel’s lower boundary, close to $109,100, before posting any recovery.

If Bitcoin breaks the $109,100 key support on a daily closing basis, the 200-day SMA level of $106,721 and the lower BB of around $106K will be the last defense of buyers before directing prices to the $100K threshold and June’s low of $98,240. A break below this could shift control to the sellers, threatening the broader upside trend.

On the upside, the 100-day SMA level of $115,300 guards immediate BTC recovery ahead of the middle BB of $116,555.

Beyond that, a seven-week-old horizontal resistance area surrounding $117,500-$117,800 and the horizontal resistance from July, close to $123,300, guards the BTC’s further rise.

However, a convergence of the rising trend line from July, forming part of the said channel, and the 38.2% Fibonacci Extension (FE) of its April-August move, close to $126,600, is the key hurdle for the bulls to cross, along with the upper BB of $127,600, before targeting the $130K threshold and 50% FE hurdle near $133K.

Ethereum Slumps!

Ethereum (ETH) marked a notable slump of above 15.0% last week, despite wavering near $3,830 by press time. The second-largest cryptocurrency’s south run could be linked to the market’s overall pessimism, a softer ETF inflow, and growing optimism around altcoins like Solana (SOL), Dogecoin (DOGE), and Avalanche (AVAX), fueled by ETF enthusiasm and rising corporate interest in diversifying crypto treasury reserves.

ETH ETFs Report Easing Inflows

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported their second consecutive weekly inflow, after hitting a seven-week high the previous week. On the daily format, the ETH ETFs reported consecutive three-day inflows before posting outflows on Thursday and Friday, resulting in the weekly inflows and a seven-month inflow streak, while challenging ETH’s recent weakness in prices.

On October 10, the U.S. Spot ETH ETFs reported its second daily outflow, with a $174.83 million figure.

This also resulted in a pullback in the weekly ETH ETF inflows from the seven-week high, with a total of $488.27 million for the week.

Still, the monthly ETH ETF scenario is upbeat as it reports the seven-month inflow pattern, with October’s inflows being $1.11 billion by press time.

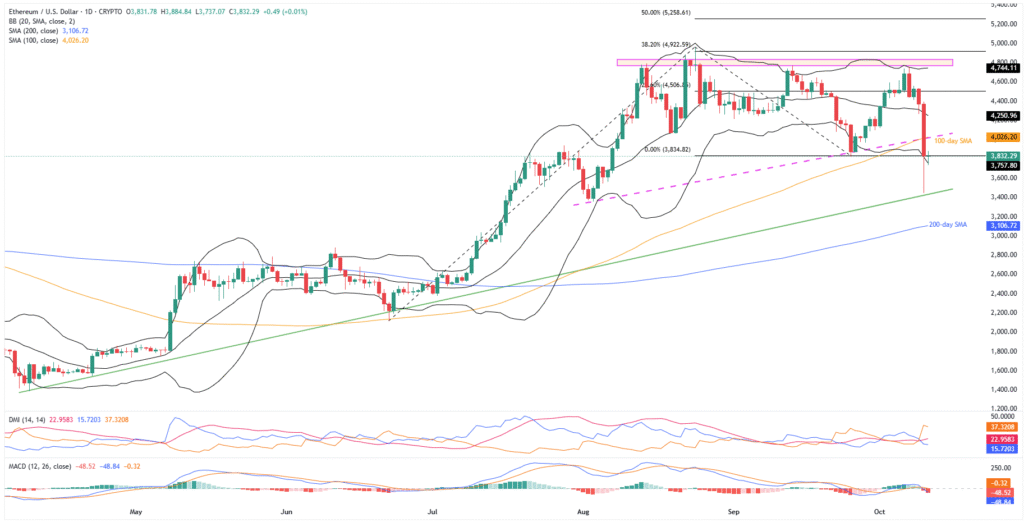

Ethereum Technical Analysis Teases Sellers

Ethereum’s downside break of the $4,030 support confluence, now resistance, joins bearish signals from the MACD and the DMI momentum indicators to lure sellers. However, a multi-month trendline support is the key to determining ETH’s next move.

Ethereum Price: Daily Chart Points To Growing Bearish Bias

Friday’s slump dragged Ethereum beneath a convergence of the 100-day SMA and an ascending trendline from early August, forming part of a bearish triangle. The downside move also gains support from the bearish MACD signals (red histograms) and the DMI indicator to lure short-term sellers.

That said, the DMI’s Downmove (D-, orange) line tops the Average Directional Index (ADX, red) and the Upmove (D+, blue) line, in that order, citing heavy downside momentum. Also favoring the short-term ETH sellers is the Downmove line’s position beyond the 25.00 neutral mark, currently near 37.32.

It’s worth noting, however, that the lower BB currently restricts the ETH downside around $3,750, a break of which could drag prices to an ascending support line from April, close to $3,433.

Should Ethereum sellers keep the reins past $3,433, the 200-day SMA level of $3,106, and the $3,000 threshold will be the last line of defense for the bulls.

On the contrary, the ETH rebound needs validation from the $4,030 support-turned-resistance to convince buyers.

Beyond that, the middle and upper Bollinger Bands, respectively near $4,250 and $4,750, could challenge the Ethereum bulls.

Above all, the $4,765-$4,830 area, forming part of a multi-week triangle, seems to be a strong resistance for buyers to cross before they aim for the all-time high of $4,955 and the $5,000 round figure.

Ripple Ignores ETF Optimism…

Ripple (XRP) posted its biggest weekly loss since March, as well as hit a yearly low, amid a broad crypto market selloff. In doing so, the altcoin ignores optimism surrounding the possible approval of the crypto ETFs by the United States Securities and Exchange Commission (SEC) despite tightly constrained government operation.

Notably, the Binance Coin (BNB) unseated XRP to become the world’s third-largest cryptocurrency amid a rush towards the BNB due to its heavy corporate treasury demand.

Also Read: Binance News Today: BNB Flips XRP, Technicals Point to $1,504 Target.

That said, the XRP dropped 16.80% weekly, even as it recovered from the yearly low to $2.47 by press time.

On Friday, Canary Capital submitted its revised S-1 filings for its XRP and SOL ETF applications to the U.S. SEC. The ETF aspirant reduced sponsor fees and changed its strategy to gain faster approval.

Read Details: Canary Capital Updates XRP & Solana ETF Filings, Cuts Fee to 0.50%

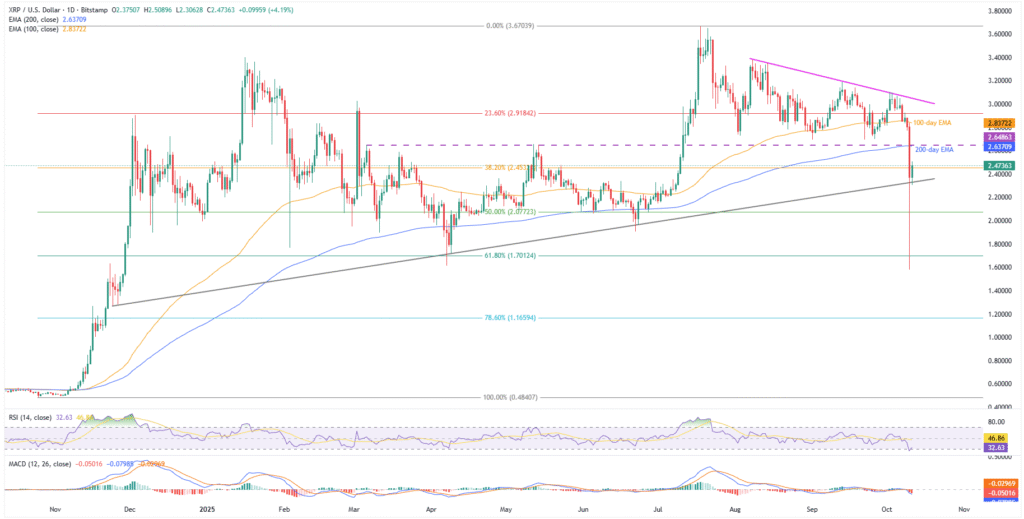

Ripple Technical Analysis Lures Short-term Buyers

Despite refreshing the yearly low, the XRP failed to offer a daily closing beneath an ascending support line from November, close to $2.32 by press time. This also joins the oversold conditions of the 14-day Relative Strength Index (RSI) momentum indicator to suggest a corrective bounce in prices. However, the bearish MACD signals (red histograms) join a clear break of the $2.63-$2.64 support confluence, now resistance, to keep sellers optimistic.

Ripple Price: Daily Chart Tests Sellers

Ripple’s clear downside break of the 200-day Exponential Moving Average (EMA) and a seven-month horizontal support, now resistance around $2.63-$2.64, joins the bearish MACD signals to favor bears as they hit the yearly low around $1.58.

However, the oversold RSI allowed the XRP to defend an ascending support line from November 2024, close to $2.32, on a daily closing basis.

With this, the XRP is likely to approach the $2.63-$2.64 support-turned-resistance during further rise.

However, the 100-day EMA and a nine-week descending trendline, respectively near $2.83 and $3.06, could challenge the bulls afterward.

Meanwhile, a daily closing beneath the $2.32 support line could drag the Ripple price to the 50% and 61.8% Fibonacci retracement of its 2024-25 upside, near $2.07 and $1.70 in that order, before revisiting the yearly low of $1.58.

In a case where the XRP remains weak past $1.58, the 78.6% Fibonacci ratio of $1.16, the $1.00 threshold and the late 2024 bottom surrounding $0.48 will gain the market’s attention.

Conclusion

Having witnessed a volatile week, the crypto market participants could keep their eyes on the pending U.S. data that has been delayed/postponed due to the U.S. government shutdown, as well as China inflation and other risk catalysts. Apart from the delayed monthly employment report for September, the U.S. Retail Sales, and speeches from several Fed officials, will also be crucial to follow.

That said, the developments about the U.S. tariffs and geopolitical tensions surrounding Russia, Israel, and U.S. President Donald Trump could also entertain the momentum traders. Furthermore, fears about the negative economic impact of the U.S. government shutdown could also affect the risk assets, including cryptocurrencies, if it materializes next week.

Given the market’s recently bearish reaction to the Fed rate cut bias, coupled with the escalated shutdown woes, not to forget the U.S.-China trade war fears, the cryptocurrency markets may witness further consolidation in prices. That said, a surprise weakness in the U.S. data and/or optimism surrounding the U.S. SEC’s ETF approvals, as well as sturdy ETF flows, might help the key coins to pare previous losses. However, the broad recovery needs fundamental support to recall the buyers.

In that case, Bitcoin, Ripple, Solana, and Dogecoin are likely to gain the major attention of buyers, while Ethereum may not be able to rise much, due to mixed technical analysis.

Also read: Top 5 Altcoins to Watch in October 2025